Bitcoin and the altcoins went via extensive volatility on Friday evening after a controversial screech from the Wall Avenue Journal, which used to be denied by Tether’s CEO without lengthen.

Nonetheless, the harm used to be carried out, which harmed over-leveraged merchants, as the liquidations skyrocketed to over $400 million on a daily scale.

CryptoPotato reported WSJ’s claims that the US federal govt had launched an investigation into the corporate in the lend a hand of the sphere’s excellent stablecoin for that you might perchance perchance perhaps deem violations of anti-cash laundering rules and sanctions.

It additional asserted that prosecutors at the The giant apple US attorney’s set up of job investigated whether USDT used to be ragged by infamous actors to handbook determined of sanctions and other US rules.

Minutes after the screech went out, Tether CEO Paolo Ardoino refuted the claims made by the WSJ, announcing, “As we told to WSJ, there might be rarely any indication that Tether is beneath investigation. WSJ is regurgitating extinct noise. Beefy quit.”

Afterward, he added that the stablecoin issuer, which has now expanded its presence into many other industries, including BTC mining, deals “continually and straight away with law enforcement officials to abet forestall rogue countries, terrorists, and criminals from misusing USDT.”

At Tether, we deal continually and straight away with law enforcement officials to abet forestall rogue countries, terrorists and criminals from misusing USDt. We would know if we’re being investigated as the article falsely claimed. Basically based completely totally on that, we can verify that the allegations in…

— Paolo Ardoino (@paoloardoino) October 25, 2024

Such info tends to absorb a straight away impact on costs in the cryptocurrency market, and this time used to be no exception. BTC stood shut to $69,000 but dumped without lengthen by over three sizable to $65,500. It recovered some ground and now trades at almost $67,000.

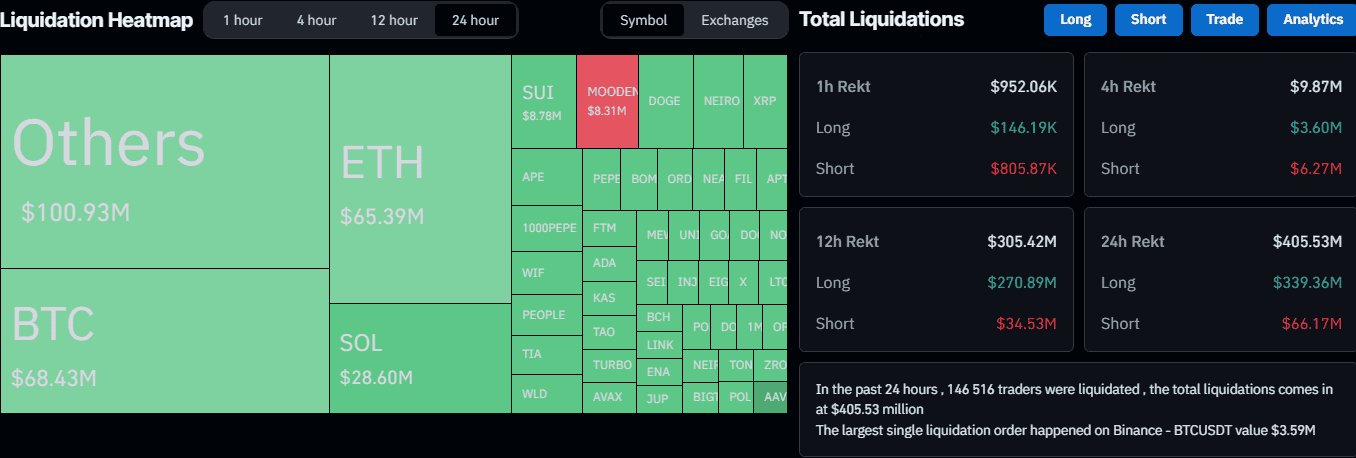

With most altcoins following swimsuit, the final liquidations absorb skyrocketed to $405 million on a daily scale. Curiously, alts had been accountable for the lion’s share, which used to be more than $100 million, with BTC and ETH trailing at $68 million and $65 million, respectively.

Nearly 150,000 over-leveraged merchants had been wrecked in the day gone by, in line with CoinGlass.