Ripple (XRP) has surged 181.38% within the past 30 days, demonstrating solid market momentum. After reaching $1.63, XRP is now consolidating, with its RSI at a neutral Fifty three.2, signaling balanced market prerequisites.

If bullish momentum builds, XRP might perchance retest $1.63 and climb in the direction of $1.70, its very top stage since 2018. Alternatively, a downtrend might perchance push the price down to $1.27 or even $1.05.

XRP Is Currently In A Honest Zone

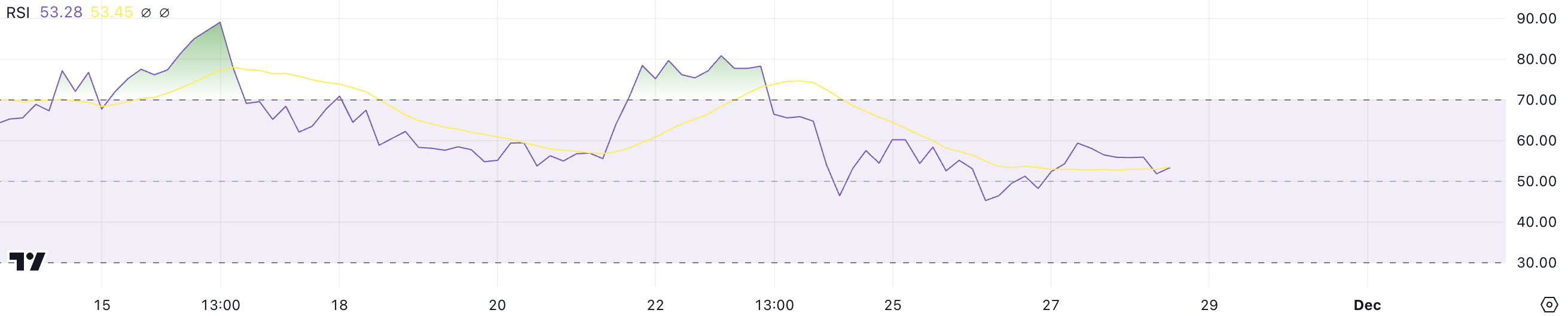

XRP RSI for the time being sits at Fifty three.2, reflecting a neutral momentum after essentially the most modern mark surge. The RSI, or Relative Strength Index, measures the fee and magnitude of mark adjustments on a scale from 0 to 100.

Values above 70 uncover overbought prerequisites, assuredly signaling a doable pullback, while values under 30 imply oversold ranges, hinting at restoration doable. XRP RSI turned into as soon as above 70 between November 21 and 23, in the end of its rally to $1.63, highlighting the overbought narrate at that peak.

At Fifty three.2, XRP’s RSI signifies a cooling of bullish momentum but does no longer ticket a reversal yet. This neutral stage suggests that the coin is consolidating after its most modern beneficial properties, leaving room for further upward run if buying for stress returns.

Alternatively, if the RSI trends decrease, it can perchance uncover weakening sentiment, potentially resulting in a pullback.

Ripple CMF Turned Harmful

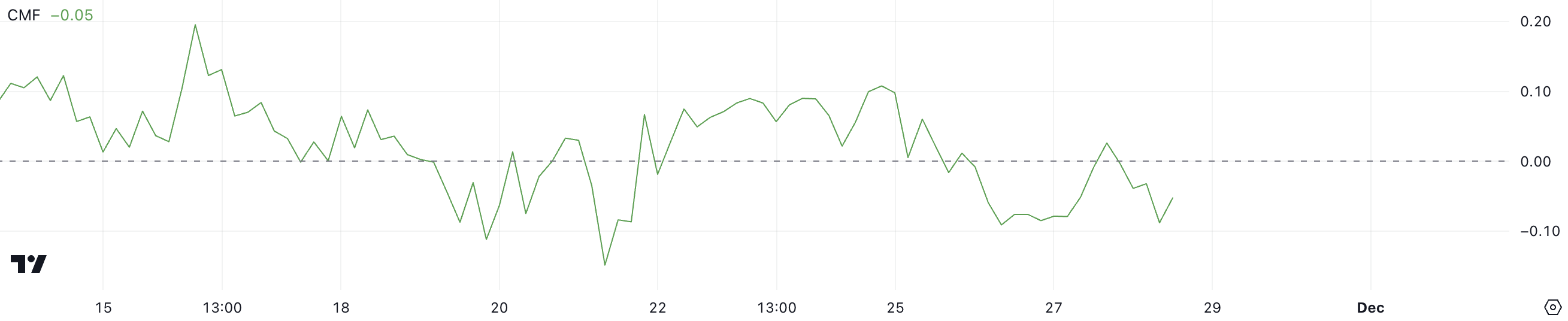

Ripple CMF is for the time being at -0.05, down from 0.10 when its mark peaked at $1.63 per week within the past, reflecting reduced capital inflows. The CMF, or Chaikin Money Circulation, measures the amount-weighted float of capital into or out of an asset, with definite values indicating buying for stress and negative values suggesting selling dominance.

The tumble to negative territory indicators that selling stress is starting up to outweigh buying for activity, though no longer yet severely.

At -0.05, XRP’s CMF signifies shrimp bearish sentiment but remains above the -0.15 stage viewed on November 21. This suggests that while selling stress is rising, it is no longer as intense as in the end of outdated corrections.

If the CMF trends further downward, it can perchance ticket more selling and a doable XRP mark decline.

Ripple Mark Prediction: Can It Rush Inspire to 2018 Stages?

XRP EMA lines dwell bullish, with short-timeframe lines positioned above lengthy-timeframe ones, signaling an ongoing uptrend. Alternatively, the narrowing hole between the lines suggests weakening bullish momentum, indicating a probable pattern reversal.

If a downtrend emerges, Ripple mark might perchance test the solid wait on at $1.27. If that stage fails to retain, the price might perchance tumble further to $1.05, reflecting a more distinguished correction.

On the replace hand, if buying for stress strengthens and a brand unusual uptrend kinds, XRP mark might perchance retest its most modern high of $1.63. Breaking this stage might perchance push the price to $1.70, marking its very top mark since 2018.