As the 2024 U.S. presidential election approaches, an inviting sample is emerging, showing a correlation between Bitcoin’s (BTC) designate and the rising odds of a capacity Donald Trump victory.

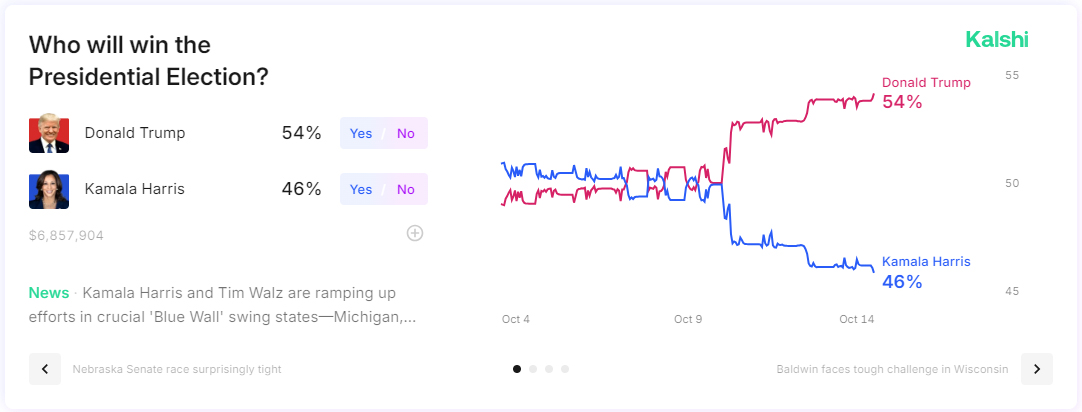

A comparison of Trump’s making a wager odds to get the election in opposition to Vice President Kamala Harris signifies that the historical president’s possibilities have been ice climbing since October 10, reaching fifty three% as of press time, in line with details from Kalshi.

Between October 10 and 14, Trump’s odds elevated from around 50% to 54%. At some stage in this same interval, the worth of Bitcoin surged from approximately $60,300 to around $65,000, reflecting an over 7% develop.

Impact of Trump’s skilled-Bitcoin stance

It looks that Trump’s skilled-Bitcoin stance will be influencing market sentiment. At some stage within the novel presidential campaigns, Trump has emerged as a stable proponent of Bitcoin, actively embracing the asset and aiming to enlighten the U.S. as a world leader within the crypto area.

His make stronger has incorporated accepting Bitcoin for marketing campaign donations, advocating for a deregulated ability to crypto, and promoting skilled-Bitcoin insurance policies at valuable conferences.

At the equal time, the historical president has adversarial the imaginable rollout of central financial institution digital currencies (CBDCs), which he believes threaten financial freedom.

To enhance his political stance on cryptocurrency, Trump could be all for associated crypto initiatives. As an instance, on October 15, he’ll unveil the sale of the World Liberty Monetary (WLF) token, a venture he has described as a “probability to wait on shape the system forward for finance.”

With Bitcoin reclaiming the $65,000 stage, crypto analyst Benjamin Cowen eminent in an X post on October 14 that the asset has proven resilience by striking forward its enlighten above the bull market make stronger band for a lot of weeks. This honest make stronger has bolstered market self belief.

Therefore, technical prognosis means that if the customary leisurely-October bullish seasonality takes abet, Bitcoin could intention the $67,000 to $68,000 range because the next key stage.