The Come Protocol label action chart saw important movements as the NEAR/USDT pair broke thru and retested a foremost trendline. It bolstered bullish sentiments among traders.

On the each day chart, NEAR saw a well-known beef up-grew to become-resistance flip at the $5.10 rate, solidifying it as modern beef up after its upward trajectory. This stage served as a well-known juncture for future label movements.

Including to the optimism, a golden crossover took place the day gone by. It’s a bullish stamp the do the momentary provocative moderate crosses above an extended-time length provocative moderate, on this case, the 13-day EMA.

This tournament normally indicated the possible of huge label will enhance and captured traders’ attention. It rapid a rising self belief within the asset’s performance.

The retest of this trendline, coupled with the golden cross, painted a promising portray for NEAR. The quantity and cost action rapid that the asset became as soon as gaining momentum, potentially focusing on the $10 rate.

As NEAR garners more interest, the market carefully watches for its next strikes. The technical setup at press time indicated a gather uptrend would perhaps perchance moreover be in store.

NEAR Protocol’s Actual Uptrend

Seth, a reputed analyst, renowned that NEAR Protocol would perhaps perchance moreover continue its spectacular performance within the crypto market, as indicated by most popular technical analysis on the each day chart.

The analyst renowned NEAR consistently maintained its upward trajectory within a successfully-defined rising channel, which has been intact since early 2023.

The Relative Power Index (RSI), a key indicator of momentum, bottomed out and became as soon as trending upwards. That rapid rising buyer interest and possible for persisted label beneficial properties.

The provocative averages have provided gather beef up, reinforcing bullish alerts. The NEAR label lately rebounded off these averages, indicating a wholesome uptrend.

Moreover, weekly purchase alerts have held agency, underscoring sustained investor self belief in NEAR’s enhance possible within the crypto sector, particularly in applications tied to AI.

As NEAR approaches the upper boundary of its channel, market watchers await a imaginable breakout.

The analyst renowned if this pattern persisted, the Come Protocol crypto label would perhaps perchance moreover reach modern heights. It would perhaps presumably moreover even take a look at the $16 resistance stage within the impending months.

This optimistic outlook became as soon as bolstered by NEAR’s constant performance and strengthening fundamentals within the crypto AI do, the do it continues to create important strides.

Grayscale Involvement Indicators Confidence

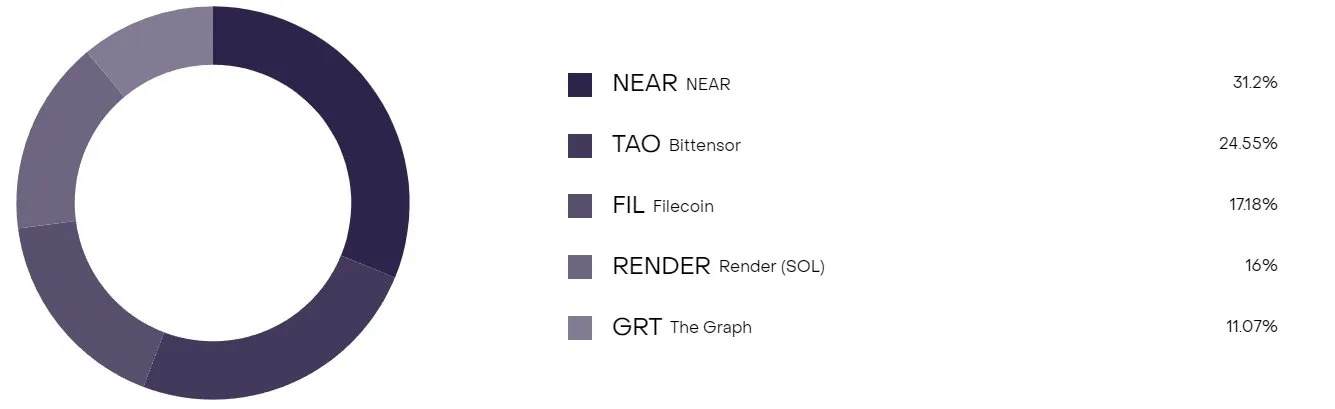

Meanwhile, Grayscale Decentralized AI Fund confirmed its preference for the Come Protocol, allocating a appreciable 31.2% of its portfolio to NEAR.

This positioning rapid Grayscale’s self belief in NEAR’s functionality within the blockchain AI sector. Bittensor (TAO) adopted with a 24.55% portion, highlighting its relevance within the identical do.

Filecoin, though in total identified for its data storage solutions, captured a foremost 17.18%. That rapid a strategic diversification into decentralized storage solutions for AI applications.

Lesser but well-known allocations encompass Render and The Graph, conserving 16% and 11.07%, respectively.

Render operates on Solana and contributes to the GPU rendering do, potentially complementing AI processes. The Graph helps indexing and querying data at some level of blockchains, well-known for decentralized AI functionalities.

This distribution no longer easiest mirrored a bullish stance on these technologies by Grayscale but moreover indicated a strategic funding sample.

It appears to be like to be esteem aiming to beef up AI capabilities at some level of assorted blockchain platforms. The varied allocations rapid Grayscale’s solution to capitalize on diversified functions of AI and blockchain integration, starting from computational energy to data accessibility and interoperability.