The worth of Bitcoin (BTC) has risen to the psychological milestone of $100,000. BTC worth analysis by Coinidol.com.

Bitcoin worth prolonged-term forecast: bullish

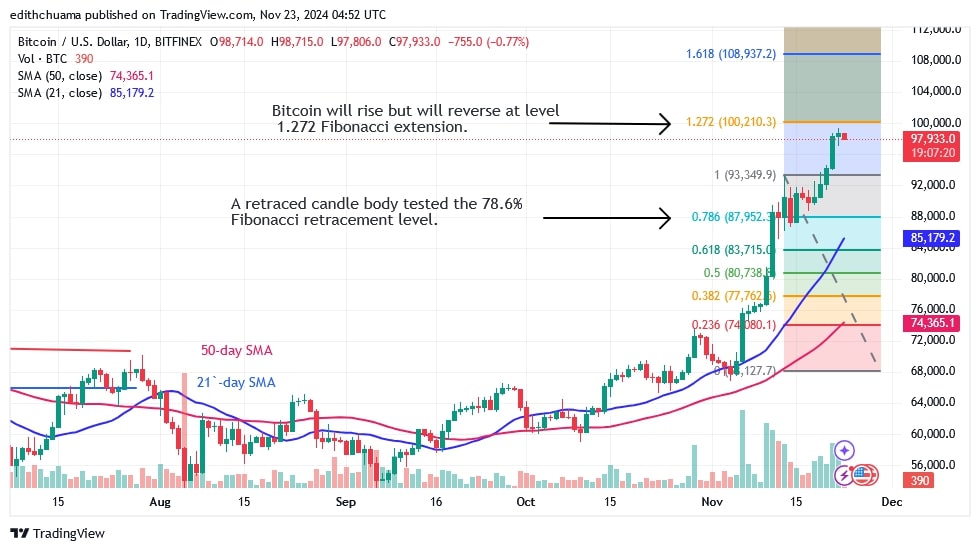

On November 22, the Bitcoin worth reached a excessive of $ninety nine,800 sooner than falling motivate. The cryptocurrency has stalled under the $100,000 resistance level however is consolidating above the $98,000 increase.

On November 22, the candle reveals a pronounced tail, signaling predominant looking for strain on the fresh increase. If the bulls withhold their positions, the cryptocurrency would possibly well also rise even extra. Bitcoin will proceed to rise if investors withhold the $93,000 breakout level and breach the $100,000 designate. Bitcoin will rise to a excessive of $115,000.

In distinction, Bitcoin will fall if the bears tumble under the $93,000 increase level. The cryptocurrency worth will fall to a low above the 21-day SMA or a low of $85,240. In the period in-between, Bitcoin is currently worth $98,200.

Bitcoin indicator reading

Bitcoin has stalled after rising to a excessive of $ninety nine,800. Doji, or diminutive indecision candles, rep emerged. These candlesticks existing that merchants rep reached a level of hesitation as Bitcoin stops under its fresh excessive. The 21-day SMA supports the cryptocurrency’s uptrend.

Technical indicators:

Resistance Ranges – $80,000 and $100,000

Toughen Ranges – $70,000 and $50,000

Which cryptocurrency leg for BTC/USD?

On the 4-hour chart, Bitcoin is on a comfy rise after breaking through the $93,000 resistance. Since the breakout, the cryptocurrency has traded moderately as a consequence of the doji candlesticks. Bitcoin is buying and selling above the 21-day SMA as the market continues its uptrend.

Disclaimer. This analysis and forecast are the private opinions of the creator. They are now not a recommendation to aquire or promote cryptocurrency and would possibly well presumably now not be viewed as an endorsement by CoinIdol.com. Readers would possibly well also easy attain their review sooner than investing in funds.