Bitcoin’s (BTC) notice no longer too prolonged within the past skilled a 7.8% decline, shedding to $60,000. On the opposite hand, because the king of cryptocurrencies recovers from this drawdown, toughen from a primary neighborhood of investors might presumably presumably push the notice bigger.

Institutional investors, in explicit, are playing a key characteristic in utilizing Bitcoin’s upward momentum, and their affect might presumably presumably propel BTC toward the $70,000 designate.

Bitcoin Notes Stable Query

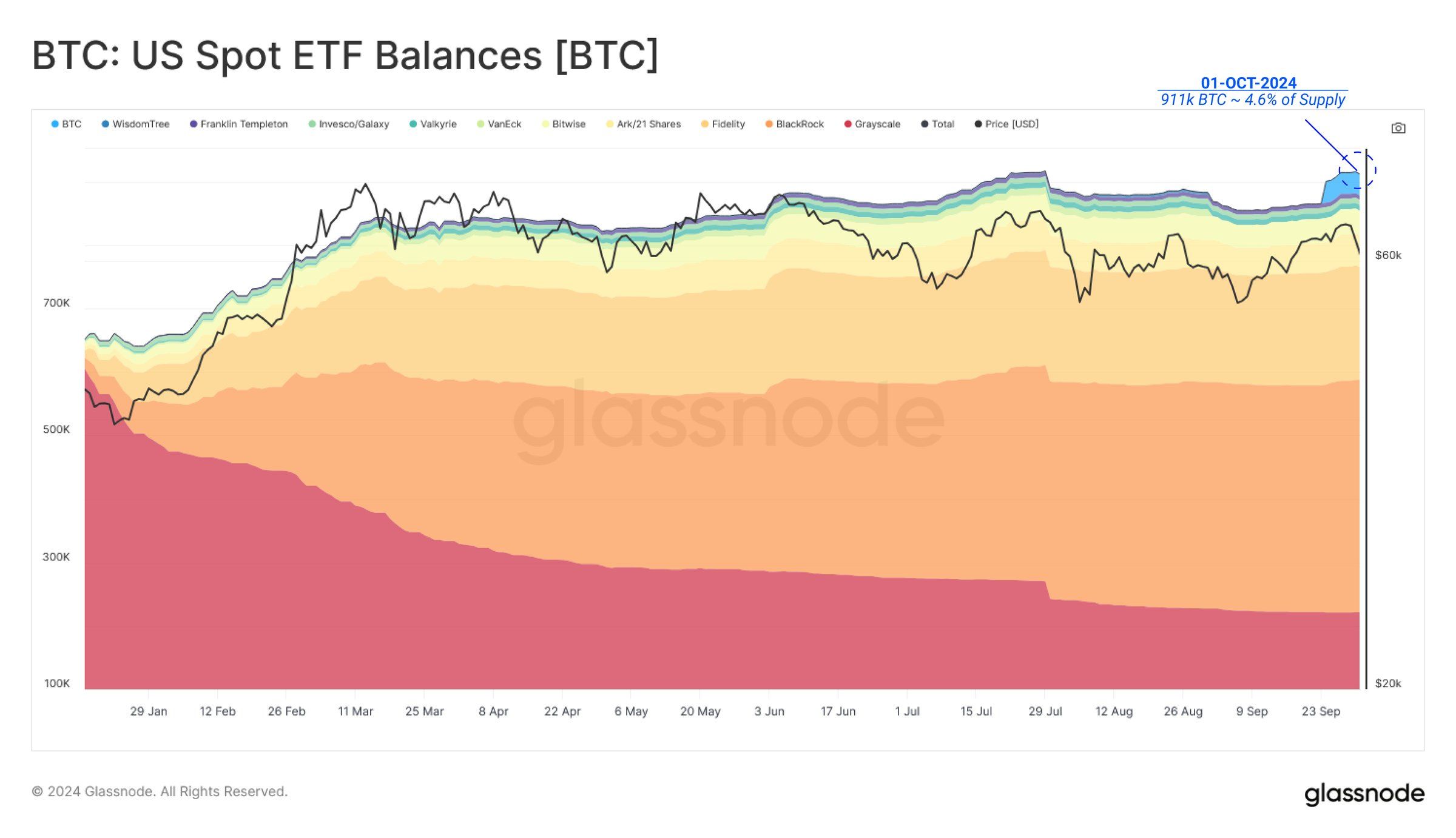

Institutional investors are a truly exceptional to Bitcoin’s doable restoration and future boost. In holding with files from Glassnode, Bitcoin trade-traded funds (ETFs) now possess over $58 billion price of BTC. This volume accounts for roughly 4.6% of Bitcoin’s circulating provide, indicating sturdy quiz for regulated publicity to the cryptocurrency.

The institutional quiz suggests that properly-organized-scale investors inquire Bitcoin as a viable and priceless asset. As these investors proceed to amass BTC thru ETFs and other regulated system, they make a contribution to the coin’s prolonged-length of time boost and steadiness. Their affect might presumably presumably be key in pushing Bitcoin’s notice toward $70,000, namely if quiz remains constant.

