Raydium is getting nearer to Uniswap in day-to-day draw volumes, as the influx of meme tokens does no longer stop. Raydium continued its exercise whereas other markets slowed down after doubtlessly the most trendy crypto rally.

The meme frenzy reveals no signs of slowing down, as Raydium is catching up with Uniswap on weekly volumes. The Solana DEX ecosystem stays terminate to its height exercise, and Raydium reached $20B in weekly draw volumes. Raydium remained one among doubtlessly the most resilient app, even as your total crypto market slowed down and moved far from its height exercise and sage valuations.

Uniswap became restful first with $26B in weekly volumes, largely due to the its distribution to multiple ecosystems. Basically based fully on CryptoRank records, PancakeSwap is the third-most curious DEX, restful retaining $10B in weekly trading volumes. Entire draw volume went above $98B, although Ethereum-based fully trading saw some outflows due to the prohibitive gas costs.

Raydium increase goes earlier than Uniswap

Raydium and Uniswap are already head to head through temporary day-to-day volumes. The Solana DEX carried $4.5B in trades, whereas Uniswap had a day-to-day turnover of $4.9B. Each of the DEX take in a terminate nick of the market, with around 26% for Uniswap and 23% for Raydium. The gradual shift to the Solana ecosystem follows the roam in DEX exercise for Ethereum-based fully tokens. Meme tokens on Uniswap restful exist, however are extra expensive to commerce.

Raydium executed a 128% increase of volumes in the previous 24 hours, exhibiting it became resilient to other market traits. Many of the exercise on Raydium got right here from the stop 10 most up-to-the-minute meme tokens, with Peanut the Squirrel (PNUT) having the absolute top trading volume.

Uniswap expanded its day-to-day volumes by 80% most curious, no matter relying on several extremely lively networks. Uniswap makes exercise of Sinister for its increase, whereas Ethereum’s swaps became prohibitive due to the high gas costs.

Raydium stays a single-chain DEX, facing older and newly launched tokens. The exercise involves every trading older resources and through bot-driven sniping of new tokens. Raydium outperforms multiple other DEX, by being the significant instrument for tapping the booming meme market.

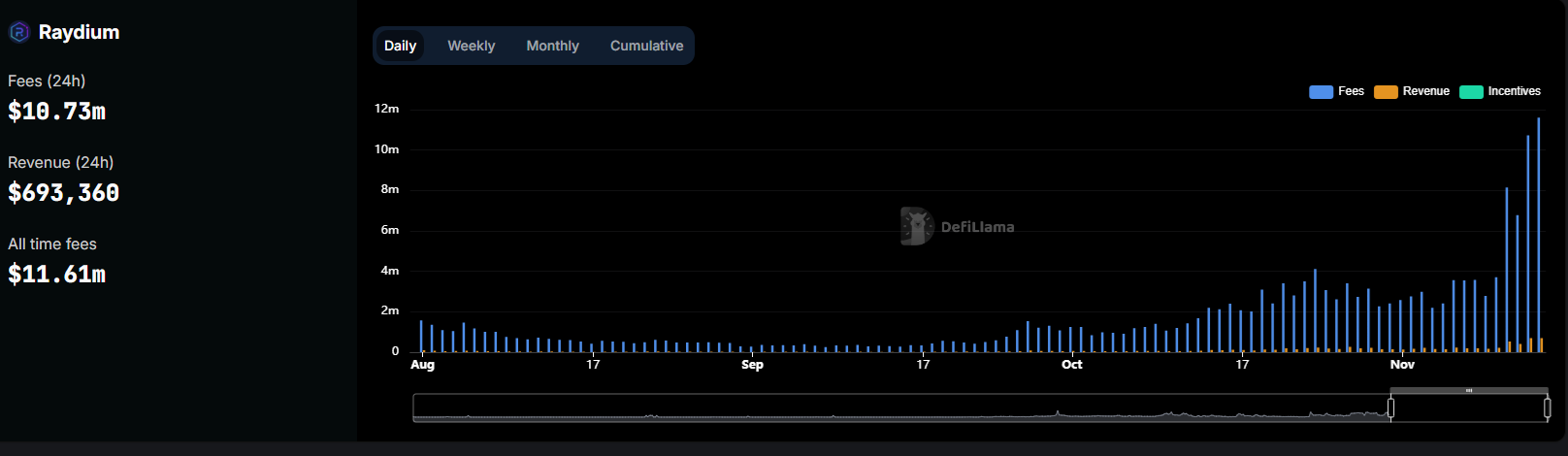

The DEX also lined up among top charge producers on the day-to-day timeframe. Raydium became at the reduction of most curious Ethereum and Tether, generating $10.37M in the previous 24 hours. Absolutely the charge sage followed one other height day for meme tokens, however especially Solana-based fully memes.

Raydium surpassed even the significant Solana chain in charge manufacturing, as successfully as Jito, the significant Solana MEV block builder. At the same time, Uniswap most curious produced $5.11M in 24-hour fees. Following the height exercise, Raydium’s native token RAY rallied to $4.70, although restful beneath its preliminary trading rally. RAY has been trading since 2021, and is yet to breakout to a new all-time high.

Top Solana meme tokens are also terminate to their height valuation, with a full market capitalization above $21B. A number of of the memes have moved on to centralized markets, however for more moderen tokens, Raydium is the significant source of attach discovery.

Pump.fun continues to originate new tokens

Pump.fun, the significant source of tokens for Raydium, continues to originate a baseline of 35K newly launched resources. Of these resources, 1-2% graduate to Raydium, whereas the rest by no draw enter attach discovery.

Raydium is restful key to the initiating of decentralized tokens due to the its characteristic of locked liquidity. The newly launched tokens supply a guarantee of no rug pulls from the group, and no possibility to empty the liquidity.

After Raydium, even fewer tokens switch on to centralized exchanges. On the other hand, the hope of discovering the next winner keeps the Solana DEX busy.

The stop on Raydium became explosive increase when put next to 2023, with up to 100X in phrases of volumes and fees. Raydium does no longer most curious elevate meme tokens, and is share of Solana’s DEX ecosystem.

Raydium will also department into DeFi, providing stablecoin alternatives, as successfully as web web hosting cbBTC, the wrapped have of BTC on Solana. Raydium carries cbBTC swaps and trades, the exercise of the services and products of Jito for guaranteed transactions.