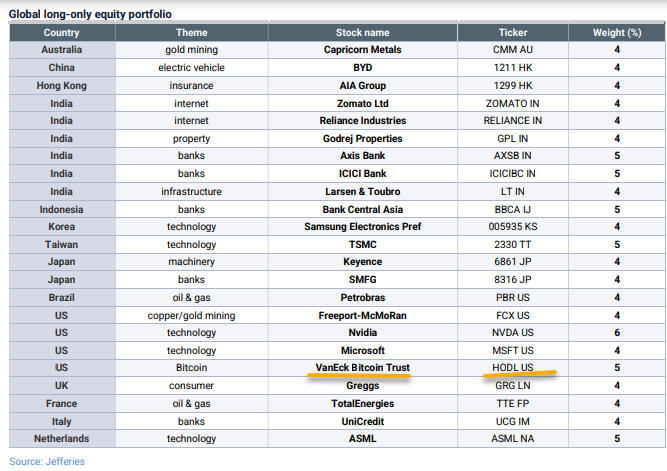

Chris Woods, the executive strategist at investment banking company Jefferies, has disclosed that the company retains 5% of its allocation in Bitcoin thru publicity to VanEck plot Bitcoin alternate-traded fund (ETF) HODL.

In a publish shared on X by the Head of Digital Resources at VanEck, Mathew Sigel, he illustrious that BTC accounts for a bigger allocation of Jefferies’ lengthy-handiest portfolio than its Microsoft and Samsung shares.

Jefferies’s interest in BTC is no longer with out any motive and represents a strategic hedge in opposition to occasions that could maybe well also lead to the devaluation of the USD. Per Woods, Bitcoin represents a reply to any disaster that could maybe well also just maintain an heed on the US greenback if the market must soundless dump US Treasuries.

He acknowledged:

“Bitcoin supplies a likely reply to the calamity that could maybe well also just face the new USD fiat machine must soundless markets attain that G7 bonds, in particular Treasuries, are seemingly to be no longer any longer risk-free.”

Woods additionally when compared Bitcoin to Gold, noting that if the market sees Gold as a hedge to forex debasement within the G7, Bitcoin could maybe well also plunge into the same category. He added that Bitcoin is nearer to the mainstream than ever earlier than because the Securities and ExchangeExchange Commission (SEC) licensed Bitcoin ETFs to alternate, and presidential candidate Donald Trump is already advocating for digital forex on a national level.

VanEck identifies a multiasset portfolio as a reply to restricted interest in BTC from brokerages

In the period in-between, Sigel illustrious that hedge funds were to blame for most of Bitcoin’s institutional purchases in 2024. Per him, investment advisors were slower with integrating BTC into their portfolios as their allocation handiest grew by 4% when compared to 38 for hedge funds.

However, VanEck already plans to fix this with its multi-asset portfolio, which contains Bitcoin. Loads of asset managers are already advertising and marketing and distributing these portfolios, and this could maybe maybe also just seemingly be the non everlasting reply till Brokers launch allocating more to the asset.

Woods sees likely in Lummis Bitcoin reserve invoice

In the period in-between, Woods additionally discussed the proposed Bill by pro-crypto Senator Cynthia Lummis that the US authorities must soundless create Bitcoin reserves equivalent to gold reserves. Per him, the proposal, which comes on the heels of Trump’s promise to determine a national stockpile of BTC, is a spell binding one even if this could maybe maybe also just no longer translate into backing the US greenback with BTC.

However, he illustrious that it’s a long way extremely unlikely for the Bill to turn out to be law on this new Congress. Easy, the discontinue result of the November presidential elections could maybe well also resolve its reception within the following Congress. Woods seen that around 50 million voters defend Bitcoin. This capacity that fact, the root of a Bitcoin reserve could maybe well need more political capital than initially thought.

His thought highlights the reportedly growing bipartisan fortify for a US Bitcoin reserve after preliminary skepticism about whether the root is doable. No decrease than one Democrat legislator, Book Ron Khanna, has openly voiced his fortify for the US having Bitcoin as a reserve asset, noting its “likely for appreciation” and how it permits the US to “plot the financial requirements.”

Easy, bipartisan fortify could maybe well no longer be adequate to fabricate a Bitcoin reserve acceptable to most Congress participants. Consultants deem that the US developing a Bitcoin stockpile can be favorable for the asset, nonetheless it could well probably per chance well no longer create essential for taxpayers and must soundless create a substantial bigger liability for the Federal Reserve.

They acknowledged:

“Holding Bitcoin would create a large running loss for the Fed. Bitcoin pays no interest, nonetheless the Fed has to pay interest on the money it borrows to finance its investments. At new rates, every greenback borrowed to defend Bitcoin would heed the Fed 5.4 percent in annual interest.”

With the experts noting other disadvantages, such because the political pressure and Bitcoin’s positioning as a alternative for the US greenback, they concluded that it’s a long way doubtful that the US Treasury will contain any proposal that explicitly promotes the adoption of Bitcoin.