Ethereum’s impending Dencun increase, scheduled for March 13, has sparked hypothesis about altcoins.

This increase, promising to very a lot increase Ethereum’s usability, security, and transaction skill, would possibly ignite a new altcoin season, atmosphere the stage for a divulge neighborhood of cryptocurrencies to skyrocket.

Why Ethereum’s Dencun Give a plot shut to Issues

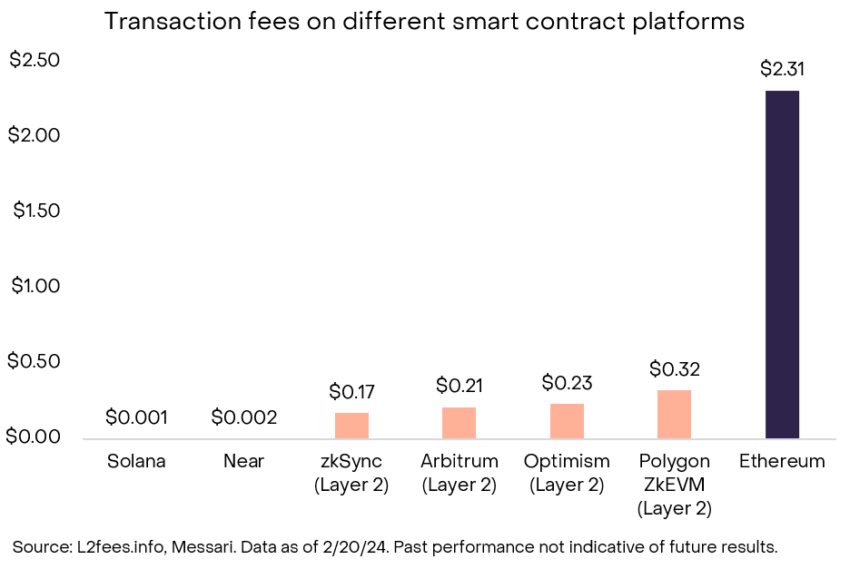

The Dencun increase bolsters Ethereum’s market competitiveness by introducing proto-danksharding and knowledge blobs. These innovations mitigate the community’s longstanding transaction charges and throughput components. In step with Grayscale, these enhancements would possibly catapult Ethereum to the forefront of the natty contract market, offering unparalleled scalability and effectivity.

This technological leap ahead is anticipated to plot a a lot broader array of purposes and builders to Ethereum, annoying the dominance of quicker chains love Solana.

“This software increase would offer Layer 2 scaling solutions a chosen storage scream on Ethereum, reducing their recordsdata rate and attributable to this fact making improvements to their margins. While unclear precisely how a lot this would possibly per chance simply within the good deal of transaction charges for cease customers of Layer 2s upon implementation, some have estimated it at over 20x,” analysts at Grayscale wrote.

The increase’s most likely to drive up Ethereum’s ticket has most titillating added to the optimism inner the crypto community. Many merchants eagerly eyeing the ripple outcomes on the broader blockchain ecosystem.

“[Ethereum] tailwinds contain: (1) its upcoming increase, (2) salvage deflationary offer, (3) community revenue expertise, $2 billion in 2023, (4) an SEC resolution concerning scream Ethereum ETFs in Might simply, and (5) rising utilize conditions to rent out Ethereum’s community security aspects,” analysts at Grayscale added.

Altcoins With Main Bullish Doable

Amid this backdrop, a seasoned dealer is known as Cyclop has meticulously compiled a listing of twenty-two altcoins, already listed on Binance, believed to have the most likely of 100X gains. His substitute requirements hinge on the tokens’ market caps and their alignment with the freshest narratives in primarily the most mute bull trail. These contain AI, DeFi, RWA, SocialFi, GameFi, BRC-20, Modular, L1, and L2 sectors.

The listing ranges from elevated market cap tokens love Injective (INJ) and Render (RNDR) to rising gamers love SleeplessAI (AI) and Stella (ALPHA). Therefore, it affords a diverse portfolio for merchants seeking to capitalize on the altcoin season.

