Bitcoin’s rally above the $95,000 label triggered a stable section of accumulation amongst retail investors.

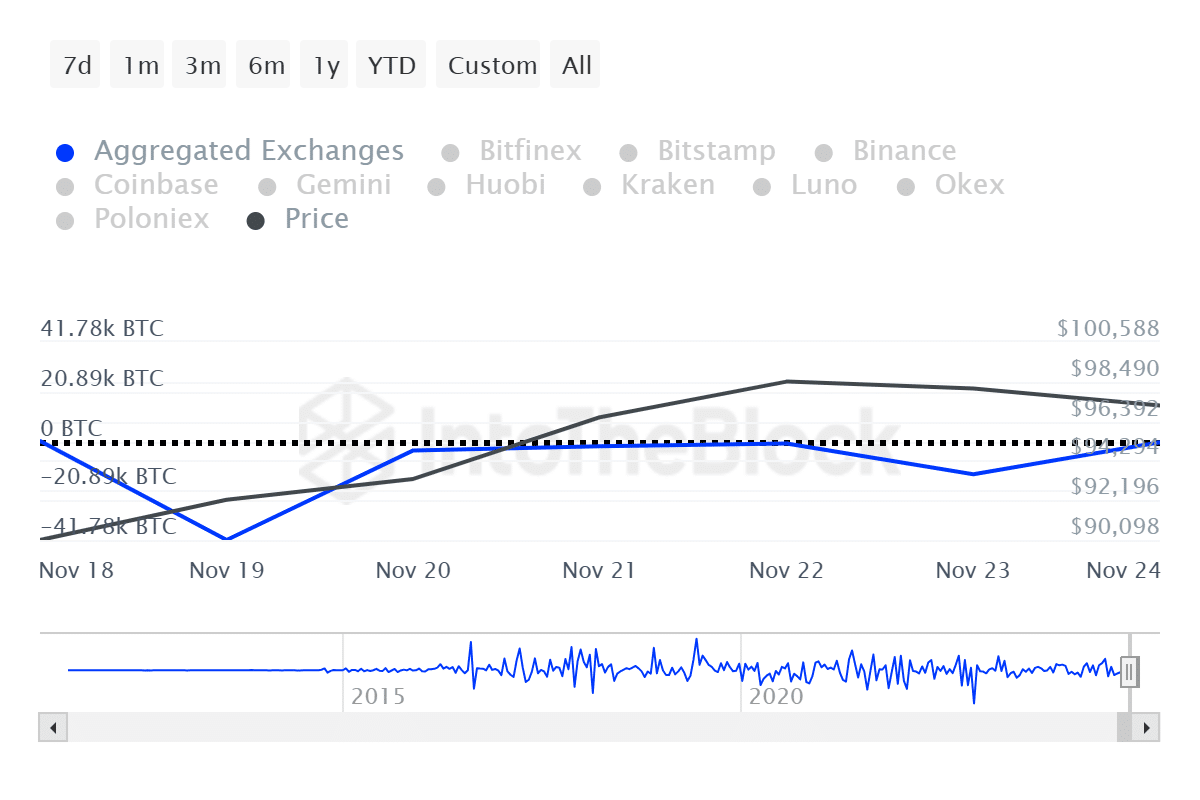

Bitcoin (BTC) recorded an alternate receive outflow of $6 billion over the final seven days — $3.9 billion on Nov. 19 on my own — in line with recordsdata supplied by IntoTheBlock. The spectacular accumulation wave sent Bitcoin to an all-time high of $Ninety nine,655 on Nov. 23.

The $3.38 billion weekly receive inflow into self-discipline BTC alternate-traded funds in the U.S. also played a indispensable role in sending Bitcoin terminate to the $100,000 label.

On the assorted hand, the whale express round Bitcoin started to quiet down sooner than the worth reached its ATH.

Info from ITB displays that huge transactions consisting of a minimal of $100,000 worth of BTC fell from 32,000 to 19,500 between Nov. 21 and 24 — the amount plunged from $136.4 billion to $Fifty three.6 billion in the mentioned timeframe.

Closing week, Bitcoin recorded a total of $243.67 billion in whale transactions.

The actions mask that retail investors dangle been extra energetic than big holders.

No topic the declining whale transactions, in line with ITB recordsdata, the Bitcoin big holder receive glide shifted from a receive outflow of 9,190 BTC to a receive inflow of 4,090 BTC on Sunday, Nov. 24.

The surge in whale accumulation could well doubtless build off the terror of missing out amongst market contributors. A surge above the $100,000 label could well doubtless lift the purchasing for stress amongst both little and big Bitcoin holders.

Bitcoin has been consolidating terminate to the $98,000 zone in the previous 24 hours. Its day-to-day trading volume, on the assorted hand, saw a 27% surge, reaching $55 billion.

The global crypto market cap slipped 2.3% over the final day to $3.47 billion. Moreover, liquidations reached $494 million as Bitcoin’s descend below the $98,000 label earlier nowadays triggered a market-broad decline, majorly affecting little-cap altcoins.