On November 23, the total Cardano (ADA) natty transaction volume was $forty five.41 billion. At the moment time, the same volume has dropped to $26.34 billion, suggesting that natty investors within the market own diminished their exposure to the cryptocurrency.

Once in a whereas, scenarios cherish this counsel that the altcoin’s be aware also shall be affected negatively. But additionally can it be the case for ADA?

Cardano Sees Plunge in Key Areas

In crypto, natty transactions discover the exercise of institutional players and whales making trades price over $100,000. An develop in natty transaction volume suggests heightened engagement from these key stakeholders.

Conversely, a decline typically indicates that establishments or whales also shall be liquidating their holdings. In Cardano’s case, the natty transactions own dropped by $19 billion over the last six days.

Historically, ADA’s be aware has typically risen alongside a surge in natty transactions. For occasion, the image below presentations an develop within the metric between November 16 and 23.

All over that length, the altcoin’s price climbed from $0.57 to $1.09, suggesting that whales played a tall half within the hike. As a consequence of this fact, if the hot decline persists, the token also can face additional downside stress.

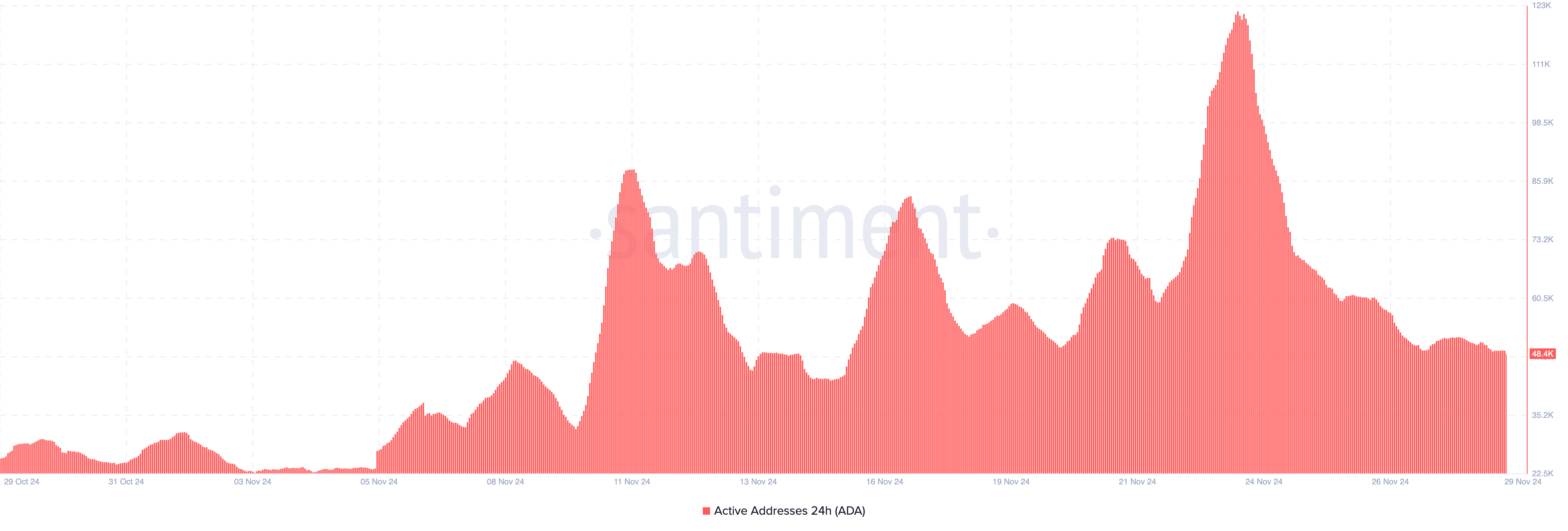

Huge transactions aren’t basically the most piquant ingredient of the Cardano ecosystem facing a decline. In accordance to recordsdata from Santiment, overall community exercise has also dropped greatly.

On-chain metrics equivalent to packed with life addresses are key indicators of community health. Active addresses consult with users who own beforehand interacted with the cryptocurrency and dwell engaged in transactions.

Over the previous seven days, packed with life addresses on the Cardano community own declined, indicating waning user participation. This style displays a bearish sentiment surrounding ADA.

ADA Mark Prediction: Retracement to $0.82?

On the day-to-day chart, ADA’s be aware trades spherical $1.04. Nevertheless, the Relative Strength Index (RSI) has a discovering out of 76.91. The RSI measures momentum utilizing the rate and dimension of be aware modifications.

It also tells when a cryptocurrency is overbought or oversold. When the discovering out is above 70.00, it’s miles overbought. Conversely, when it’s miles below 30.00, it’s miles oversold.

Pondering the hot outlook, it appears to be like that ADA’s be aware is overbought, and a decline also shall be next.

The Bollinger Bands (BB) — a hallmark that measures volatility, also validates this bias. The BB, cherish the RSI, also gauges if an asset is overbought or oversold. When the upper band of the indicator toches the be aware, it’s miles overbought.

But when the decrease band hits the price, it’s oversold. With the upper band of the BB shut to hitting ADA, the be aware also can decrease to $0.82.

Nevertheless, if the Cardano natty transactions develop, this also can no longer happen. As yet every other, the cryptocurrency’s price also can climb above $1.15.