CPI amplify induced fears of rate hikes, and Ethereum fell by 3%. Market uncertainty ended in ETF outflows as merchants hunted for conceivable selections. ETH label has the aptitude of pumping by 12 per cent after hitting key enhance.

Ethereum Slides 3% Amid CPI Files Release

After news of Person Sign Index info open which clocked Inflation of 2.4% a 0.1% upward push Year on Year (YoY) ended in a 3% topple of Ethereum. A minute spike in inflation rattled merchants horrified about increasing hobby charges to chilly an already bearish crypto market.

Ethereum rapidly reacted and started declining in opposition to the $2,300 label, as merchants stepped in with promoting. Ether’s uphill struggle to gain bullish momentum has been further clouded by the outlook for total market uncertainty, which contains further inflation info.

Bitcoin and Ethereum ETFs Ogle Most crucial Outflows Amid Ongoing Market Uncertainty

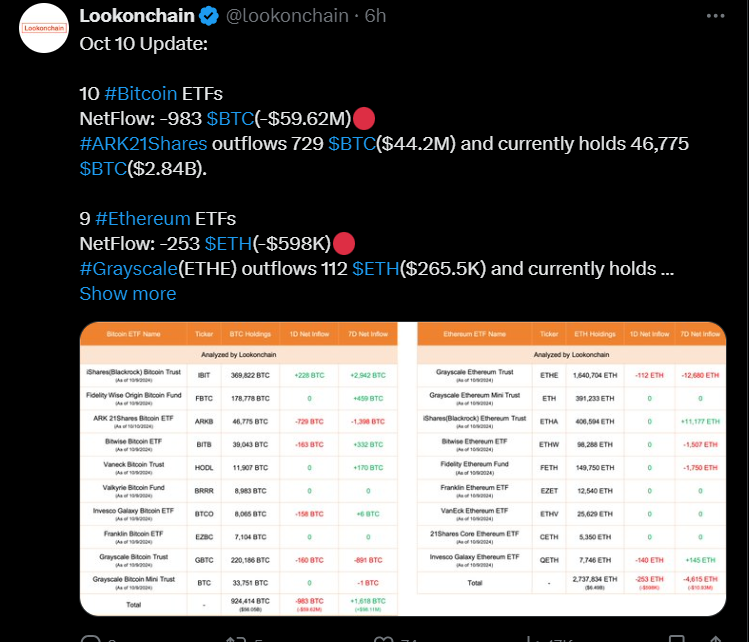

Basically the most up-to-date info from Lookonchain unearths adversarial netflows for every and every Bitcoin and Ethereum ETFs, signaling persisted promoting stress. Bitcoin ETFs skilled a fundamental get outflow of 983 BTC, equating to $59.62 million, with ARK21Shares on my own accounting for 729 BTC of this outflow.

The continuing outflows point to cautious sentiment among merchants amid uncertain market stipulations. The higher myth has affected ETH label as effectively.

Ethereum ETFs also saw adversarial netflows, with a entire of 253 ETH outflowing, valued at approximately $598,000.

Grayscale’s Ethereum Belief recorded the largest outflow, shedding 112 ETH worth $265.5K. These outflows counsel chronic promoting traits in Ethereum ETFs, reflecting broader market volatility and investor repositioning.

Ethereum Faces Additional Decline Amid Market Force

Ethereum is grappling with ongoing promoting stress, which has intensified after the open of CPI info. ETH label is currently trading at $2,363 label and is sorting out the $2,350 key enhance stage.

A a hit breakout above the $2,420 stage and the slanting trendline may per chance presumably presumably place of abode the stage for a doable 12% surge. In this scenario, Ethereum may per chance presumably presumably merely operate for the $2,720 resistance stage, a target supported by historical label motion.

The RSI is at 45, indicating a gradual shift from oversold stipulations but tranquil under the neutral 50 stage, suggesting that promoting stress has eased but bullish momentum stays tentative.

ETH label is sorting out the key $2,350 enhance stage, and a a hit rebound here, coupled with a rising RSI, may per chance presumably presumably rate a solid restoration. If the RSI crosses above 50, it will verify rising procuring hobby.