Procedure Bitcoin substitute-traded fund inflows shot up larger than 580% this week, as one analyst pointed out that whales had been loading up on Bitcoin at a walk linked to the lead-up to the 2020 rally.

At some level of the final week, inflows into the 12 space Bitcoin ETFs reached $2.13 billion, following six consecutive days of determined inflows. This marks the first time weekly inflows into Bitcoin ETFs agree with surpassed the $2 billion impress since March 2024.

Total get inflows all over Bitcoin ETFs agree with hit a file $20.94 billion. That’s a milestone that took gold ETFs years to achieve, in step with Bloomberg’s Eric Balchunas. Bitcoin products took less than a twelve months.

Weekly inflows hit their high on Oct. 14, with $555.86 million flowing into the ETFs, but by Oct. 18, the walk slowed down, dipping to $273.71 million, in step with SoSoValue files.

None of the funds saw detrimental flows on the final trading day, with ARK 21Shares’ ARKB leading the pack. The inflows recorded had been as follows:

- ARK 21Shares’ ARKB, $109.86 million, 7-day influx lumber.

- BlackRock’s IBIT, $70.41 million, 5-day influx lumber.

- Bitwise’s BITB, $35.96 million.

- VanEck’s HODL, $23.34 million.

- Fidelity’s FBTC, $18.0 million, 6-day influx lumber.

- Invesco’s BTCO, $16.11 million.

- Franklin Templeton’s EZBC, Info Tree’s BTCW, Grayscale’s GBTC and BTC, and Hashdex’s DEFI saw no flows.

Whale accumulation intensifies

This week’s inflows into Bitcoin (BTC) products signal steady query among retail and institutional investors and came alongside an absorbing accumulation sample illustrious among whales.