Learn extra: What Took place on the Final Bitcoin Halving? Predictions for 2024

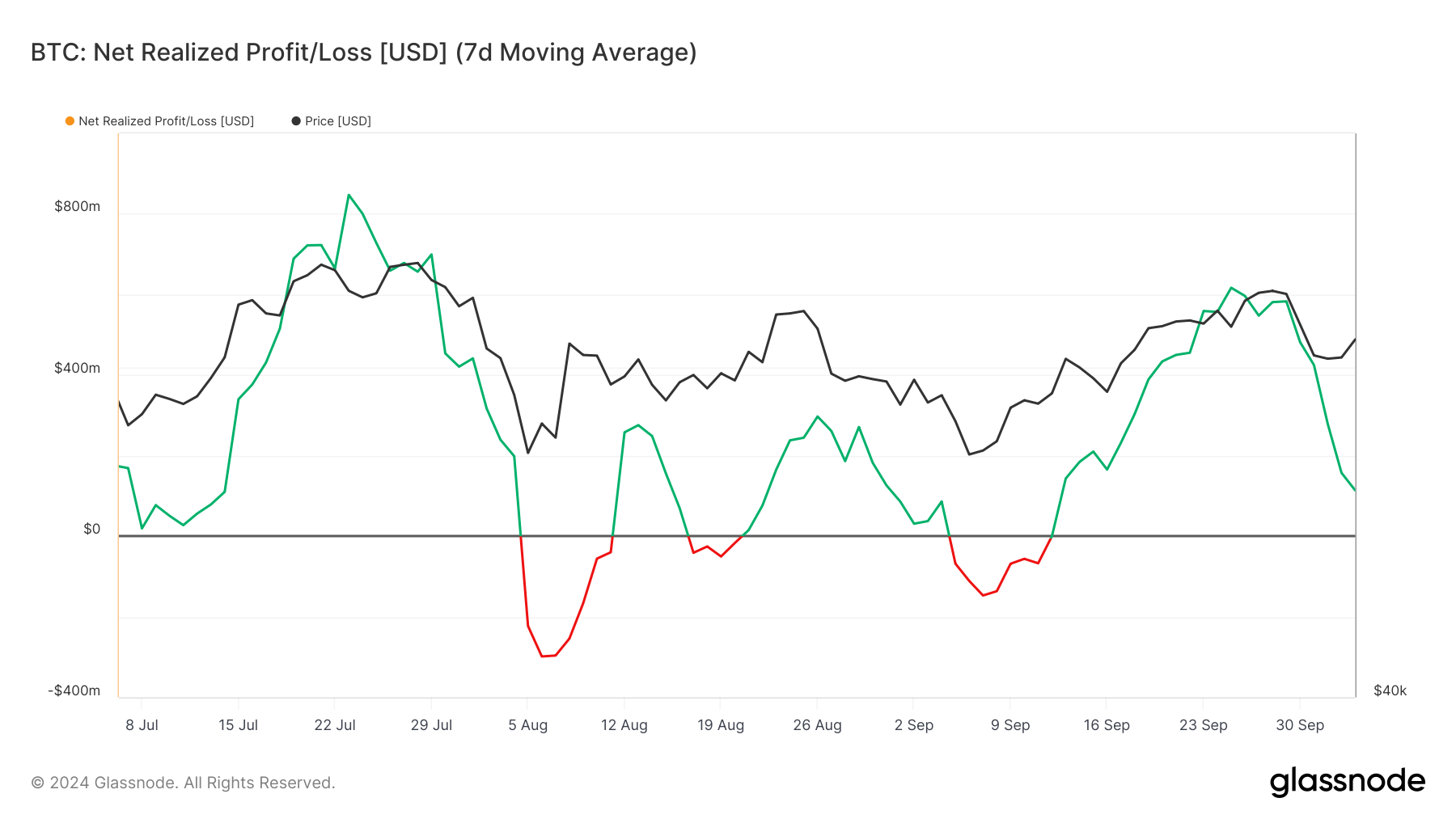

Bitcoin’s total macro momentum additionally appears favorable for a doable notice rise. The on-line realized income/loss indicator, which tracks investor sentiment and behavior, no longer too prolonged within the past famend a downtick, signaling that income booking is slowing down. This shift suggests that selling tension is decreasing, giving Bitcoin the distinguished respiratory room for a comeback.

As selling sentiment wanes, Bitcoin’s notice might presumably presumably maintain the support of a extra balanced market. This sever price in income-taking permits for a extra accurate notice ambiance, rising the probabilities of a sustained restoration. With institutional quiz remaining sturdy and selling tension subsiding, Bitcoin might presumably presumably be heading within the correct course for a notice surge.

BTC Tag Prediction: Rallying Hopes

Bitcoin is currently procuring and selling at $62,353, accurate above the a truly exceptional toughen stage of $61,868. While here’s a favorable signal, BTC nonetheless faces a primary barrier at $65,292 prior to it will arrangement for $70,000. Breaking this resistance is a truly exceptional for the next leg up in Bitcoin’s notice circulation.

The factors talked about above counsel that a notice rise is possible, however this might presumably even require common boost supported by persevered institutional quiz. If institutional investors possess their passion in BTC, Bitcoin might presumably presumably breach the $65,292 barrier and run closer to $70,000.

Learn extra: Bitcoin Halving History: Every thing You Need To Know

On the opposite hand, if institutional quiz weakens or properly-organized investors pull encourage, Bitcoin might presumably even fight to spoil previous $65,292. In this form of express of affairs, BTC might presumably presumably test its toughen stage at $61,868, potentially invalidating the bullish outlook and delaying additional gains.