Terra Traditional (LUNC) is catching the honour of crypto enthusiasts. Recent patterns and a solid trading volume counsel that the potential rally is likely to be bigger than a short enhance – it’s miles likely to be the open up of an extended upward model. On this Terra Traditional rate prediction article, we are going to dive into what’s riding Terra Traditional’s breakout, why merchants are feeling bullish, and what would possibly perhaps perhaps lie forward for LUNC’s rate scamper.

How has the Terra Traditional (LUNC) Win Moved No longer too lengthy previously?

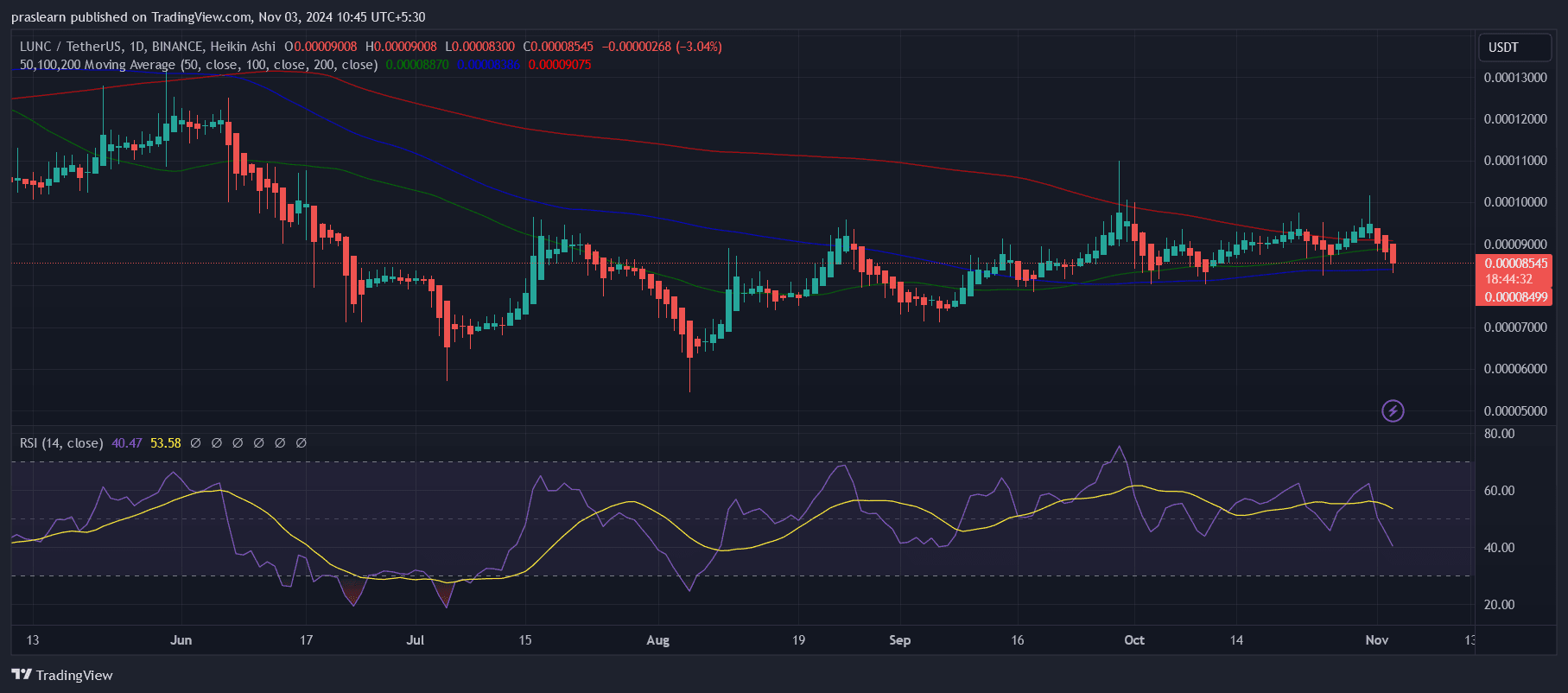

As of on the present time, Terra Traditional (LUNC) is valued at $0.00008496, with a 24-hour trading volume of $18.84 million, a market cap of $492.12 million, and a market dominance of 0.02%. At some point soon of the final day, LUNC’s rate has dropped by 5.38%.

Terra Traditional hit its height rate on April 5, 2022, when it reached an all-time excessive of $119.01. Its lowest recorded rate used to be $0.00001651 on Could perhaps 13, 2022. Since that top, LUNC’s lowest point has been $0.00001651, while its highest since then used to be $0.00059. In the intervening time, the market sentiment spherical Terra Traditional leans bearish, while the Worry & Greed Index displays a level of 69, indicating ‘Greed’.

The circulating provide for Terra Traditional stands at 5.seventy 9 trillion LUNC, out of a most provide of 6.88 trillion. The annual provide inflation rate is a shrimp detrimental at -0.01%, with 579.27 million fewer LUNC created in the previous three hundred and sixty five days.

Terra Traditional Win Drops Following Important Token Burn

In most recent days, Terra Traditional (LUNC) has skilled considerable rate movements driven by intensified token burn activities. In a single transaction, 49,472.28 LUNC tokens had been burned inside correct one hour, bringing the whole burn depend to a fundamental 7,062,267.40 LUNC. Of this, 49,573.28 tokens had been removed by the utilization of reveal transactions, while the bulk—7,012,694.12 tokens—used to be eliminated by strategy of tax-basically based entirely mechanisms.

With a burn rate surge of 2,494%, these actions inform the community’s aggressive stance on reducing LUNC’s provide. This kind of excessive burn rate signifies a strategic method to controlling token circulation, which would possibly perhaps perhaps succor enhance rate steadiness and potentially power rate appreciation over time. If the community maintains this tempo, the cumulative impact on LUNC’s market dynamics would possibly perhaps perhaps fair give a take dangle of to shortage, potentially fostering a extra bullish sentiment finally.

Examining LUNC’s Re-Denomination Proposal and Neighborhood Impact

The proposed re-denomination of Terra Traditional (LUNC) aims to power the token’s rate up to $1 by vastly reducing its total provide by a a part of spherical 11,090. If performed, this would pronounce the provision down from roughly 6.77 trillion to 610.45 million LUNC, successfully aligning provide ranges with the market capitalization wished to ascertain the $1 target.

This formulation would possibly perhaps perhaps theoretically expand LUNC’s shortage, fostering a stronger rate contaminated and sharp to merchants searching out for tokens with a shrimp provide.

On the opposite hand, this proposal raises fundamental concerns inside the LUNC community. Key aspects of contention consist of the lack of prior community session referring to preliminary token minting, which some peep as a prime transparency declare.

Moreover, the accountability of re-pegging charges appears to be like to fall on the community, leading to unease over the potential financial burden and perceived mismanagement, comparable to the controversial BTC purchases for reserves. The apprehensions over token burn logistics, handsome distribution, and risks of market manipulation highlight the necessity for clarity and transparency in the re-denomination strategy.

Taking a see forward, the proposal’s success will largely rely on structured community discussions, a actually finest balloting assignment, and obvious pattern plans. Gaining consensus is considerable; without it, the re-denomination would possibly perhaps perhaps face resistance and fail to construct the intended definite market outcomes.

If efficiently implemented, monitored, and managed, this re-denomination would possibly perhaps perhaps delivery a pathway for LUNC to total its $1 target. On the opposite hand, balancing community believe with strategic provide reductions shall be pivotal for lengthy-term rate sustainability and ecosystem steadiness.