Bitcoin’s abundant commence to the week is triggering a huge quantity of liquidations all over the crypto markets.

At time of writing, Bitcoin is trading at $53,584 whereas Ethereum adjustments fingers for $3,152, costs now not viewed since November of 2021.

In step with crypto recordsdata aggregator Coinglass, $182.33 million in liquidations gain rocked merchants on Binance, Bybit, OKX, Huobi and others, the overwhelming majority of which gain near from these looking out for to brief BTC in contemporary hours.

As the value of BTC breaks by the wall of shorts, analysts are speculating on what the next essential stages of resistance are.

Glassnode founders Jan Happel and Yann Allemann, who piece the Negentropic handle on the social media platform X, lisp that BTC is gearing up to escape of its multi-week vary with an initial aim of $57,000 earlier than all-time highs.

“BTC now appears to be like to eventually escape from the vary it has been in since Feb. 15.

Momentum is shifting up strongly. All sails are situation.

Next degree is 57-58 – earlier than ATH.”

In step with the analysts, all-time highs might maybe maybe maybe additionally just near ahead of most folk ask.

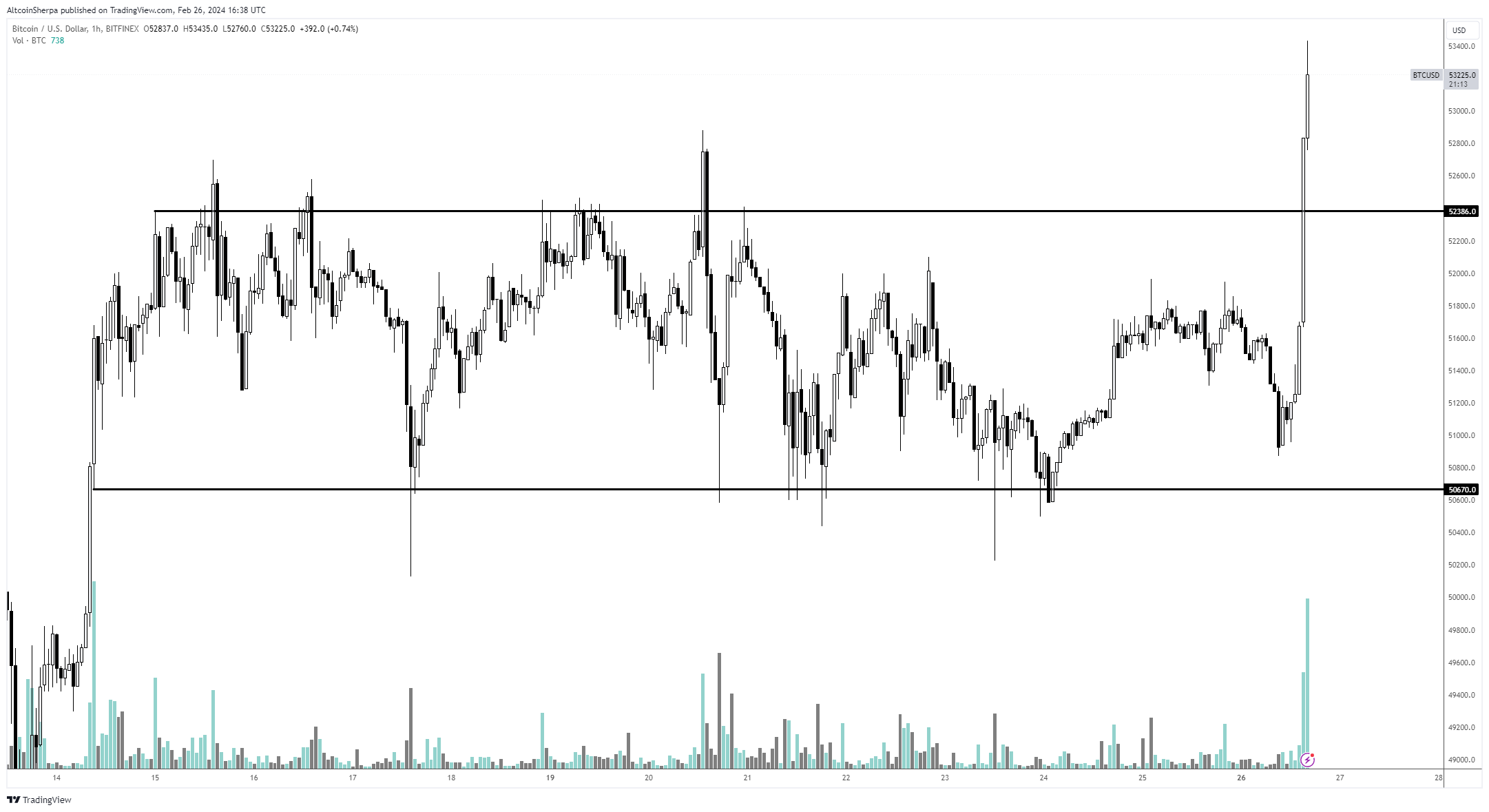

Pseudonymous analyst Altcoin Sherpa shares with his 208,000 followers on X a chart additionally suggesting that BTC has cleanly broken out of a vary between $50,600 and $52,300.

“BTC: I don’t gain any belief why we’re pumping but I’m occupied with it. Staring at for BTC to largely soundless outperform the majority of altcoins though in the brief term.”

In a brand new interview with SkyBridge Capital founder Anthony Scaramucci on the Wealthion YouTube channel, enterprise capitalist Dan Tapiero says that he’s now not watching for a important correction for Bitcoin, and that BTC likely might maybe maybe maybe now not ever lumber into the $20,000s ever all but again.

“So if you’re pronouncing quit I deem we’re going to lumber succor appropriate down to the $20,000, $18,000 lows in Bitcoin, I don’t see it at all.

I deem we’re in the second inning of this bull market, so I’d be worthy extra concerned and deem that there [could be] problems potentially if I felt we gain been in the seventh inning, the eighth inning. The bullish consensus at 75%-80% – I indicate that’s a matter but per chance [it] good means you might maybe maybe additionally just gain a non permanent correction.

We’re good getting started here.”

Featured Describe: Shutterstock/Hib_Stu/Sol Invictus