Bitcoin SV is seeing elevated demand from short-time frame traders and traders as its ticket surpasses the $50 sign amid excessive volatility.

Bitcoin SV (BSV) is up 17% within the previous 24 hours and is trading at $52.95 at the time of writing. The asset’s market cap is for the time being sitting at $1.05 billion, making it the 67th-greatest cryptocurrency.

Data displays that BSV’s day-to-day trading volume skyrocketed by 215%, reaching $93 million.

BSV has been wandering in unpleasant volatility since gradual June and may perchance well infrequently surpass the $50 sign after it plunged from a two-year excessive of $128 in March.

At this level, BSV is down by 89% from its all-time excessive of $491 on April 16, 2021.

Particularly, BSV’s ticket surge comes alongside with the market-broad bullish momentum. The worldwide crypto market capitalization surpassed the $2.5 trillion sign, according to data from CoinGecko. Bitcoin (BTC) reached the $71,000 sign for the principle time since June.

Birth ardour rises, as a result of shorts

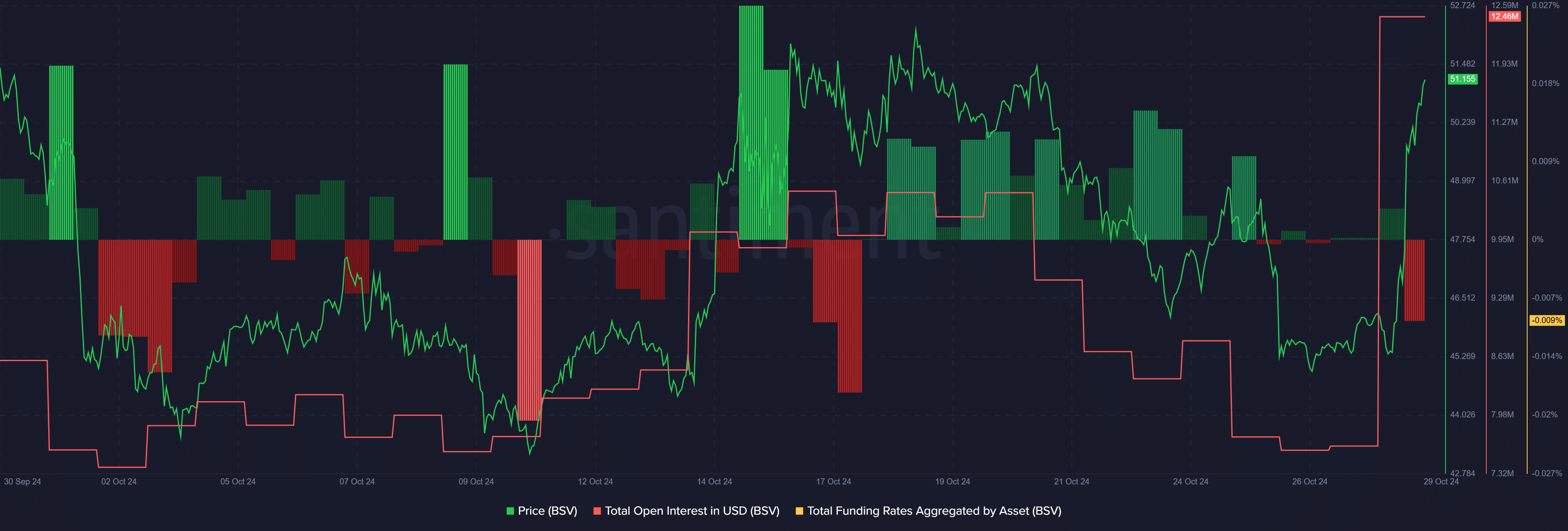

BSV’s ticket surge comes alongside with rallying commence ardour.

In step with data offered by Santiment, the general commence ardour in BSV elevated by 63% over the last day—rising from $7.6 million to $12.4 million.

On the various hand, the token is already seeing expectations of a ticket fall whereas the rising commence ardour and trading volume hint at elevated demand.

This may perchance presumably issue a essential amplify in temporary-time frame traders eyeing rapidly beneficial properties sooner than the BSV ticket falls.

The originate of short liquidations may perchance well doubtlessly push the cost elevated and vice versa.

Data from Santiment displays that the sentiment round BSV is largely been just over the last month with about a spikes and plunges on Oct. 18 and 25.

It’s crucial to point out that leading crypto exchanges Binance and Kraken delisted BSV in 2019 and Coinbase eradicated BSV from its platform in February this year.

Binance talked about the asset didn’t meet its requirements after the Australian computer scientist Craig Wright claimed that he used to be Satoshi Nakamoto, the creator of Bitcoin. Kraken even known as it “unsuitable claims” in its delisting announcement.

For Coinbase, the principle motive used to be the 51% assault on the BSV network in 2021.