Goatseus Maximus (GOAT) mark honest no longer too long ago reached a brand new all-time high. The present mark action has been accompanied by solid technical indicators, suggesting an ongoing bullish growth.

On the more than just a few hand, some indicators hint that this rally might per chance per chance very properly be nearing its restrict. Because the prognosis continues, the functionality for every continued beneficial properties and the probability of a correction in the near future will likely be explored.

GOAT Present Pattern Is Nonetheless Sturdy

GOAT’s ADX is for the time being at 27.63, down from above 36 closing week. This tumble suggests a weakening in growth strength.

When ADX modified into above 36, it indicated a solid growth. Now, with ADX below 30, the growth is unruffled expose however less worthy.

The Real looking Directional Index (ADX) measures growth strength. It ranges from 0 to 100, with values above 25 indicating a solid growth and below 20 suggesting no necessary growth.

GOAT ADX of 27.63 displays that it remains in an uptrend, though the momentum is no longer as solid as ahead of. The uptrend persists, however it might per chance per chance per chance no longer be as forceful as it modified into closing week.

GOAT Is Conclude To The Overbought Zone

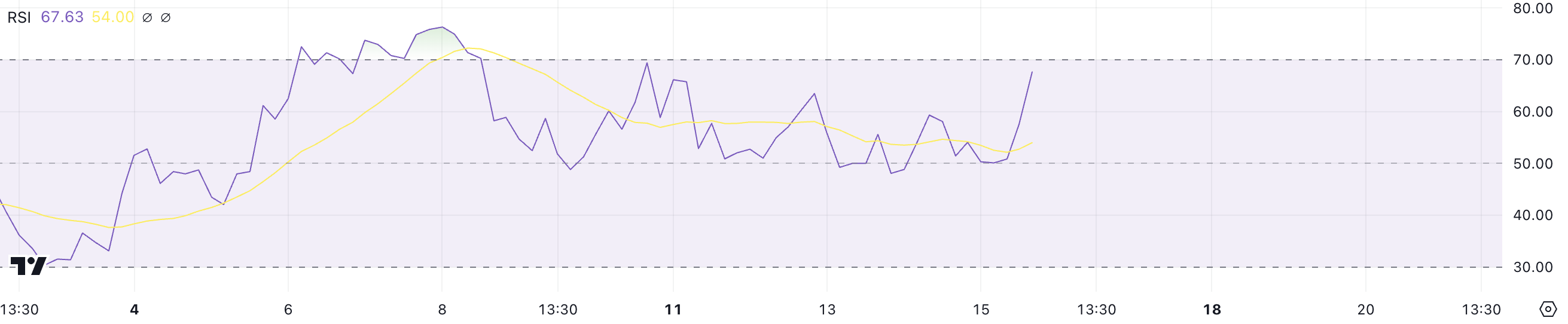

GOAT’s RSI is for the time being at 67.63, following a present mark jump and a brand new all-time high. It has risen sharply from 50 in only some hours. This swift originate bigger suggests solid buying momentum, pushing GOAT nearer to overbought ranges.

The Relative Strength Index (RSI) measures the bustle and commerce of mark movements. It ranges from 0 to 100, with values above 70 indicating overbought instances and below 30 suggesting oversold instances. With GOAT’s RSI nearing 70, it signals that the asset might per chance per chance very properly be overextended.

The present mark surge and all-time high, coupled with the RSI’s present stage, imply that GOAT might per chance perhaps per chance face a solid correction rapidly. That would take GOAT off the tip 10 largest meme coins by market cap.

GOAT Sign Prediction: Is a 39% Correction Imminent?

GOAT honest no longer too long ago reached its all-time high, and its EMA traces are very bullish.

The price is above all EMA traces, with short traces positioned above long-term ones. This alignment suggests solid upward momentum, confirming a wholesome uptrend.

On the more than just a few hand, the RSI indicates that the meme coin might per chance per chance very properly be getting into overbought territory, hinting at a doable correction. The closest increase zone for GOAT mark is around $0.76.

If this stage fails to preserve, the price might per chance perhaps per chance tumble to $0.69, suggesting a that you might per chance per chance per chance be assume 39% correction. This highlights the probability of a pullback after this form of solid rally.