Main cryptocurrency Bitcoin (BTC) has been on a relentless bull poke, consistently breaking novel all-time highs over the final week. As of this writing, the king coin exchanges hands at $85,662, recording a 5% amplify within the final 24 hours.

Because the market anticipates Bitcoin’s worth rally against the $90,000 mark, signs imply this milestone also can stay out of attain. This prognosis delves into two serious factors that would also slack down or even stall the cryptocurrency’s ascent against this worth aim.

Bitcoin Sends Cautionary Indicators

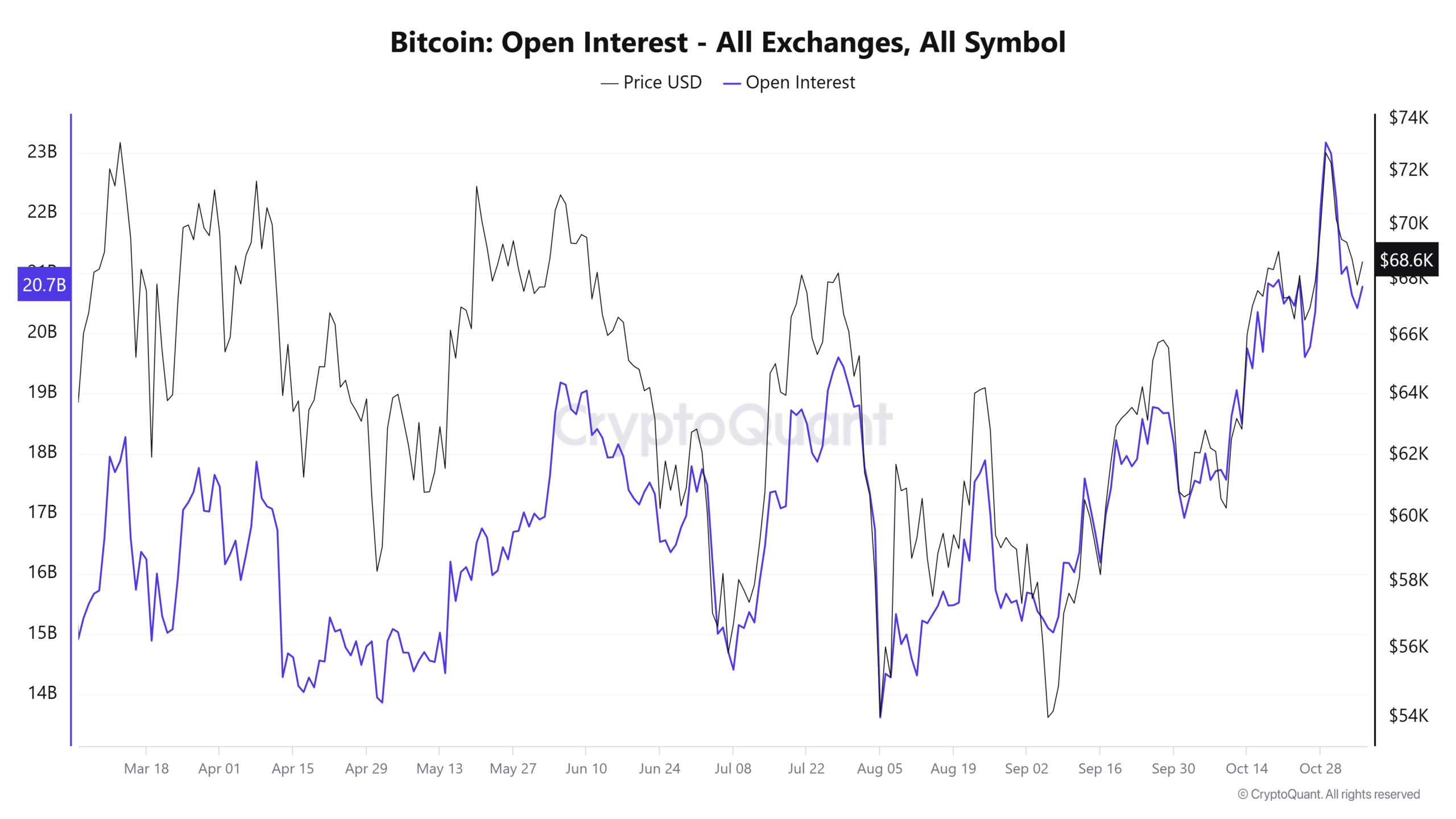

Bitcoin’s exploding launch hobby is a key enlighten that will stay its ascent to the $90,000 worth mark within the short interval of time. Per CryptoQuant’s data, over the final week, the futures market has seen an addition of over $16 billion in launch positions. This marks a indispensable amplify in leverage. As of this writing, BTC’s launch hobby is at $25 billion, its highest since August 2022.

Open hobby tracks the entire replacement of outstanding contracts (choices and futures) which gain yet to be settled. At some level of a worth rally, a surging launch hobby is a bullish signal. Nevertheless, when an asset’s worth rises too rapidly, a excessive launch hobby can signal doable instability.

Over the previous week, Bitcoin’s worth has rallied by 25%. The accompanying spike in launch hobby indicates that many consumers gain taken leveraged positions. This has created an environment inclined to liquidation cascades if costs originate to topple.

If the coin’s worth reverses, even a little, these leveraged positions can trigger a chain response. When highly leveraged merchants are forced to shut out positions to possess a long way from losses, the resulting promote orders can intensify downward stress, inflicting the coin’s worth to decline extra and triggering extra liquidations.

