Final week, the crypto market noteworthy indispensable liquidations. This in particular affected Moonwell users employing yield programs that alive to borrowing AERO crypto tokens.

These programs, while doubtlessly a success, list users to excessive volatility, with AERO’s label fluctuations assuredly exceeding 100%.

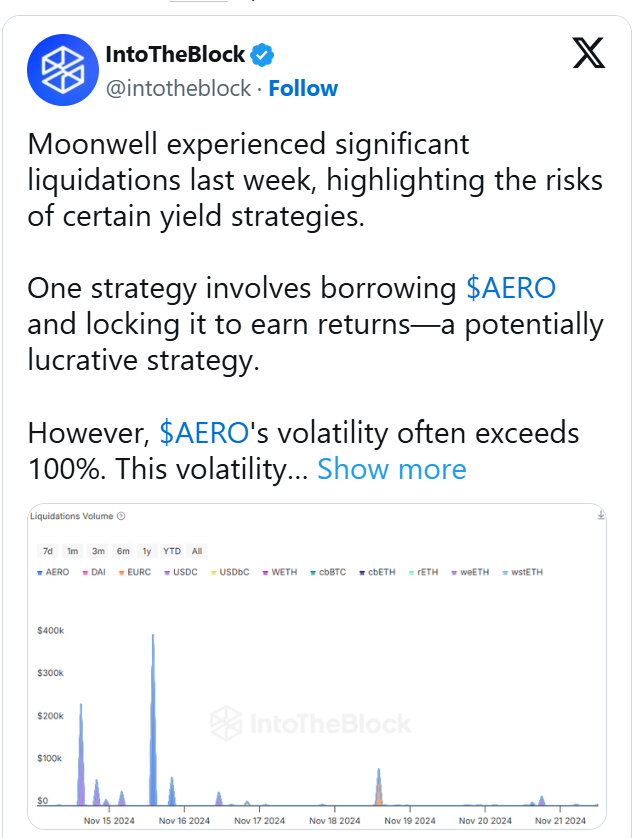

The liquidation quantity charts confirmed a moving spike, especially around mid-November. This highlights the heightened threat when AERO‘s label circulate intensifies.

This pattern urged that users locking AERO crypto to safe returns found themselves unable to repay loans attributable to those label surges, resulting in liquidations.

AERO crypto’s label is inclined to drastic modifications. Therefore, the strategy of locking tokens for returns poses a appreciable threat to investors.

Right here’s crucial in a market the glean liquidity is indispensable for affirming positions. Because the market enters key moments, warning is wished, desirous about the alternative of moving declines or spikes that may possibly possibly lead to further liquidations.

AERO Crypto Volume and its Income Sharing

Aerodrome Finance experienced its largest payout this week, distributing a yarn-breaking $9.04 Million to its veAERO token holders.

This newest payout marked a 300% amplify from factual two months prior, environment assist-to-assist data for total rewards. This entails both costs and incentives.

The amplify coincided with a formidable surge in shopping and selling quantity, reaching $6.134 Billion, the second-absolute most life like in the platform’s history.

This indispensable enhance stemmed from Aerodrome’s unusual earnings-sharing model. 100% of protocol revenues are returned to veAERO voters as incentives.

This makes it a lucrative option for liquidity companies and governance participants.

The incentives are structured to support long-length of time conserving and energetic participation in governance choices, influencing the protocol’s pattern and strategy.

Such reward mechanisms are instrumental in affirming excessive engagement ranges amongst participants. Subsequently, this at once impacts the platform’s overall liquidity and shopping and selling exercise.

This cycle of reinvestment and reward attracts extra users and capital to Aerodrome, environment it rather then opponents. This indicators rising dominance in the decentralized finance (DeFi) set up.

Coinbase Ventures AERO Buy and Designate Prediction

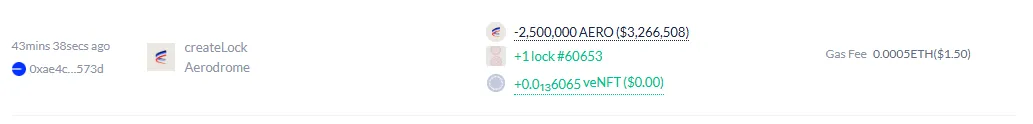

Again, Coinbase Ventures persisted to carry out huge investments in AERO, acquiring $3.3 Million worth of AERO crypto and locking it up. Complete holdings stand at roughly $14 Million.

This strategic acquisition by one in all the leading enterprise corporations in the cryptocurrency set up indicated rising self assurance in AERO’s doable for label appreciation.

