Cardano rapid holders (STHs) private added over 3 billion ADA to their stash since October, however history suggests this will presumably per chance even be concerning.

The broader market recovery has to this point benefited Cardano (ADA), as the altcoin leverages the continued momentum to recover the pivotal $1 imprint territory after giving it up days within the past.

Cardano STHs Add 3B+ ADA in November

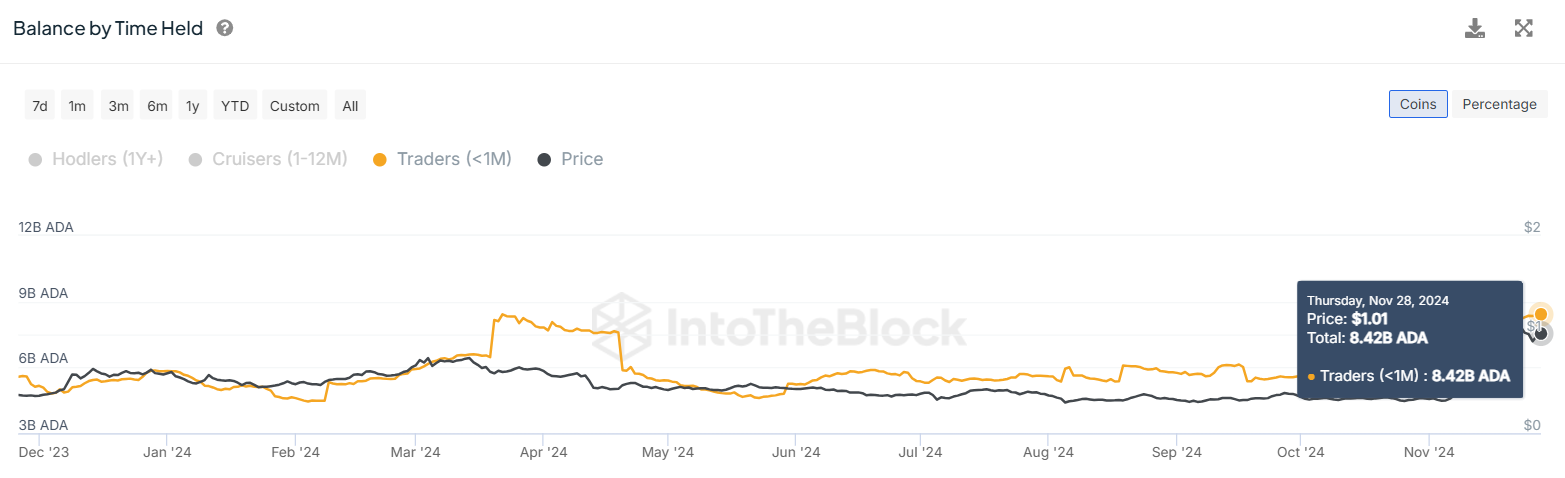

In nowadays’s ADA recordsdata now, Amid this upsurge, the Cardano network looks to be welcoming contemporary traders. Data from IntoTheBlock indicates that traders (traders who private held ADA for lower than a month) now protect 8.42 billion charge $9 billion at press time, marking an 8-month peak of their steadiness.

The closing time this tier of traders held this grand steadiness was as soon as in March when ADA traded for $0.6208. The most modern 8.42 billion ADA figure means that these addresses procured 3.15 billion ADA this month, as their initial holdings stood at 5.27 billion ADA on Nov. 5.

Recall that Nov. 5 marked the decisive 2d within the continued market uptrend, with professional-crypto Donald Trump’s election victory triggering a bull section amid big accumulations, alongside side the purchases by rapid ADA holders.

A Bearish Signal

On the opposite hand, historical recordsdata means that a spike in these addresses’ holdings veritably outcomes in imprint corrections or consolidation. As an instance, in January 2022, as ADA soared to $1.53, these traders increased their holdings to 11 billion ADA weeks later.

Nonetheless, Cardano indirectly collapsed to $0.82 almost in the present day after, coinciding with a topple of their balances. Additionally, earlier within the year, when ADA soared to $0.75 on March 13, the steadiness of those holders surged to a peak of 8.4 billion ADA nine days later.

After this surge, ADA witnessed a imprint correction that seen it topple to $0.45 in mid-April, with these addresses indirectly reducing their holdings to 5.49 billion ADA. Now that Cardano has reclaimed the $1 designate, these addresses private all as soon as more entered the market.

Particularly, these traders signify individuals who FOMO into the market following a imprint surge after which indirectly dump their holdings on the most main reflect about of resistance, ensuing in extra promoting stress and contributing to the charge correction.

Cardano May per chance per chance Gape Toughen from Whale Accumulation

Nonetheless, The Crypto Frequent confirmed earlier this week that Cardano whales appear to private furthermore entered the market. If these whales soak up the provide sold by these rapid holders when ADA hits a roadblock, this will presumably per chance aid mitigate the potentialities of a collapse.

Additionally, the founding father of Merit Shillers highlighted a spike in Cardano’s on-chain tell, with over 840,000 transactions and charges reaching 279,000 ADA—the ideal since March 2022.

He common that, now not like its earlier speculative employ, ADA had shown in vogue growth in holders since July 2022. In step with him, this implies increased self belief within the Cardano blockchain and its ecosystem. At press time, ADA trades for $1.06, up 6.6% over the closing 24 hours.