Bitcoin (BTC) has opened November surpassing the $70,000 psychological resistance after keeping about a days above this diploma. As this recent month starts, Finbold checked out Bitcoin’s ancient returns to provide a BTC notice projection for November 30.

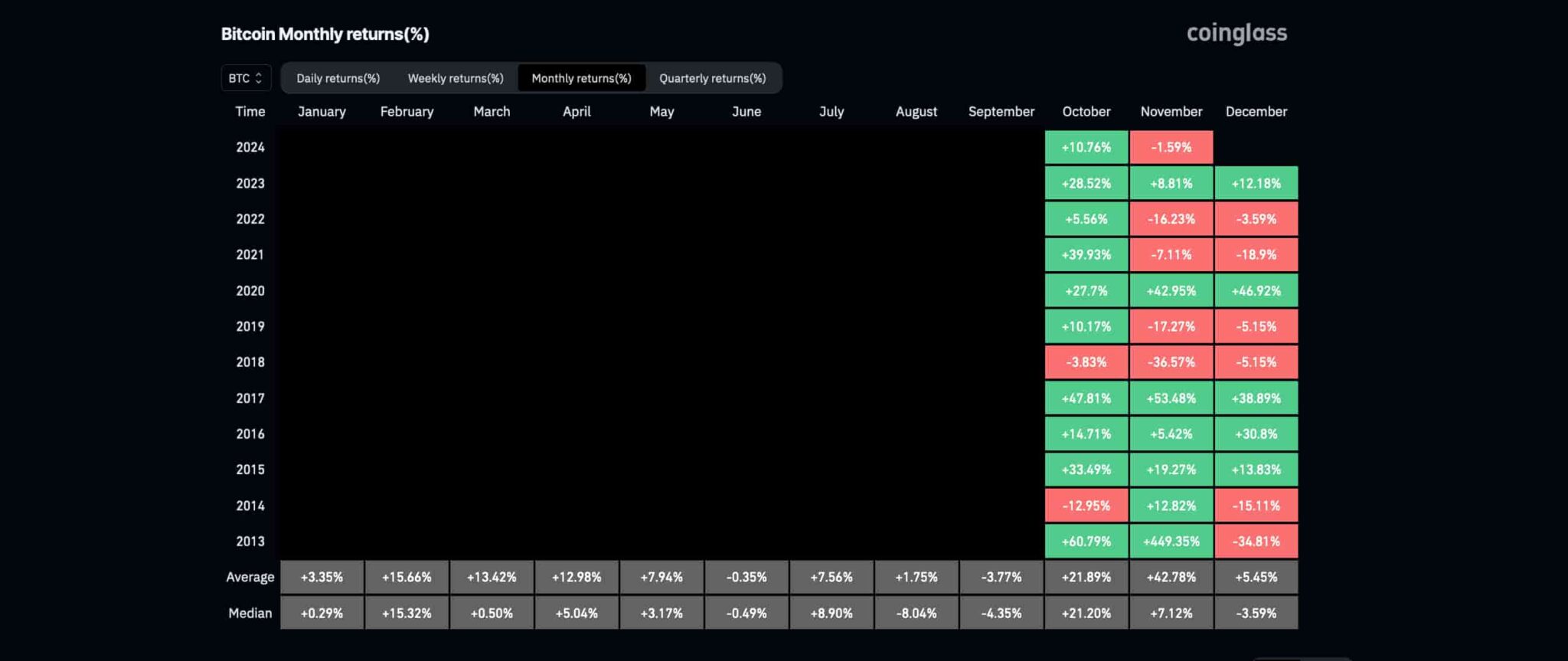

In hindsight, Bitcoin closed October with 10.76% beneficial properties, reaching almost half of the frequent and median ancient returns for “Uptober.” Knowledge from Coinglass shows November has even greater common ancient returns while having decrease median beneficial properties than its outdated month.

Seriously, Bitcoin’s monthly performance in November, courting abet from 2013, has collected 42.78% beneficial properties on common. With seven sure years out of 11, November additionally has a median return of seven.12%, from opening to closing.

In command, November’s most productive year became once 2013 with staggering 449.35% beneficial properties from day one to 30, followed by 2017 and 2020, with 53.forty eight% and 42.95%, respectively. Meanwhile, 2018’s maintain market resulted in -36.57% returns in November for Bitcoin, being its worst year followers by 2019.

Bitcoin (BTC) notice prediction by November 30

As of this writing, Bitcoin is buying and selling at $69,495, below November’s opening notice of $70,272. The leading cryptocurrency shows strength after breaking out of excessive and low timeframe downtrends, successfully retesting the LTF.

For that reason of this truth, BTC would possibly perchance well per chance substitute between $75,275 and $100,334 by the dwell of November, in accordance to its ancient returns. The prediction initiatives Bitcoin’s notice from November’s opening the utilization of the median and common ancient returns if BTC keeps its momentum.

While this diagnosis mustn’t ever be taken in isolation, Bitcoin’s ancient returns provide significant insight into what merchants and merchants would possibly perchance well per chance query as this month’s notice circulation unfolds.

Interestingly, Finbold shared two connected analyses earlier this Saturday, November 2, the $100,000 notice target. First, the man made intelligence (AI) ChatGPT forecasts BTC to reach this target by mid-to-slack 2025. Alan Santana, in one other diagnosis, sees a the same outlook – even if he believes this recent rally is on the whole a bull lure.

All issues thought about, Bitcoin notice is awfully unlikely to predict with precision, because the market is extraordinarily unstable and unsure. Investors can must notice what they’re shopping for and have in thoughts a pair of issues before making any financial decision.