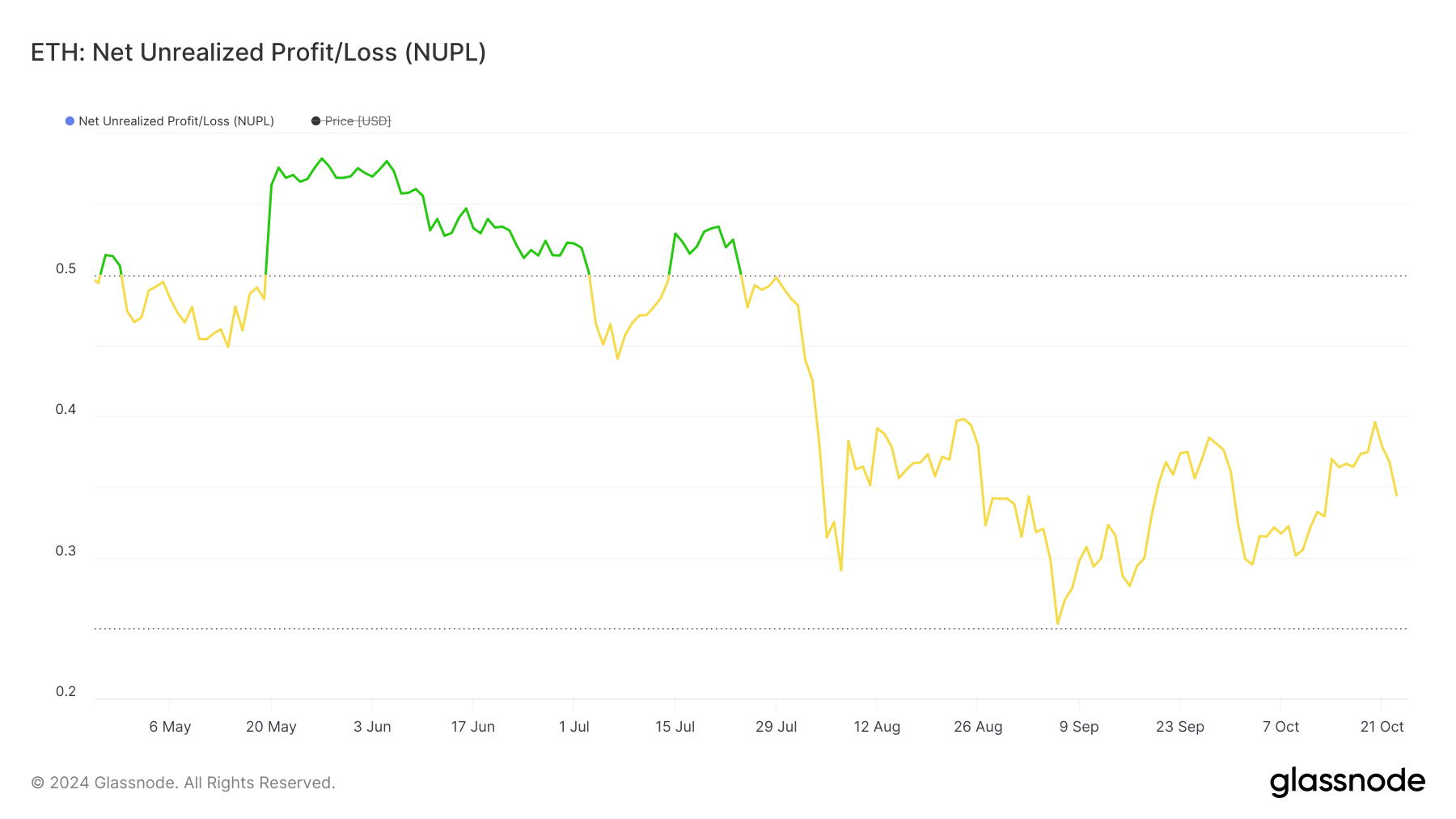

Ethereum (ETH) label appears to be provocative within a honest vary, as indicated by several market metrics. Essentially the most up-to-date Fetch Unrealized Income/Loss (NUPL) worth indicators that most traders are neither highly winning nor experiencing heavy losses.

This balanced sentiment suggests a combine of cautious optimism and alarm nonetheless lacks the solid feelings that infrequently pressure dramatic label shifts. Combined with the habits of larger holders and key technical indicators, ETH could per chance well proceed its sideways motion in the short term.

ETH NUPL Is Currently Just

ETH’s NUPL is currently at 0.34, signaling a honest market snort. This worth suggests that most traders are neither deeply in earnings nor in critical loss. It reflects a balanced sentiment amongst holders, with a combine of optimism and alarm nonetheless no excessive feelings that usually pressure super market actions.

NUPL, or Fetch Unrealized Income/Loss, measures investor sentiment by evaluating unrealized beneficial properties and losses. When NUPL is clear, it signifies holders are in earnings, and when unfavorable, it indicators losses. A label of 0.34 areas ETH in the ‘Optimism — Dread’ segment, suggesting traders feel cautiously optimistic nonetheless are also wary.

ETH is powerful from the more excessive phases of ‘Hope — Anguish’ or ‘Perception — Denial’, indicating a stable, honest market situation. This neutrality functions to a probable sideways label motion in the short term, as neither solid buying nor promoting power is currently dominant.

