No longer too lengthy ago, Tellor has experienced some foremost impress action after 2 whales moved 226,741 Tellor tokens to the OKX alternate. The token nears a breakout.

With this prance accounting for 8.42% of TRB’s total supply, the market is closely looking at. Contemporary impress gyrations within the Tellor token market possess raised issues over attainable impress volatility.

The fluctuations possess led to extensive Tellor token market movements, which took region one day of the last 12 hours. Two predominant investors, or whales, by shock transferred in a mixed 226,741 TRB tokens.

The tokens had been rate roughly $12.18 million, to the OKX alternate. With a entire of 8.42% of TRB’s total supply on this deposit, here’s a substantial share of the market which will impact trade dynamics.

Mountainous deposits into exchanges are in total a signal that a holder is on the point of sell the token. That caused the token impress to descend.

The indicators of this impact are already mirrored in Tellor’s present impress chart, with a tiny dip shown. Tellor is currently priced at $53.78, down 2.1% from the past duration.

When when in contrast with lots of predominant cryptocurrencies, the token is down 1.9% in Bitcoin terms. It’s now rate 0.0007032 BTC per TRB.

It has viewed a steeper decline in opposition to Ethereum, falling 5.0% to 0.01779 ETH. Tellor’s 24-hour shopping and selling differ exhibits a low of $51.80 and a high of $56.02. This means some shifting about but staying consistent within this differ.

Tellor Market Outlook: Charge Patterns Point to a Breakout Presently

At the time of writing, Tellor’s impress is within the confines of a descending wedge sample. This sample in total components to the aptitude for a breakout. The direction is correct isn’t identified.

The important toughen level is at $51.00. A rupture beneath that level might maybe maybe maybe point out a most likely downside goal. It falls in step with a descend of 19.87% to $41.

If bullish momentum carries on, there’s a correct likelihood Tellor will prance up to the $65.00 resistance with a continuation goal of $100.00. The goal represents a 53.18% do, which is a foremost quantity of upside attainable if shopping rigidity continues to assemble.

RSI currently stands at 42.22, a mildly oversold studying that might maybe maybe maybe rapidly flip into a rebound if shopping emerges.

On the opposite hand, it’s not that a long way from the overly oversold zone, so the downside soundless has legs. The MACD indicator too is in a bearish posture.

The lines beneath zero gift feeble momentum. The MACD line is beneath the signal line indicating feeble momentum as effectively. A bullish crossover might maybe maybe maybe maybe effectively be an early signal of a reversal.

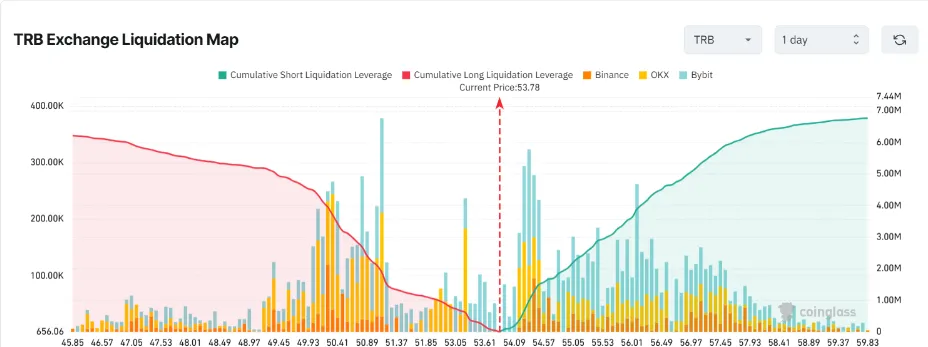

Liquidation Plot Reveals $53.78 Breakout Could well maybe Station off Main Liquidations

With the present impress being $53.78, the Tellor Liquidation Plot exhibits a in actuality well-known balance point for leveraged positions.

On the downside, lengthy liquidations steal accumulate. As they lunge up and the token impress continues to float beneath this point, liquidation threat reaches its peak at $forty five.85.

It’s for this motive that a appealing impress descend might maybe maybe maybe maybe additionally lead to a wave of lengthy liquidations. It would kick in some promoting rigidity that might maybe maybe maybe push the cost beneath grand extra.

On the opposite, quick liquidations prance up if the cost goes beyond $53.78, especially past $54.50, where cumulative liquidation ranges originate mountain climbing.

In consequence, a impress rally below this setup sets participants to shut their quick positions. This acts as additional shopping rigidity and will increase the likelihood of an upward spike.

The coloured bars checklist liquidation volumes on every alternate and mark that OKX has the largest liquidation quantity, adopted by Binance and Bybit.

The point of hobby on OKX in explicit exhibits that the alternate is essentially susceptible to liquidation risks, and the cost scoot might maybe maybe maybe very with out bother lead to greater volatility.

If the $53.78 level is broken out above or beneath, it might maybe maybe maybe maybe maybe maintain like a flash, leveraged-precipitated strikes in either direction, pushed by cascading liquidations on one side of the market.

This imbalance of lengthy and quick pressures represents a extremely leveraged market one day of which a appealing impress prance might maybe maybe maybe with out bother be wiped out by a greater-than-anticipated reaction.