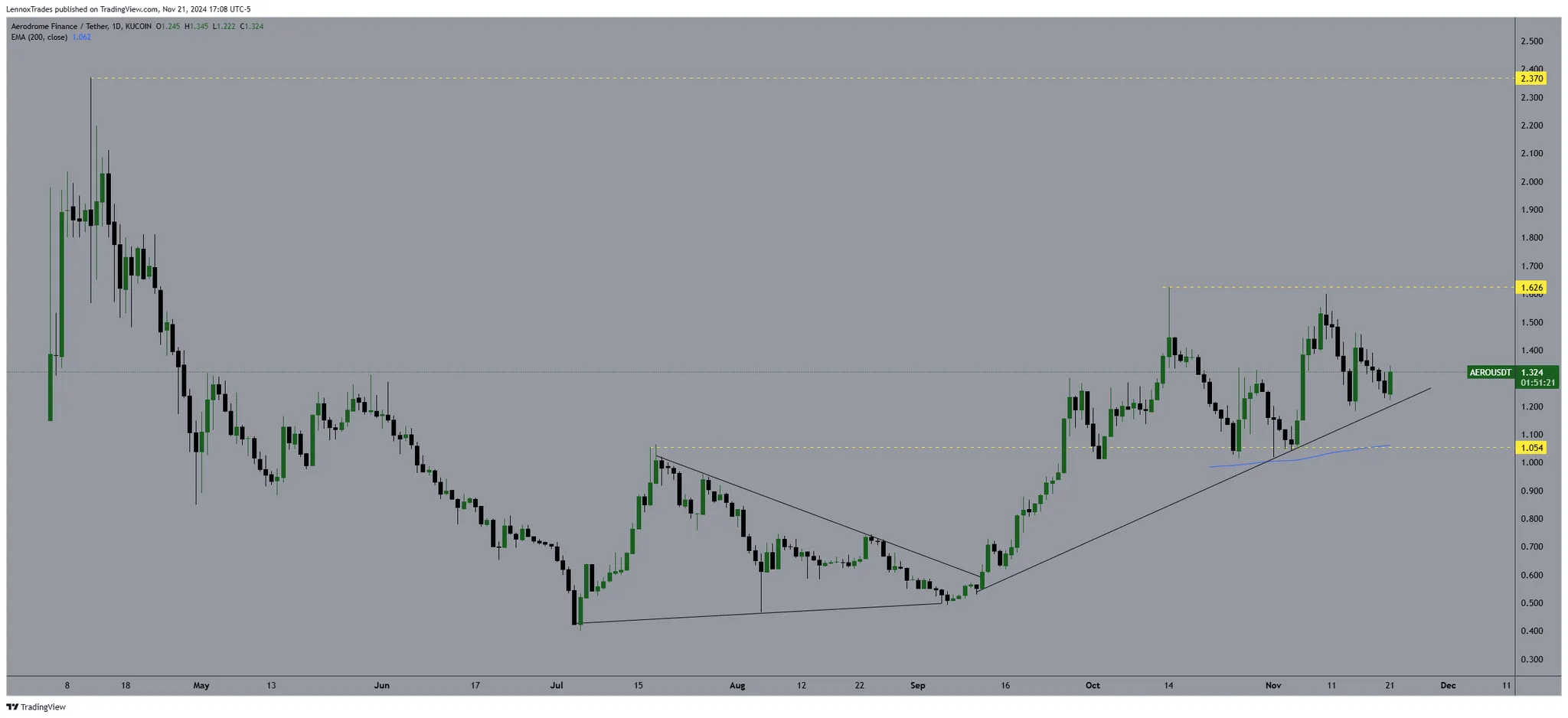

Over the previous several months, AERO had shown a essential reversal in its shopping and selling pattern, indicating solid bullish sentiment.

Initially, the worth stabilized at a key enhance stage of $1.05, which spurred a proper amplify in its valuation.

Following a trough in June, AERO crypto began a commendable ascent, continuously forming higher lows along a clearly defined upward trend line.

The momentum persisted through September, with AERO surging previous the $1.60 label designate.

A beforehand tense resistance at around $1.63 wants to be effectively surpassed, turning it into a doable enhance stage for future pullbacks.

AERO’s rally may possibly possibly arrangement its veteran height at $2.37 come the indispensable $2.40 resistance set up. As of press time, AERO crypto was consolidating at around $1.29.

If making an strive to search out strain is sustained and the doable enhance trendline, AERO is susceptible to be effectively-poised to breach the $2.40 stage and jam contemporary highs, especially in gentle of newest huge investments signaling self assurance in its upward trajectory.