PNUT sign has dropped bigger than 20% within the final 24 hours, following its latest surge after being listed on principal exchanges, the build aside it reached $2.28. This fascinating decline highlights weakening momentum, as indicators fancy ADX and RSI indicate that the uptrend is fading.

Regardless of this, PNUT tranquil has the aptitude for a solid restoration if investors return. Nonetheless, if bearish stress continues, PNUT might well well per chance face a principal correction, checking out key improve stages and potentially shedding extra floor.

PNUT Fresh Uptrend Is Fading Away

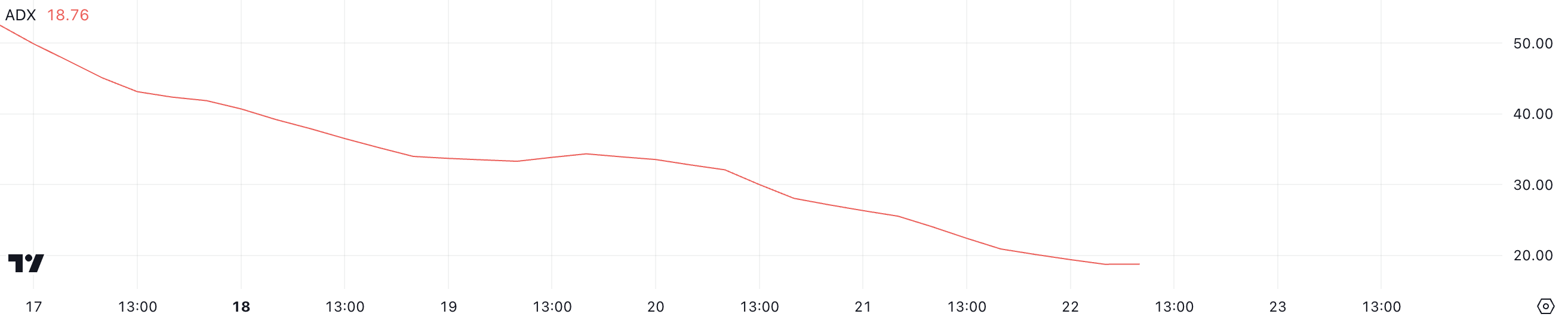

PNUT within the mean time has an ADX of 18.76, enormously down from above 50 correct about a days within the past. This consistent decline in ADX indicates that the energy of PNUT’s uptrend has been progressively weakening.

Regardless of tranquil being in an uptrend, the fascinating tumble in sign over the final 24 hours highlights the increasing vulnerability of hanging forward upward momentum. The ADX suggests a ability reversal shall be on the horizon.

The ADX measures the energy of a trend, with values above 25 indicating a solid trend and beneath 20 indicating a ancient or nonexistent trend.

PNUT’s ADX shedding beneath 20 displays a weakening trend, even supposing the most fresh directional circulate tranquil leans bullish. If this trend energy continues to deteriorate, PNUT might well well per chance wrestle to take care of its uptrend. That might well well per chance per chance plug away PNUT sign at threat of a extra necessary reversal within the advance time length.

PNUT Is Nearly Reaching The Oversold Zone

PNUT within the mean time has an RSI of 32.6, marking its lowest level since being listed on Binance.

The Relative Strength Index (RSI) measures the plod and magnitude of sign movements, with values above 70 indicating overbought stipulations and beneath 30 signaling oversold stages.

The consistent decline in PNUT’s RSI over the final few days highlights weakening momentum, with the asset now drawing discontinuance oversold stages.

If the RSI falls beneath 30, it might well well most likely per chance per chance also signal that PNUT is enormously undervalued within the short time length. Nonetheless, persisted bearish sentiment might well well per chance take care of the price below stress, delaying any restoration.

PNUT Designate Prediction: A 72% Correction Ahead?

If PNUT sign experiences a reversal and a solid downtrend emerges, it might well well most likely per chance per chance also take a look at the improve at $0.749. Can bear to this level fail to take care of, the price might well well per chance tumble extra to $0.41 and even $0.32, marking a principal seemingly correction of up to 72%. This might well compose PNUT be surpassed by diverse meme coins fair like MOG, GOAT, and MEW in phrases of market cap.

This form of self-discipline would divulge increased bearish stress, with traders potentially persevering with to exit positions after the surges following the listing on principal exchanges.

On the loads of hand, if PNUT uptrend regains energy, the price might well well per chance upward thrust to take a look at the resistances at $1.87 and $2.21.

Breaking thru these stages might well well per chance permit PNUT to retest its earlier all-time high of $2.50. That might well well per chance per chance offer a ability 111% upside and put PNUT as a high 10 meme coin within the market.