With Bitcoin sitting end to $70K, is $100K the subsequent stop? How will the U.S. election, ETF approvals, and market sentiment impact its future course?

Desk of Contents

Bitcoin is bitcoining

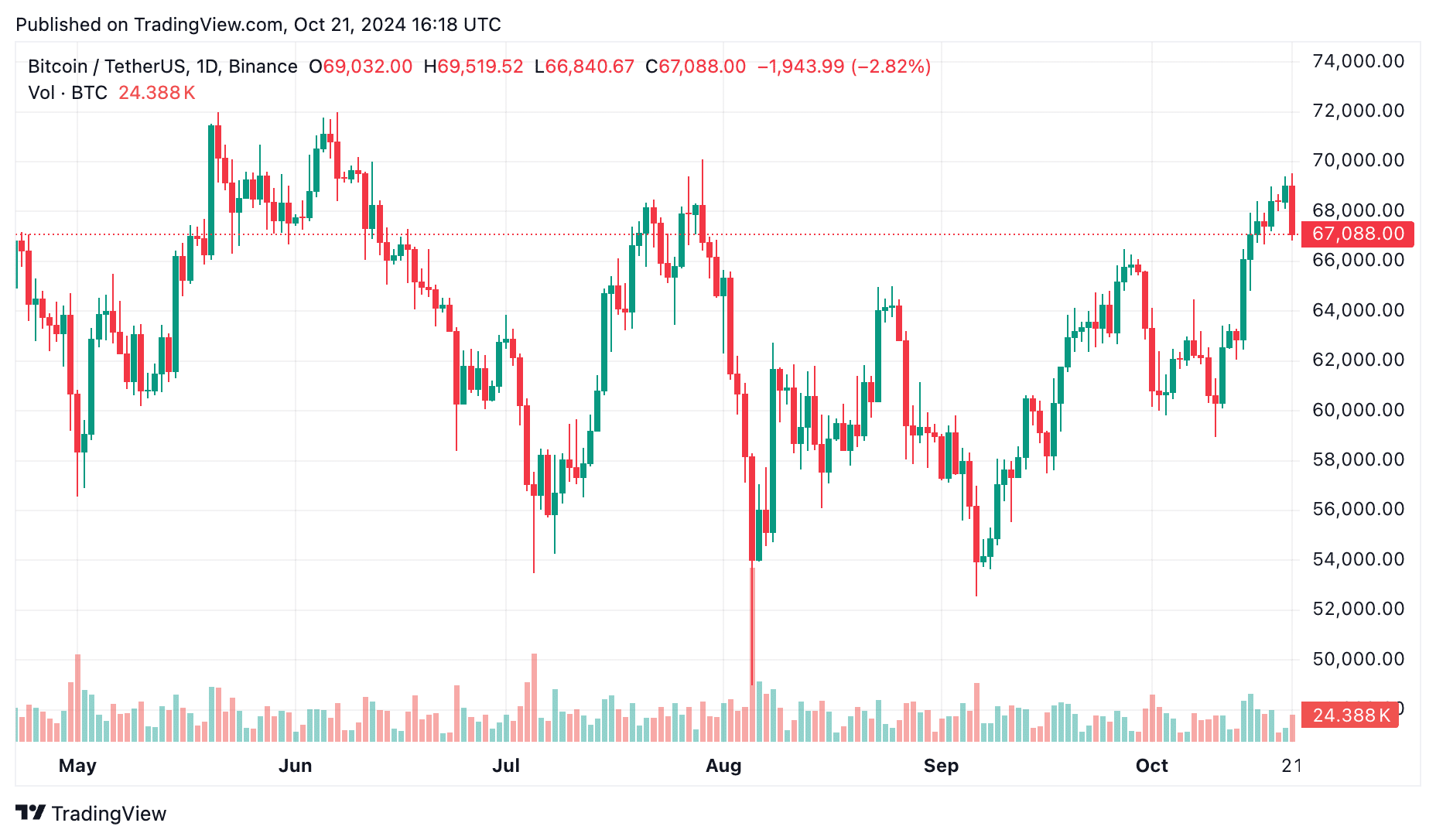

Bitcoin (BTC) has been on a ambitious bull flee, gaining over 2% in the previous week as the “Uptober” enact sweeps via the crypto market.

As of Oct. 21, BTC is shopping and selling at $67,100—a level it hasn’t considered since leisurely July, marking a 3-month excessive. The truth is, BTC briefly touched $69,500 before taking flight as bears stepped in to curb the rally.