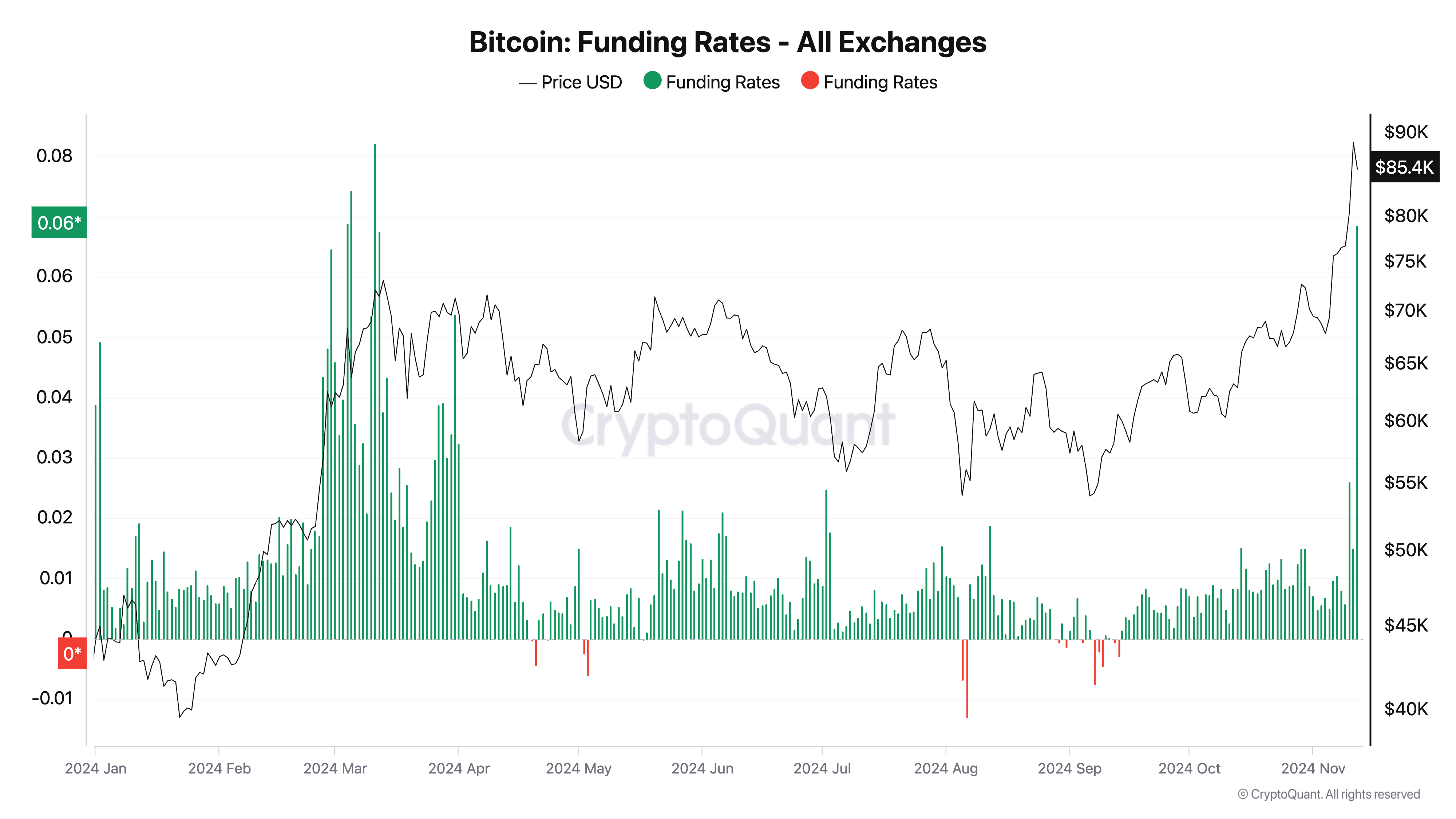

Furthermore, BTC’s rising funding price is yet another enlighten that will encourage its worth below $90,000 within the short interval of time. It is within the meanwhile at 0.015%, its highest fee for the explanation that discontinuance of March when BTC suffered a extra indispensable correction.

In futures trading, the funding price is a periodic price paid between merchants preserving long and short positions, incentivizing steadiness between the 2. Nevertheless, when the funding price surges considerably, it most incessantly indicators that searching for to safe side of the market is heavily dominant. Right here’s a bearish signal that most incessantly precedes a worth pullback.

BTC Impress Prediction: Coin Is Overbought

When long positions turn out to be costly to retain, some merchants also can originate to shut their positions to possess a long way from excessive funding charges, which would possibly possibly possibly build downward stress on the asset’s worth. Moreover, if the asset’s worth begins to decline, heavily leveraged long positions are vulnerable to liquidation, constructing a cascade enact that can lead to a intriguing topple in worth.

Bitcoin’s overbought readings from its Relative Strength Index (RSI) confirm the bearish outlook above. As of this writing, the coin’s RSI is 74.83.

The RSI indicator measures an asset’s overbought and oversold market situations. It ranges between 0 and 100, with values above 70 suggesting that the asset is overbought and due for a correction. On the diversified hand, values below 30 portray that the asset in quiz is oversold and shall be poised for a rebound.

At 74.83, BTC’s RSI indicates it’s considerably overbought and can quickly decline. If these factors retain upright and Bitcoin experiences a non permanent pullback, it can well well also fall to $81,215. If this level fails to retain, the coin’s worth also can fall extra to $74,340.

Nevertheless, if searching for to safe stress strengthens, the coin also can reclaim its most modern all-time excessive of $89,972 and rally previous it into the $90,000 worth territory.