Bitcoin is closely correlated with Donald Trump’s potentialities of profitable within the US presidential election in November.

At this level, analysts predict that the BTC imprint may perhaps well upward push to $90,000 after Trump’s that that you would possibly accept as true with victory, while possibility investors anticipate Bitcoin to upward push to $100,000 by the rupture of the year.

Bitcoin’s Probability of Reaching $100,000 is 9.5 Percent!

Nonetheless, it modified into as soon as acknowledged that in step with the brand new negate of Bitcoin alternate strategies, the possibility of the BTC imprint reaching $ 100,000 by the rupture of the year is 9.58%.

Analysts mentioned the possibility of Bitcoin imprint reaching $100,000 is 9.58%, in step with details from crypto alternate strategies procuring and selling platform Deribit.

Pointing out that Deribit’s BTC Volatility Index (DVOL) is for the time being at 54%, analysts negate that in step with this charge, Bitcoin is more at likelihood of upward push to $80,000 by the rupture of the year.

Analysts additionally added that Bitcoin may perhaps well experience a 22% imprint swing in either route by the rupture of December, in step with alternate strategies market details.

“The new market implied volatility of BTC alternate strategies expiring on December 27 is 54%. This implies that in basically the most productive-case grunt, the BTC imprint will upward push by more than 22% by the rupture of the year to round $82,000. Nonetheless, volatility goes every systems, so a 22% drop may perhaps well also honest silent not be dominated out,” Griffin Ardern, head of alternate strategies procuring and selling and overview at BloFin, told Coindesk.

No topic investors’ optimism about Bitcoin hitting $100,000, Blume analysts mentioned volatility may perhaps well develop looking out on the rupture end result of the US presidential election in November, noting that alternate strategies details and rates can replace impulsively with market prerequisites.

“A victory for either Kamala Harris or Donald Trump is not fully priced in, and crypto investors may perhaps well also honest silent be willing for hundreds of volatility either near.

This jogs my reminiscence of biotech stocks on the dates when the FDA is figuring out whether medication can be authorized. These stocks either cruise or drop on nowadays, and likewise that you would possibly in most cases wager one thing unstable goes to happen.

A that that you would possibly accept as true with Harris victory may perhaps well bring downward volatility to the Bitcoin market, and a Harris victory would not make certain for BTC and the crypto market, as a minimal for a while.”

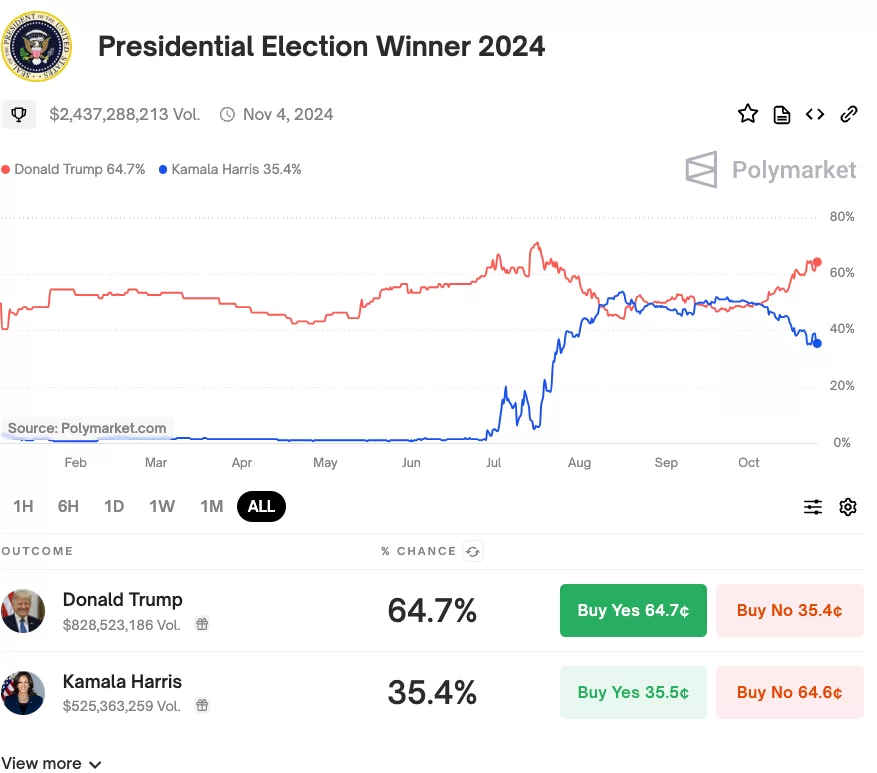

In accordance to Polymarket details, Trump’s likelihood of profitable the election is priced at 64.7%, while Harris’ likelihood of profitable is priced at 35.4%.

*Right here is not investment advice.