The market sentiment is fascinating immediate, too. The crypto fear and greed index now sits at 63, signaling “greed,” a sharp distinction to the once a 12 months low of 26 on Sep. 7, when fear dominated the market.

Investors seem optimistic, especially with the U.S. presidential election correct across the corner on Nov. 5. Frail President Donald Trump, who has proposed crypto-pleasant policies, is gaining momentum in election polls.

Many factor in his capability procure may maybe well maybe also push Bitcoin to original heights, as his policies are considered as priceless for the crypto industry.

So, what’s subsequent for BTC? With key economic events on the horizon and a extremely charged political enviornment, the keep may maybe well maybe BTC head in the arrival days? Let’s uncover.

Feature Bitcoin ETFs succeed in traction as obvious adjustments roll in

In a mountainous procure for the Bitcoin market, dilemma Bitcoin alternate-traded funds are dwelling to explore extra action, thanks to a up to date rule change by the U.S. Securities and Exchange Commission.

On Oct. 18, the SEC licensed a original rule allowing the Recent York Stock Exchange (NYSE) and the Chicago Board Alternatives Exchange to provide alternate choices shopping and selling for a couple of dilemma Bitcoin ETFs. This switch opens the door to higher liquidity and smoother impress actions in the crypto situation.

Some mountainous names are tormented by this change. The NYSE now has the inexperienced light to listing alternate choices for the Grayscale Bitcoin Belief (GBTC), Grayscale Bitcoin Mini Belief (BTC), and Bitwise Bitcoin ETF (BITB).

Within the intervening time, Cboe Worldwide Markets can listing alternate choices for the Constancy Wise Origin Bitcoin Fund (FBTC) and the ARK 21Shares Bitcoin ETF (ARKB).

These developments near correct weeks after the SEC granted Nasdaq approval to listing alternate choices for BlackRock’s iShares Bitcoin Belief (IBIT).

Alternatives are financial contracts that give merchants the apt—however now not the responsibility—to aquire or promote an asset at a dwelling impress before a obvious date. In this case, the underlying asset is a Bitcoin ETF.

Even though no open dates were confirmed for these alternate choices, consultants factor in the approval may maybe well maybe even bear a extensive impact.

Extra financial products on necessary U.S. exchanges suggest broader get entry to to crypto, which may maybe well maybe also attract a wider vary of contributors—from institutional avid gamers to day to day merchants.

The timing couldn’t be better. Bitcoin ETFs bear considered a ambitious surge in inflows these days. Based mostly mostly on files from CoinGlass, dilemma Bitcoin ETFs raked in over $2.13 billion in inflows in the week ending Oct. 18, pushing full assets below administration to a stable $52 billion.

Final week’s inflows marked the strongest efficiency for Bitcoin ETFs in about seven months, signaling that investor self belief in crypto is on the upward thrust.

Is a breakout approaching?

As Bitcoin flirts with the $70K stamp, many consultants bear taken to social media to fragment their insights on the keep the market may maybe well maybe head subsequent.

Bitcoin is the “Dreary Zone”

Crypto analyst Michaël van de Poppe has dubbed the most contemporary divulge of Bitcoin as being in the “Dreary Zone.” Nonetheless, this doesn’t label defective news.

#Bitcoin is at veil in the Dreary Zone.#Altcoins are at veil reversing and ending the longest endure market in historical previous.

This implies it be time for Banana Zone, and looking on how long this can even just take with liquidity, this Banana Zone is going to be memoir. pic.twitter.com/XNNBpvUomr

— Michaël van de Poppe (@CryptoMichNL) October 21, 2024

Bitcoin has been consolidating across the $68,000 level, while at the support of the scenes, altcoins bear started to veil signs of restoration.

Based mostly mostly on van de Poppe, this section is harking support to a coiled spring gazing for a jolt of liquidity. “Altcoins are at veil reversing and ending the longest endure market in historical previous,” he explains.

This “Dreary Zone” is in point of fact the most important duration for Bitcoin, the keep the worth hovers in a tight vary however builds momentum underneath the skin. Historically, similar phases in Bitcoin’s impress action bear led to orderly upward actions, as merchants jump support in once they sense the flooring has been established.

Bullish momentum signals are flashing

On the technical front, Ali, one more prominent crypto analyst, has changed into to a particular metric to gauge Bitcoin’s subsequent switch.

Undoubtedly one of my creep-to indicators for gauging #Bitcoin’s order, the MVRV Momentum, has flipped bullish again!!! pic.twitter.com/qOtIJgXTWe

— Ali (@ali_charts) October 20, 2024

The market worth to realized worth momentum indicator, which compares Bitcoin’s most up-to-date impress to the worth at which most BTC used to be closing moved, has these days flipped bullish.