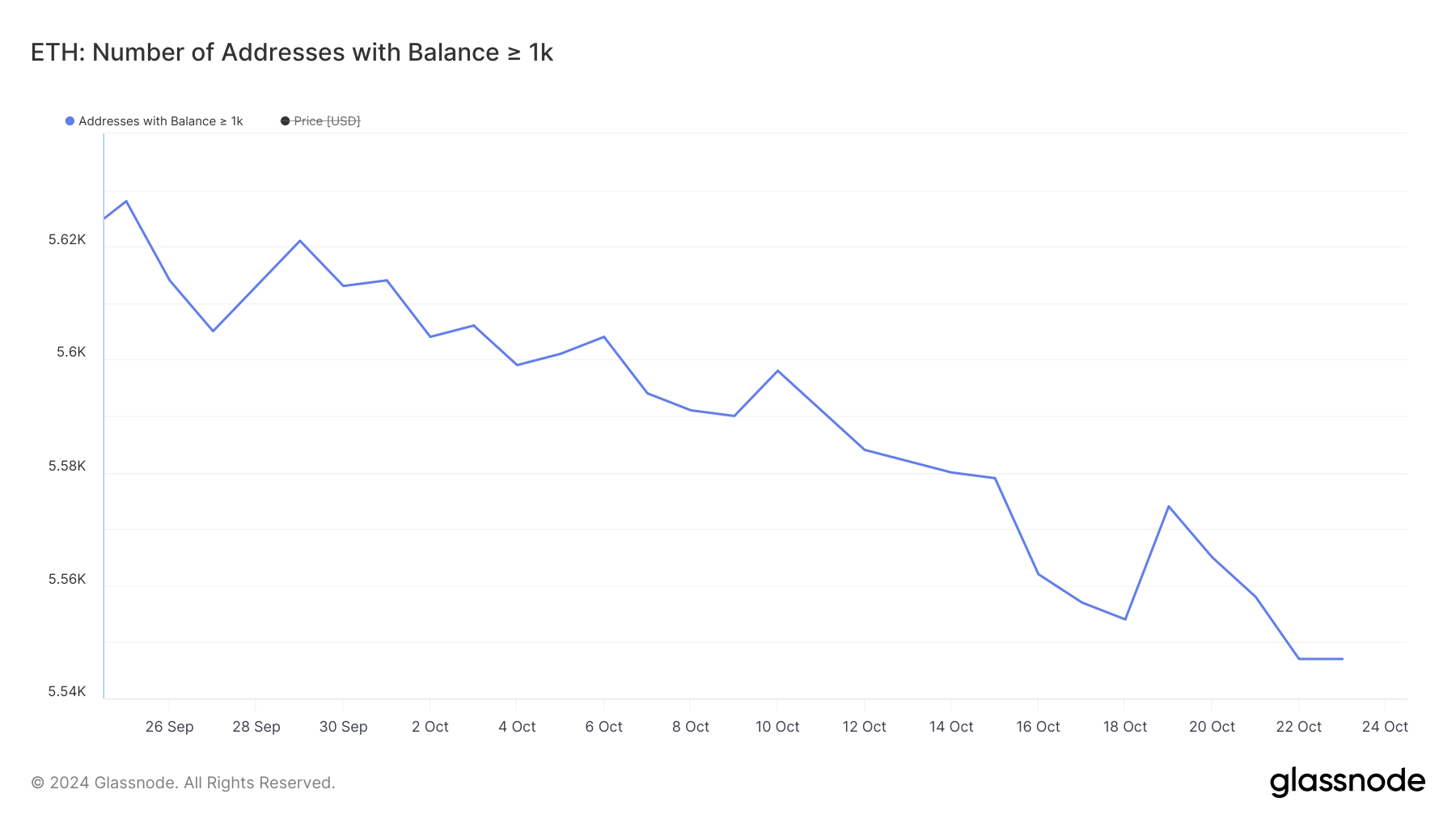

Ethereum Whales Are Now not Accumulating

The selection of addresses keeping no longer no longer as much as 1,000 ETH is declining, indicating that whales are no longer gathering ETH. On September 25, there delight in been around 5,628 such addresses, and now this quantity has dropped to 5,547. This exact lower suggests an absence of self belief amongst super holders.

Tracking these whale addresses is a actually worthy because of the they may be able to drastically affect market trends. When whales acquire, it on the total indicators optimism and could per chance well pressure costs higher. Conversely, a decline reveals hesitation or threat aversion.

The fixed topple in whale addresses over the previous month implies that enormous traders are no longer confident sufficient to derive ETH straight away. As an alternative, they could per chance well be reallocated to other sources or expecting clearer indicators sooner than buying more ETH.

ETH Imprint Prediction: Extra Sideways Actions Forward?

This Ethereum (ETH) chart displays several key provocative averages (EMAs) and skill beef up and resistance ranges. Currently, ETH is buying and selling around $2,526, just below just a few EMA lines, indicating downward power.

That’s also bolstered by the fact that its non permanent lines are happening. If they dreadful below the lengthy-term ones, this could per chance web a bearish brand.

The chart also highlights sure resistance ranges at $2,728 and $2,820, with previous makes an try to atomize these functions being unsuccessful. These ranges will could per chance well tranquil be breached convincingly to role off any solid bullish momentum. On the arrangement back, the beef up ranges are marked at $2,308 and $2,150, indicating areas the set aside traders could per chance well step in.

The presence of those beef up and resistance ranges, at the side of the dearth of decisive motion around EMAs, suggests that ETH could per chance well proceed consolidating, with label fluctuations for the duration of the vary sooner than a transparent kind develops.