Solana (SOL) has attracted the eyes of the crypto market with expectations that it’d rise to $780.

Analysts and market contributors are attempting to determine whether Solana’s impressive beneficial properties, community job in the most up-to-date length, and other key market trends can proceed to propel the token elevated to full this just.

Solana Community Mutter and Market Job Gasoline Optimism

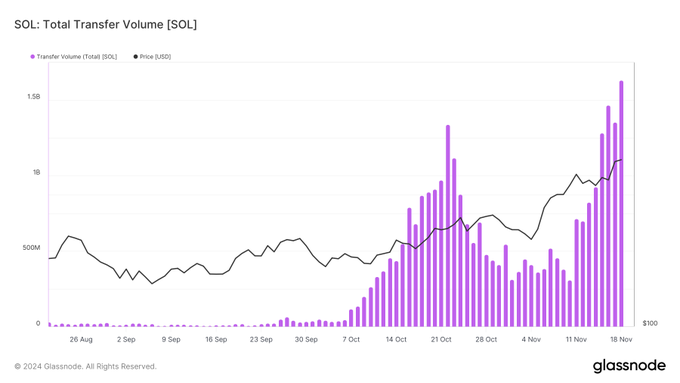

Solana has recorded critical achievements primarily based mostly on data from blockchain analytics company Glassnode on community job.

Day-to-day trading quantity soared to $318 Billion and the different of addresses all in favour of transactions stood at higher than 22 million.

This growth reveals elevated consciousness of the blockchain, in particular as a result of the high tempo of transactions and low charges.

Then again, there are questions regarding the feasibility of this vogue of job. Glassnode furthermore pointed to apprehensive practical and median transaction sizes.

This is in a position to imply that among the community job may maybe well well successfully be coming from bots, no longer novel users. Monetary analysts are now watching if this elevated usage will undergo as a pattern or will die out.

SOL Key Resistance Ranges and Historic Designate Patterns

Solana’s trace soared to $248.52 and nearly reached its outdated epic of $259, which modified into order in November 2021. Crypto analyst Miles Deutscher no longer too long up to now pointed out that Solana is mirroring the sample it had in 2021.

On the time, Solana saw a inspiring rise in its trace, which ended in hypothesis that it’d attain the identical and hit $780.

Analysts pointed out that a SOL trace shut above the $250 stage is well-known for the foreign money pair to proceed its upward trajectory.

Crypto trader Bonybean acknowledged, “If Solana can wreck through $250, it’d lag even elevated, presumably even to $291 in the short length of time.”

More hope can even be drawn from the customary cycle of the cryptocurrency market. Some contributors demand this “altseason” in 2025, when most altcoins rise in price in a critical manner, to be favorable for Solana.

Institutional Ardour and ETF Speculation

The adoption of Solana has been on the upward push as extra institutions originate up to consist of the asset of their portfolios. Furthermore, the filing of the Solana net page ETF by VanEck has boosted the markets extra.

Notably, this comes amid rumors surrounding the approval of such products following the aptitude departure of Gary Gensler as SEC Chair.

Commence curiosity in Solana futures contracts surged by 96% this month, reaching $5.64 Billion, primarily based mostly on Coinglass data.

This manufacture bigger indicates increasing self assurance amongst merchants, as successfully as heightened capital inflows into the derivatives market.

Market contributors take a look at this pattern as a favorable signal for Solana’s trace growth.

Market Catalysts and SOL Designate Predictions

The surge in the price of Solana has furthermore been boosted by other market elements such because the bullish bustle of memecoins and the rising institutional investors’ curiosity.

The most up-to-date listings of Solana-primarily based mostly tokens on Binance and Robinhood have elevated the asset’s publicity.

Furthermore, the adoption of Solana in the no longer too long up to now launched Coinbase’s COIN50 index will enhance adoption amongst institutional investors.

Designate predictions for Solana live divided. Whereas some consultants, impartial like Deutscher, retain that Solana’s historical patterns may maybe well maybe toughen an extended-length of time target of $780, others counsel extra cautious targets.

Analysts extensively agree that breaking the $250 resistance is a well-known step in direction of elevated trace levels, with near-length of time projections ranging between $350 and $500.

