Analyst Ali Martinez identifies $2,400 as an well-known enhance stage for Ethereum, suggesting a ability rally in direction of $6,000 because the crypto retests this key zone.

Ethereum has been trending within an ascending channel since July 2023. New mark circulate saw Ethereum transferring in direction of the decrease edge of this channel. As of October 26, the crypto retested the decrease trendline of this channel.

The present mark stage shut to $2,400 serves as a most valuable enhance zone, consistent with analyst Ali Martinez. He pressured out that a bounce from this level could well per chance space the stage for an upward circulate in direction of the greater boundary, estimated round $6,000.

#Ethereum is making an strive out a key enhance zone at $2,400. If this stage holds, shall we see $ETH aiming for the channel’s greater boundary shut to $6,000! pic.twitter.com/W8J8WVy5CL

— Ali (@ali_charts) October 26, 2024

Ethereum’s Ascending Channel

The ascending channel sample, characterised by two parallel trendlines, signifies clear resistance and enhance zones, guiding Ethereum’s mark circulate. The greater boundary serves as resistance, whereas the decrease boundary affords enhance. Ethereum’s ability to the decrease boundary all the blueprint in which by the $2,400 stage signifies an most valuable enhance retest.

Primarily based totally on Martinez’s bullish sentiment about Ethereum, a commenter argued that the mark could well per chance ruin down from the enhance stage barely than ascend to the greater resistance. On the other hand, Martinez countered that a solid possibility-to-reward ratio exists if stops are space between $2,300 and $2,150.

At press time, Ethereum is getting better from recent losses, buying and selling at $2,507.68. This represents a 1.65% upward thrust prior to now 24 hours despite a 7.61% fall over the final week.

Lowered Selling Rigidity?

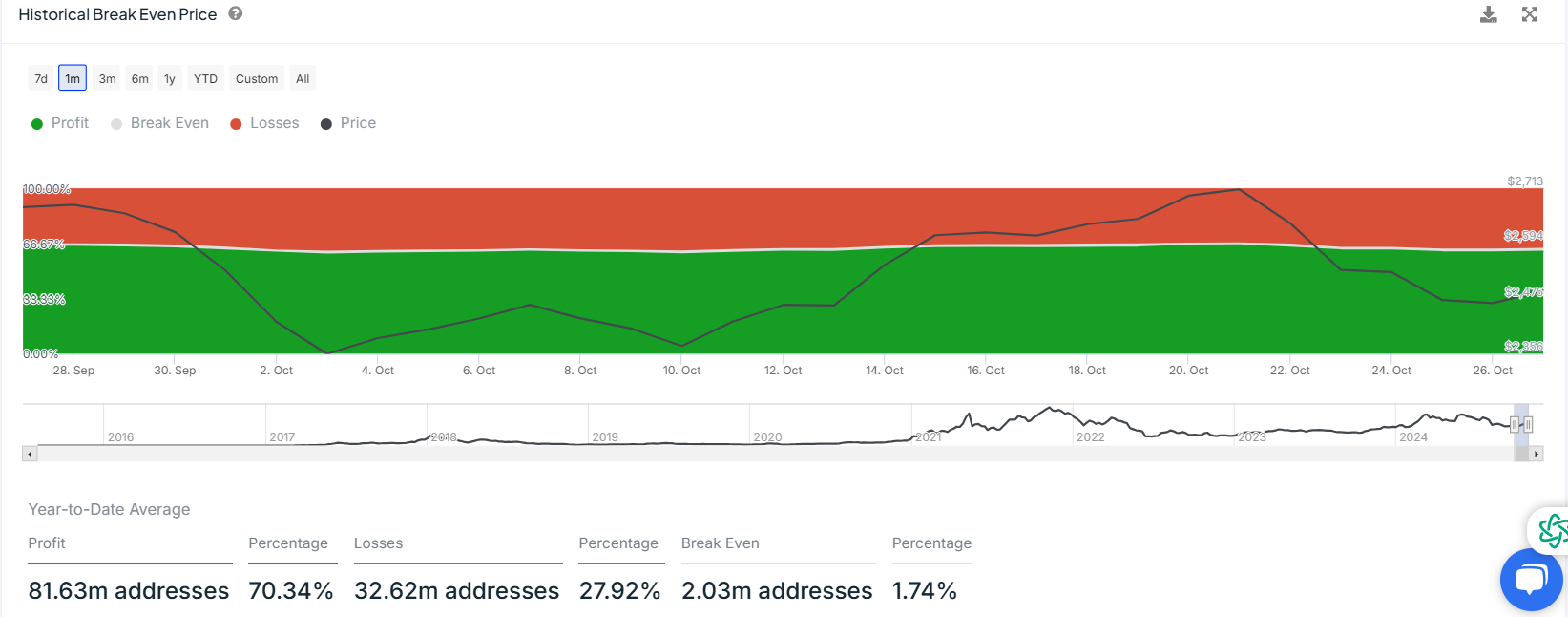

Additional evaluation of IntoTheBlock’s files highlights on-chain metrics that counsel a bullish sentiment for Ethereum. The files implies that 70.34% of Ethereum addresses are for the time being in profit, whereas a mere 1.74% are at ruin-even, and over 27% are in losses.

This imbalance in most cases reduces selling stress since fewer holders are inclined to promote on the present mark levels. With the huge majority of holders in profit and minimal ruin-even positions, market instances seem supportive of a continuation within the ascending channel.

In other locations, consistent with neighborhood considerations about Ethereum Foundation’s periodic ETH gross sales, co-founder Vitalik Buterin clarified the rationale in the support of those actions. In accordance to Buterin, proceeds from the gross sales fund core style projects, akin to reducing transaction cases, reducing transaction prices by EIP-1559, and transitioning Ethereum away from Proof of Work to support token cost.

Additionally, Buterin addressed why the Foundation avoids staking all its ETH holdings, citing the must stay fair real by contentious tense forks. The Foundation is taking into account replace approaches, akin to delegating staking to third parties whereas maintaining ethical oversight. This approach targets to distribute Ethereum’s legitimacy all the blueprint in which by just a few organizations, enhancing ecosystem balance.