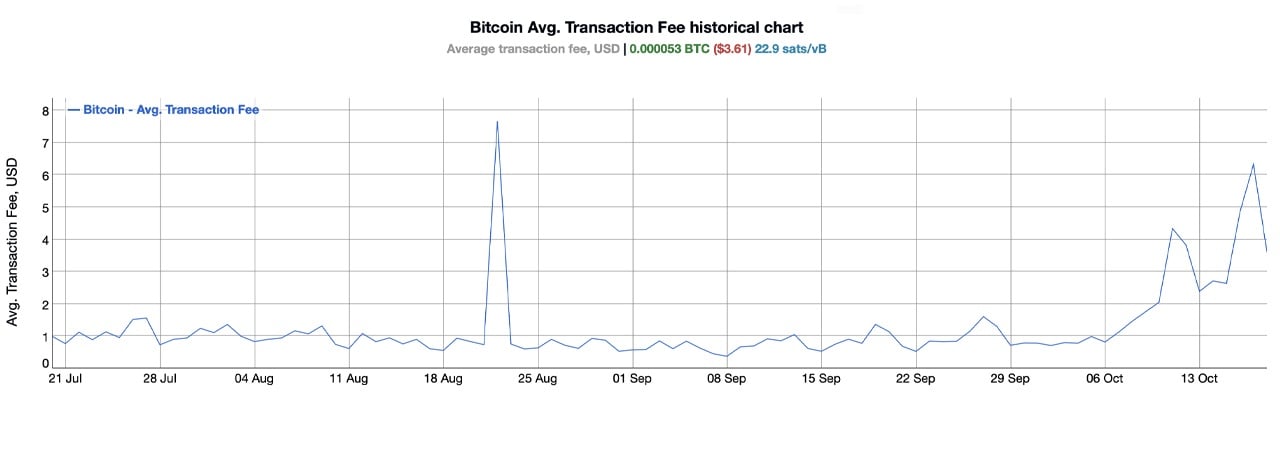

While bitcoin’s mark has remained above $68,000, onchain prices tagged along for the streak. Earlier this month, prices were below $1, but two days ago on Oct. 17, the favored switch rate hit a top of $6.32. At the present time, onchain prices stand at spherical 22.9 satoshis per digital byte (sat/vB), or roughly $3.61 per transaction.

Bitcoin’s $68K Label Push Sparks Price Increases

The most recent spike in onchain prices correlates with bitcoin’s rise previous $68K. For instance, on Oct. 6, the favored switch rate, essentially essentially based totally on bitinfocharts.com records, turned into simply $0.81. Mercurial forward to now, and that rate has jumped over 354%, landing at $3.61. On Oct. 17, it spiked even extra dramatically, reaching 680% larger than the Oct. 6 rate.

On the opposite hand, averages don’t show the paunchy myth for all people. A extra conventional median rate is spherical 0.000017 BTC or 7.4 sat/vB, translating to $1.16 at fresh charges. Excessive-precedence transactions, essentially essentially based totally on mempool.condo, display camouflage even lower prices, spherical 4 sat/vB or $0.38 per transaction at 3 p.m. Jap Time on Saturday. Yet, Bitcoin’s mempool tranquil holds a queue of 213,015 unconfirmed transfers.

Moreover, October’s rate totals dangle already outdone wonderful month’s figures. Bitcoin miners pulled in $13.86 million from onchain prices in September. To this level in October, with nearly two weeks left, miners dangle accumulated $27.54 million in prices alone. Remaining month’s mixed earnings from prices and the subsidy hit $815.7 million, while October’s earnings has reached $568.95 million to this level—corresponding to about 69.74% of September’s total haul.

As bitcoin’s mark momentum continues to ripple by transaction prices and mining earnings, the community’s evolving rate dynamics display camouflage the complexities of market conduct. While the fresh increases affect user choices, to boot they enhance bitcoin’s function in balancing present, ask, and miner incentives. Having a glimpse forward, sustained mark shifts might per chance extra reshape the interplay between prices and community capability.

What are your suggestions on this topic? Converse us what you concentrate on within the feedback part below.