The most unique surge in Bitcoin mark appears to be like to align with a shift in investor habits, in accordance with a CryptoQuant analyst is named ‘crypto sunmoon.’

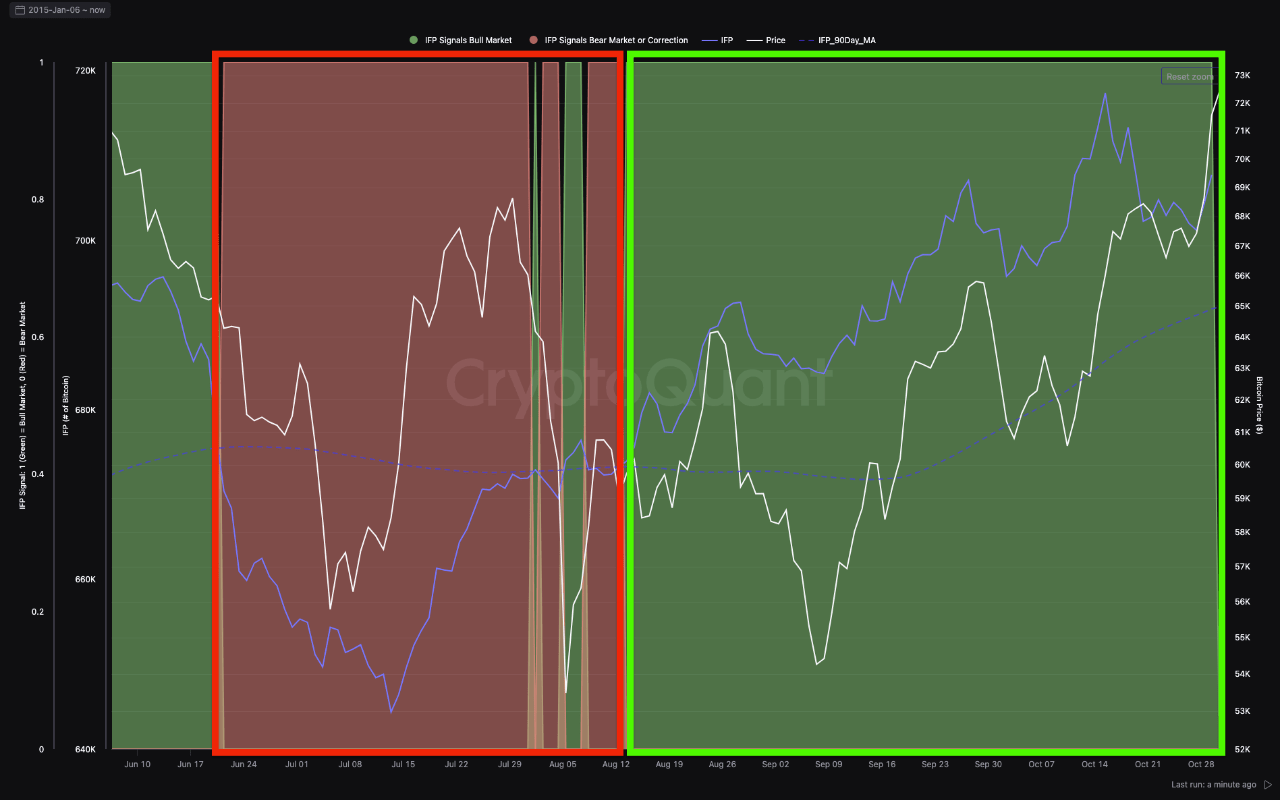

In a post on the CryptoQuant QuickTake platform, the analyst observed that the most unique bull market is driven by leveraged bets, in particular in derivatives markets.

This pattern is essential as it contrasts with past market cycles the put increased deposits customarily accompanied BTC bull runs to standing exchanges.

Leveraged Bets’ Aim in Bitcoin Designate Teach

Elaborating extra on leverage bets contains using borrowed funds to multiply the dimensions of an funding. For instance, with 2x leverage, a trader can commence a put twice as huge as their capital.

In Bitcoin futures trading, this reach can also simply additionally be worthwhile during upward mark actions but additionally comes with dangers. If the market shifts in opposition to their put, merchants can face fundamental losses known as liquidation.

The analyst notes that the influx of Bitcoin into derivatives exchanges signals increased self perception amongst merchants, suggesting a perception in extra mark gains. This self perception can indulge in a feedback loop, the put rising costs support extra leveraged bets, extra fueling the bull market.

Bitcoin bull market begins with leveraged bets

“The bull market will proceed as #bitcoin is nonetheless deposited into futures exchanges for leveraged bets using derivatives, as a substitute of into standing exchanges for promoting.” – By @t0_god

Hyperlink 👇https://t.co/1egL7L2YoO pic.twitter.com/uuQPEiSWtb

— CryptoQuant.com (@cryptoquant_com) October 30, 2024

BTC Designate Efficiency And Outlook

With Bitcoin’s mark exhibiting an 8.2% lengthen all the draw by the final week, within the within the intervening time trading at $71,804, the characteristic of leverage becomes increasingly extra relevant. Seriously, BTC noticed a dinky retracement from its most unique 24-hour high of $73,562 yet continues to serve upward momentum.

This trusty mark development and leveraged inflows signal broader investor optimism toward Bitcoin’s future mark most likely. Per the analyst, as long as Bitcoin continues to waft into futures as a substitute of standing exchanges, the bullish sentiment will likely dwell solid.

Seriously, leveraged bets happen to be correct one of many completely different metrics of Bitcoin, suggesting a most likely continuity of the continuing lengthen in mark.

To this level, the Stablecoin Present Ratio Oscillator (SSRO) has seen low ranges no longer seen since 2022. The decrease of this metric into lower ranges methodology extra stablecoins are being converted to BTC, therefore suggesting increasing put a query to for the asset.

Within the intervening time, the technical outlook isn’t left in a single of the completely different metrics indicating extra rally for BTC’s mark. Earlier on the present time, the famed crypto analyst Ali highlighted that traditionally, BTC has increased to 1.618 and 2.272 Fibonacci retracement ranges.

Would possibly mute the asset apply the identical sample this time, Ali predicts BTC will surge to a mark between $174,000 and $462,000.

In past bull cycles, #Bitcoin has peaked between the 1.618 and 2.272 Fibonacci retracement ranges. Following a equivalent sample, the next $BTC top would possibly perhaps land between $174,000 and $462,000! pic.twitter.com/KUq51Tt57z

— Ali (@ali_charts) October 30, 2024

Featured image created with DALL-E, Chart from TradingView