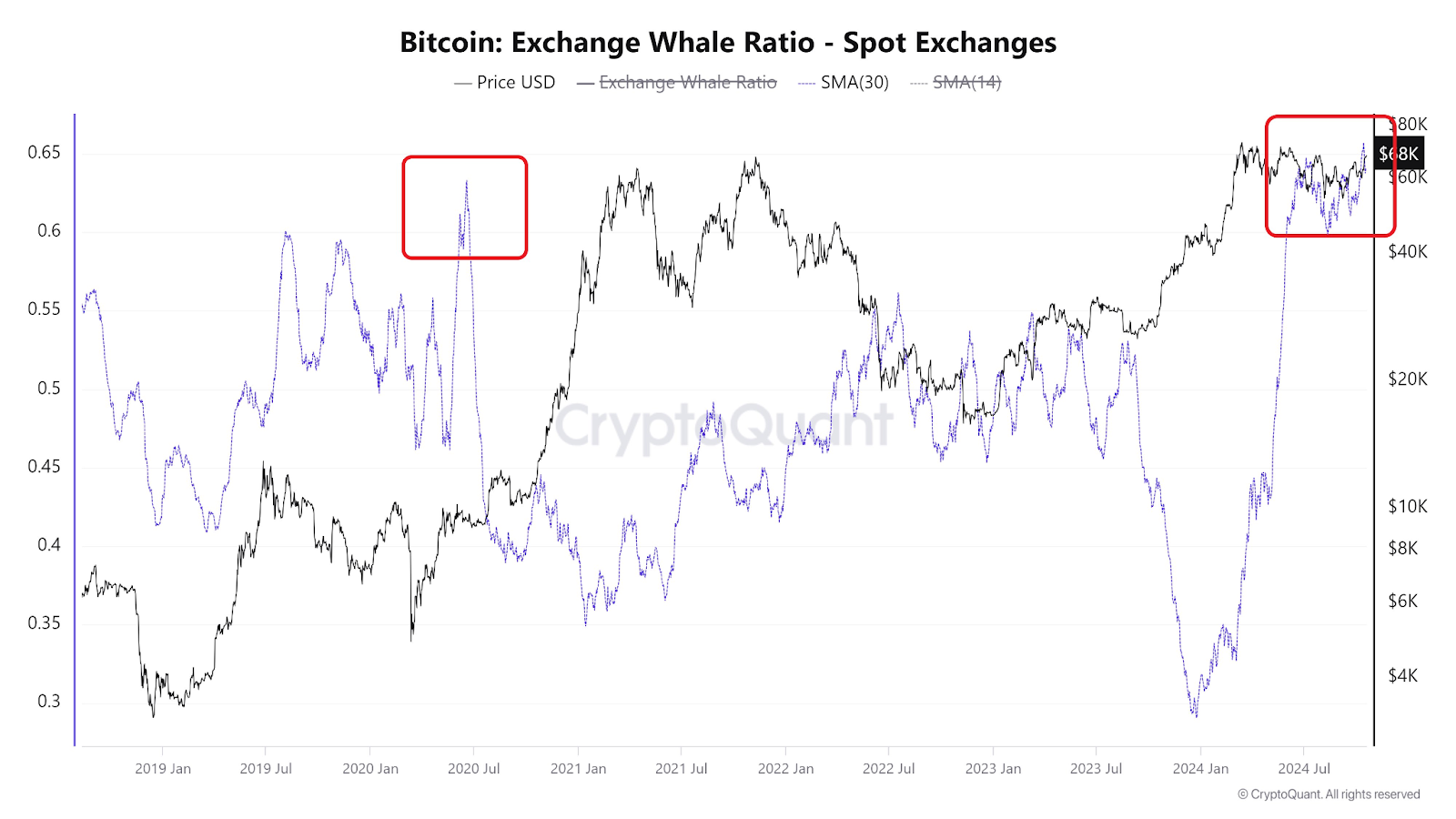

On X, CryptoQuant writer Woominkyu pointed out that the Bitcoin whale ratio on space exchanges is having a gaze lots admire it did abet in July 2020, dazzling after the COVID wreck. In accordance to the chart he shared, that’s when a critical Bitcoin rally took off — hinting that whales will be gearing up for one more prolonged-term designate surge. (Gaze beneath.)

A identical accumulation sample became additionally observed among more moderen whales by fellow analyst and CryptoQuant CEO Ki-Young Ju, who wrote in an Oct 16 X post that original whale wallets with an common coin age of beneath 155 days reached a brand original high of 1.97 million BTC. (Gaze beneath.)

Fresh whale wallets now withhold 1.97M #Bitcoin.

Every has over 1K BTC, common coin age beneath 155 days, other than substitute and miner wallets, doubtless custodial.

Their BTC steadiness surged 813% YTD, taking on 9.3% of the total offer, valued at $132B this day. pic.twitter.com/pxq0tcqMuW

— Ki Young Ju (@ki_young_ju) October 16, 2024

Whales are most frequently known as “natty money” because of they’ve an inclination to aquire right thru market dips and withhold thru the usaand downs, using their deep pockets and strategic timing to agree with calculated strikes. Their actions can most frequently signal the build the market will be heading next, as and they also position themselves earlier than colossal designate shifts.

Whereas the uptick in whale accumulation has ignited hopes of a coming near rally, several market analysts are additionally awaiting the bellwether to reach a brand original all-time high soon buoyed by the upcoming U.S. presidential elections as a doubtless catalyst.

Pseudonymous trader Crypto Raven pointed out that polls impart rising odds for Republican candidate Donald Trump winning the November elections, which might perchance well well be steady the push BTC wants to hit original highs. As Raven attach it, “every little thing goes this easy, we might perchance well blueprint for the moon.”

On a more bullish existing, Bitwise CIO Matt Hougan predicts Bitcoin will hit six figures, pushed now not steady by the upcoming elections, but additionally by a surge in institutional query and quite numerous macroeconomic factors.

At press time, the flagship cryptocurrency became trading at $68,280, up 8.5% over the past week.