This day, revel within the Empire e-newsletter on Blockworks.co. Day after as we snarl, win the news delivered true now to your inbox. Subscribe to the Empire e-newsletter.

Fri-yay!

It’s been a basically restful week for crypto across the board, so we’re taking a examine a pair of a bunch of areas. David, as an instance, infamous the tip of the week with memecoins.

Oh, moreover, Yano gave some perception into what he’s staring at — and one thing that may maybe maybe merely be either bullish or a minute bit touching on.

We’ll watch you on Monday.

— Katherine Ross

Three commas for every coin

Whisper what you will about memecoins — they’ve clearly found product-market fit.

Aid when the /r/wallstreetbets saga kicked off the predominant memecoin mania in 2021, it became as soon as mostly dogs coins that had been substantial sizzling: Dogecoin copy-cats worship shiba inu, babydoge and floki, the latter of which became as soon as named after Elon Musk’s dogs, a shiba inu.

On the time, normally any memecoins had been on the discontinue discontinue of the market. There had been, as continuously, silly initiatives with corrupt valuations that weren’t explicitly memecoins — equivalent to SafeMoon and Hex.

However out of the discontinue 250 or so, pure-play memecoins had been represented by that small handful of dogs coins orbiting Musk’s then-newly found appreciation for Dogecoin.

This day, over 10% of the discontinue-250 are memecoins, and they’re securing more billion-dollar market caps sooner than ever.

Out of the memecoins which beget launched true by technique of this cycle (which, let’s sigh, began in 2022), seven beget reached the $1 billion ticket one day : BONK, BOME, WIF, BRETT, POPCAT, CORGIAI and PEPE.

On common, it took those seven memecoins about 5 months to attain three commas. BOME did it in four days, PEPE in 21 and WIF in 84.

A slew of smaller memecoins beget moreover either currently hit all-time highs or are drawing terminate new records as we discuss, collectively with MOG, TURBO, SPX6900, NEIRO, GIGACHAD and NPC.

One idea goes that memecoins are capturing so noteworthy interest merely since the SEC has sued the market into submission:

If a majority of the crypto market is concept of as investment contracts (regulated within the a associated skill as securities), then why no longer commerce the most pointless tokens as an different?

Let’s sigh that’s lawful. Thanks loads Gensler, you’ve made crypto more fun than ever!

— David Canellis

IYKYK

We caught up with Empire podcast host (and Blockworks co-founder!) Jason Yanowitz again this week to gauge his sentiment with the election neatly suited a pair of weeks away.

I’ll preface this now: There’s correct, and then there are some doubtlessly depressed issues headed our skill. However I’ll high-tail away you to make a choice and resolve what you take away from our dialog.

“I possess, even [at the] discontinue of Q4, I in fact think there’s a gamble that bitcoin breaks all-time highs in November or December. You beget, on a macro level … The dollar’s more or less turning over … Interest charges are happening,” Yanowitz outlined to me.

He added that he doesn’t agree with those that think that a single presidential candidate is correct or depraved for the commerce.

“Either skill, Kamala [Harris] or [Donald] Trump … shall be correct for crypto. We neatly suited want a new administration, Democratic or Republican.”

He’s moreover cautious of the amount of tokens coming down the pipeline.

“All individuals’s looking out to initiate a token after the election and sooner than Q1 ends. In the event that they’re low-shuffle, excessive-FDV tokens, that’s a depraved thing and pretty a pair of folk are going to lose pretty a pair of money,” Yano stated. However, on the flip facet, within the event that they initiate at “cheap valuations,” then that may maybe maybe merely be bullish. All of it is reckoning on the method, which we don’t know presently.

And now you realize.