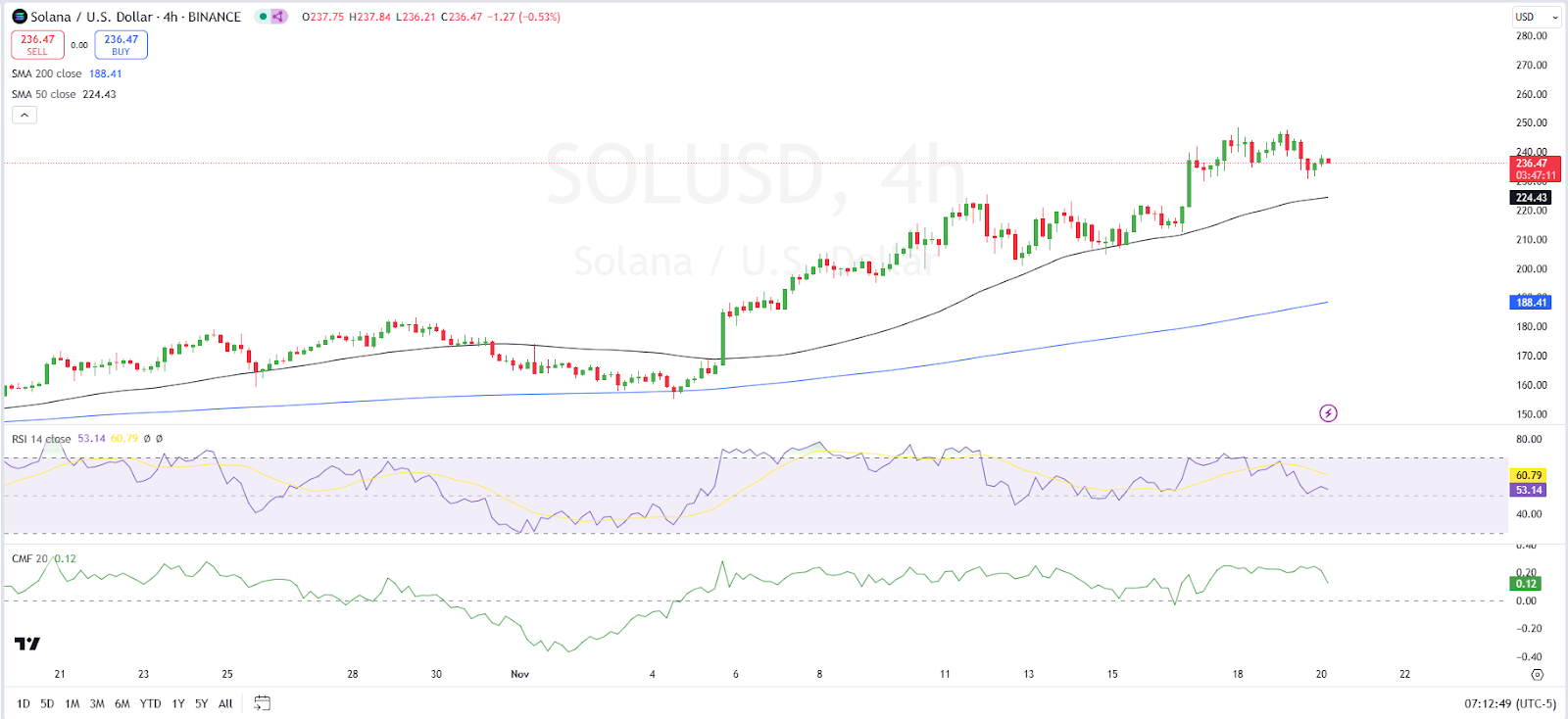

Adding to the bullish sentiment, the 50-day MA is eager above the 200-day MA suggesting that the bulls are silent up to the mark.

This switch means that SOL trace may maybe well maybe head in direction of the $260 resistance stage. Then again, with the RSI keen under its signal line, the bullish momentum may maybe well well successfully be dwindling.

As well, the Chaikin Money Drift (CMF) trending southwards on the 4-hour trace chart means that money is exiting the market as merchants seize income. Might maybe well maybe silent the CMF drop into the harmful order, a bearish pattern may maybe well well successfully be expected.