The Ethereum community continues to grow progressively, reaching fresh highs in validators and staked Ether this one year, however this could per chance per chance now no longer be the handiest final result for the ecosystem going forward.

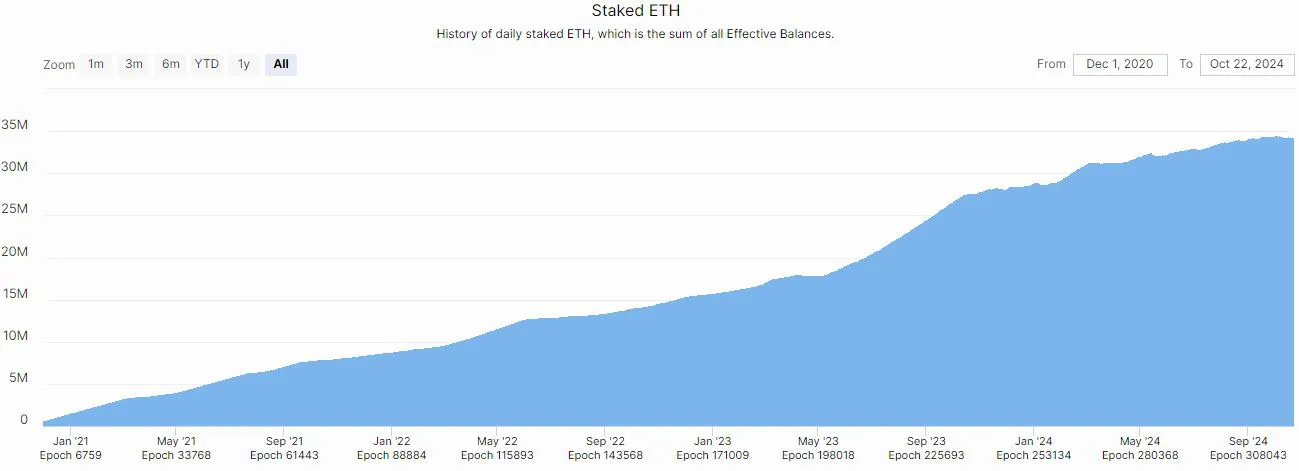

Per the Beacon Chain, the amount of staked Ether has been growing yearly, increasing by over 6 million for the length of 2024 and hitting a high of over 34 million on Oct. 2.

Lachlan Feeney, founder and CEO of Ethereum infrastructure agency Labrys, told Cryptopolitan the enhance is actual because that’s what the method has been designed to incentivize.

The extra ETH staked, the decrease the yield for all stakers. On the opposite hand, he says it’s crucial to acknowledge that the Ethereum ecosystem is now no longer looking out to grow the amount of staked Ether.

“It continues to grow because for an expansion of traders who meant to possess ETH anyway, they could well per chance to boot stake it, no matter how low the staking APY is, and beget extra yield,” he acknowledged.

“On the opposite hand, traders who appreciate been on the muse drawn to ETH attributable to high yield appreciate mostly stopped adding to their stake by now. The Ethereum ecosystem is now no longer looking out to grow the amount of staked ETH. Slowing staked ETH is an correct ingredient.”

Amount of staked Ether already handed the point of positivity

Roughly 28.43% of the 120.39 million circulating provide of Ether has been staked for the time being. In January, the proportion of Ether staked became as soon as 23.8%, which plan that a further 5.1% became as soon as staked within the closing 10 months, in response to an Oct. 8 X submit from on-chain files provider IntoTheBlock.

Feeney says the amount of staked Ether has already seemingly handed the point of positivity for the community; extra won’t basically add any advantages.

He thinks any extra staked Ether is adding a non-well-known amount of safety to the community, which plan that extra enhance is now no longer basically titillating.

“No person knows precisely what the correct amount of staked ETH is, however there is a limit. In my thought, I have faith we’ve already handed that limit,” Feeney acknowledged.

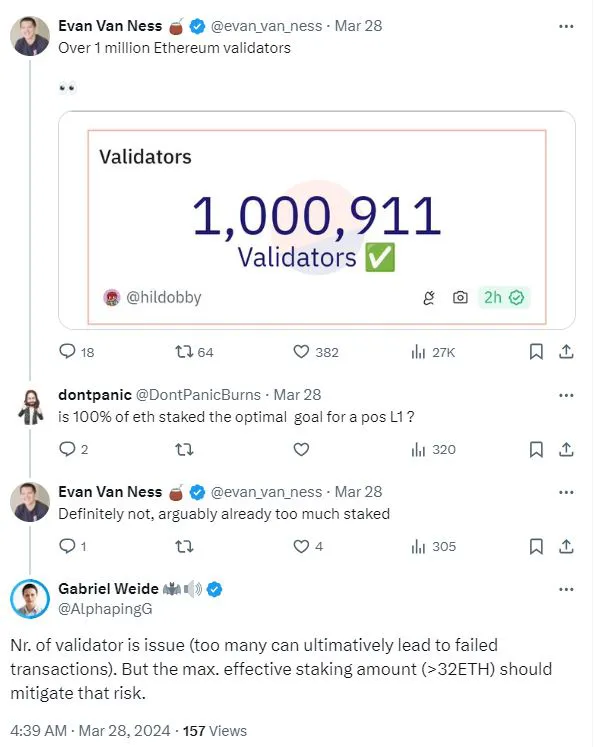

When the community clocked over a million validators and over 32 million Ether staked in March, concerns appreciate been raised that this could per chance per chance save concerns for the Ethereum ecosystem.

While the replacement of validators could well per chance translate into increased safety for a blockchain, some neighborhood members puzzled if too many validators and staked Ether could well per chance pose concerns for the community.

Venture investor and Ethereum recommend Evan Van Ness acknowledged there became as soon as already “too out of the ordinary” staked. Gabriel Weide, who runs a staking pool, speculated that too many validators could well per chance finally lead to “failed transactions.”

Extra isn’t continuously higher

“One could well per chance judge that undoubtedly the extra ETH staked the higher, as staked ETH represents the protection of the community, nonetheless, in case you snatch that argument to an coarse where 100% of all ETH in existence is staked, right here’s clearly now no longer a titillating final result,” Feeney acknowledged.

While that scenario is now no longer going, Feeney says any well-known amount of Ether, 90%, 80%, or even 70%, is a less-than-ideal final result for the community. As a substitute of for the possibility of failed transactions speculated by others, he thinks a increased insist could well per chance arise.

“One obvious area is that without ETH available, you could well furthermore’t pay for gasoline which desires to be paid in ETH, users will deserve to make use of stETH and cbETH and swETH in any utility where ETH is currently outmoded,” he acknowledged.

“This forces the user to make a selection an LST, liquid staking token, which comes with pointless possibility. Native ETH could well per chance composed continuously remain the major possibility-free asset for the length of the Ethereum ecosystem.”

Whatever the rising curiosity in staking Ether, its brand has declined since its all time high of over $4,000, which it hit on March 12, in response to CoinMarketCap.

As of Oct. 24, the brand is hovering round $ 2,500.