When this indicator flashes bullish, it’s veritably an early label of extra impress gains to end. The truth is, persons are holding onto their Bitcoin, believing the market is primed for a push elevated — basically the most important psychological element in impress circulation.

As merchants feel assured and preserve their Bitcoin, selling stress reduces. With less selling stress, upward momentum becomes more uncomplicated to withhold, pushing Bitcoin elevated.

Rising open ardour

One other key element is the upward thrust in Bitcoin CME Futures Delivery Passion, which these days hit an all-time excessive of $12 billion, as noted by Maartunn, a crypto futures educated.

Bitcoin: CME Futures Delivery Passion hits an ALL-TIME-HIGH with $12.0B$BTC #OpenInterest #Futures pic.twitter.com/NSDCy6ozMS

— Maartunn (@JA_Maartun) October 20, 2024

Delivery ardour refers to the full amount of prominent futures contracts that haven’t been settled. A upward thrust in open ardour plan extra merchants are inserting bets on Bitcoin’s future impress circulation.

The surge in open ardour fits into the broader record of Bitcoin’s most up-to-date momentum. Traders are clearly awaiting a breakout, likely pushed by the macroeconomic events at play.

Nonetheless, there’s a earn—elevated open ardour can every every so often lead to elevated volatility, especially if a orderly amount of merchants are on the same facet of the trade, whether bullish or bearish. If the market strikes against these positions, it may maybe maybe maybe well maybe also trigger liquidations, leading to surprising impress swings.

U.S. elections and Fed charge cuts

Macroeconomic components are additionally at play, with the U.S. presidential election on Nov. 5 and the Federal Reserve’s subsequent assembly on Nov. 7 doubtlessly influencing Bitcoin’s impress circulation.

Frail President Donald Trump, who leads in a couple of polls, is considered as crypto-pleasant. A Trump victory may maybe well maybe enhance Bitcoin’s impress as merchants grow extra assured in regulatory clarity and support for the industry.

On the diversified hand, if Kamala Harris wins, the market reaction is more difficult to foretell. Harris hasn’t made her stance on crypto determined, which may maybe well maybe also introduce uncertainty.

Then there’s the Federal Reserve’s upcoming determination on ardour rates. Presently, there’s a 90.5% likelihood the Fed will minimize rates by 25 basis parts at their Nov. 7 assembly.

A charge minimize would inject extra liquidity into the economy, veritably benefiting chance assets bask in Bitcoin. Extra liquidity plan extra money flowing into markets, and Bitcoin may maybe well maybe also straight away show pride on this elevated capital.

If each and each a Trump procure and a Fed charge minimize materialize, the mixed enact may maybe well maybe also make to take into accounta good storm for Bitcoin’s impress to surge previous $70K.

Where may maybe well maybe also Bitcoin head subsequent?

One crypto analyst believes that Bitcoin’s subsequent target is $98,000. A most celebrated sentiment across the team is that momentum is step by step building, with rising self belief that BTC is ready for its subsequent leg up.

#Bitcoin Next Target: $98,000 🎯

Momentum is building.

Issues are initiating to smell correct for #BTC 🚀 pic.twitter.com/30kOF5GA1w— Titan of Crypto (@Washigorira) October 20, 2024

Within the intervening time, per smartly-known crypto analyst Rekt Capital’s diagnosis, we are at veil in the $65,000 to $70,000 vary, and the subsequent necessary stop may maybe well be wherever between $90,000 and $160,000.

#BTC

We are right here (orange circle)

We would be there (inexperienced circle)$BTC #Crypto #Bitcoin pic.twitter.com/cdom1cxnpm

— Rekt Capital (@rektcapital) October 18, 2024

As Bitcoin builds strength across the $70K stamp, the subsequent logical resistance may maybe well be at $90K. But when Bitcoin breaks via $90K with solid momentum, it may maybe maybe maybe well maybe also like a flash glide up towards $100K and previous.

Right here is as a result of once Bitcoin enters impress discovery (shopping and selling above earlier all-time highs), market euphoria tends to power costs great elevated in an attractive immediate duration.

For now, the momentum appears to be like to determine on Bitcoin’s upward thrust. Nonetheless, merchants may maybe well maybe also just amassed remain vigilant, gazing each and each the technicals and broader economic indicators to gauge BTC’s subsequent circulation. As continuously, trade properly and never invest extra than you may maybe well maybe maybe afford to lose.