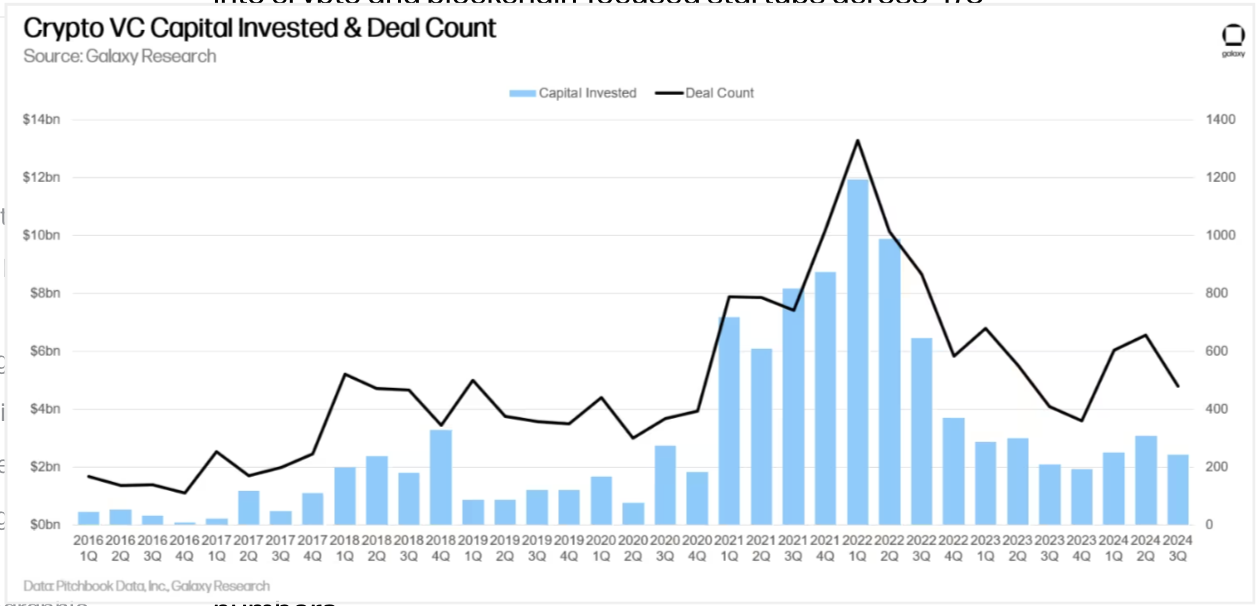

Earlier this week, Galaxy released its quarterly replace on endeavor capital task in crypto.

A few of the predominant takeaways: VCs invested $2.4 billion closing quarter, a 20% decrease quarter-over-quarter. 2024 is now arrange to neatly suited barely exceed 2023.

In the event you’ve been a accurate Empire reader, that closing stat is no longer going to be too fine, given our pretty a pair of conversations with PitchBook’s Robert Le about funding task.

Le’s been pretty vocal about when lets watch task acquire (spoiler alert — it’s no longer this one year).

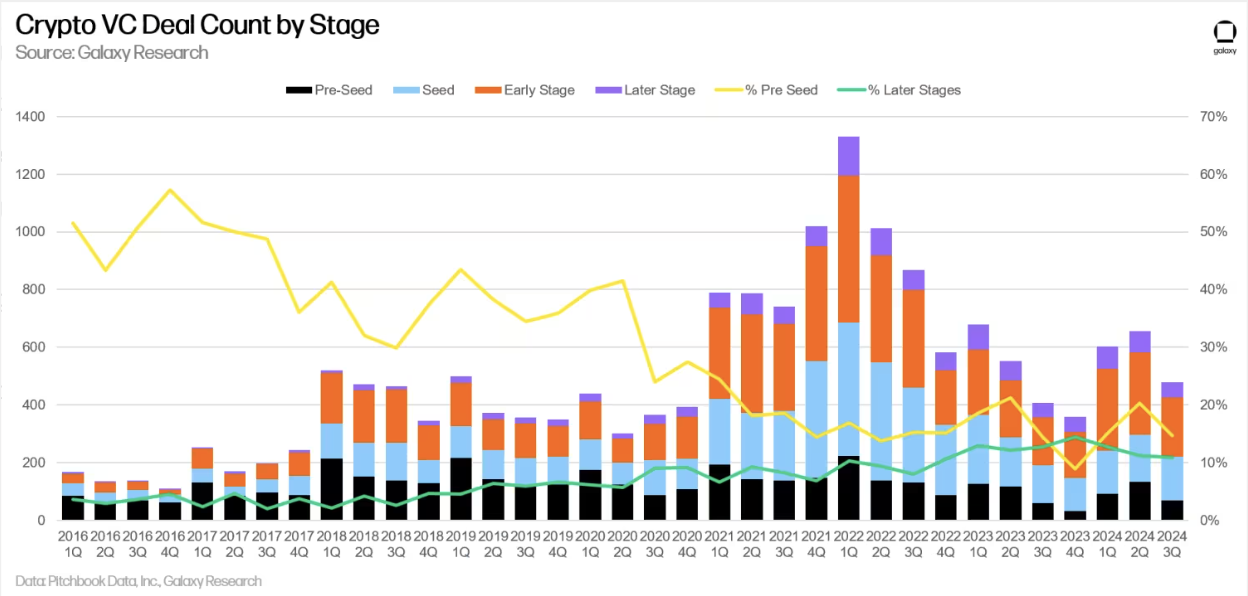

However the stat I obligatory to hone in on is that closing quarter indubitably seen an massive carve of the VC pie head to early-stage crypto initiatives. 85%, to be accurate, leaving handiest 15% invested in later-stage companies.

While VCs are quiet piling in, it seems to be to be worship it’ll be some time sooner than we watch those styles of initiatives hit the broader market.

The true news, for us as a minimal, is that it’s that you presumably can imagine to track dealflow and personal an look on how VC task is impacting crypto. More or less fun, pretty?

— Katherine Ross