Cyclop’s strategy emphasizes the importance of investing in tokens poised for mass adoption, highlighting the most likely of critical returns.

Be taught more: 11 Most productive Altcoin Exchanges for Shopping and selling in February 2024

Right here is the corpulent listing of altcoins with the most likely of 100X gains:

- Injective (INJ), market cap: $3 billion

- Reder (RNDR), market cap: $2,8 billion

- Arbitrum (ARB), market cap: $2,37 billion

- Sei Network (SEI), market cap: $2,11 billion

- Sui Network (SUI), market cap: $1,89 billion

- MakerDAO (MKR), market cap: $1,88 billion

- Starknet (STRK), market cap: $1,39 billion

- Ordi (ORDI), market cap: $1,33 billion

- Theta Network (THETA), market cap: $1,3 billion

- Synthetix (SNX), market cap: $1,27 billion

- Dymension (DYM), market cap: $934 million

- Astar (ASTR), market cap: $892 million

- Ronin Network (RON), market cap: $873 million

- Altlayer (ALT), market cap: $557 million

- Admire (MAGIC), market cap: $326 million

- Ankr (ANKR), market cap: $320 million

- Dwelling ID (ID), market cap: $255 million

- SleeplessAI (AI), market cap: $216 million

- Polymesh (POLYX), market cap: $194 million

- Magnificent Capital (RDNT), market cap: $167 million

- MyNeighborAlice (ALICE), market cap: $130 million

- Stella (ALPHA), market cap: $117 million

A Neatly timed Entry Into the Crypto Market

Michaël van de Poppe, one other revered scream within the crypto market, offered narrative advice for navigating the altcoin season. He strongly suggested in opposition to buying into the frenzy sooner or later of the height of an altcoin hype cycle, when social media buzz and exponential ticket increases can seduce merchants into making impulsive decisions.

Van de Poppe highlighted the importance of entering the market when self belief is low, akin to after a correction or within the wake of negative news. This counterintuitive strategy banks on the cyclical nature of markets, suggesting that what’s currently undervalued would possibly simply be the next day’s success narrative.

“An instance is the rate of Bitcoin. After the collapse of FTX, Bitcoin’s ticket became as soon as swimming around a rate of $15,500 per Bitcoin. All the procedure via this length, nearly no person became as soon as drawn to entering right into a build,” van de Poppe outlined.

He also suggested looking ahead to a vital correction earlier than investing. Subsequently, persistence can lead to extra favorable entry substances and the next risk-reward ratio. He added that nearly all altcoins will journey pullbacks after vital rallies, offering a strategic window for entry.

This vogue discourages chasing rallies and as a substitute suggests buying sooner or later of moments of consolidation or downturn when the asset is more at risk of be undervalued. By doing so, merchants sustain away from the pitfalls of buying at the head and facing most likely losses sooner or later of the inevitable corrections.

Be taught more: 13 Most productive Altcoins To Make investments In February 2024

His strategy also included the precept of early entry into market segments that are not yet within the limelight but show solid fundamentals and are section of rising ecosystems. Van de Poppe’s rule of thumb for entry is to have in suggestions investments in altcoins that have corrected by 25-60% from their recent highs, ceaselessly indicating a shaking out of speculative extra and rate stabilization.

“Whilst you preserve up for the correction to be happening, in all likelihood other folks that desire to plot shut profits had been doing this and are out of the markets, [and] other folks that desire to enter the markets are getting nearer to their entry substances. This means patrons are at risk of plot shut over, and the risk/reward is more sure,” van de Poppe concluded.

By adhering to these suggestions, merchants can navigate the complexities of the altcoin market with a technique designed to capture upside while holding in opposition to plot back risk.

Disclaimer

Your total recordsdata contained on our web build is printed in appropriate form faith and for frequent recordsdata purposes most titillating. Any motion the reader takes upon the knowledge stumbled on on our web build is strictly at their have risk.