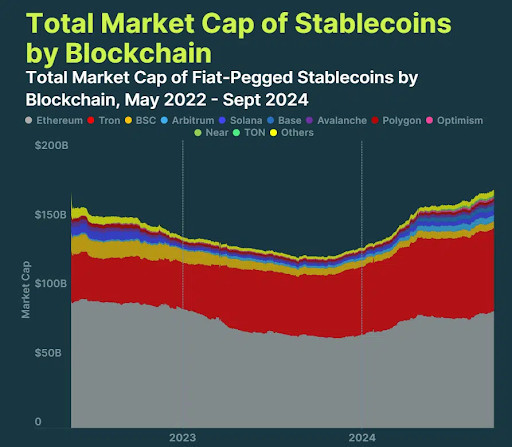

Ethereum remained the live platform for stablecoins even with the fluctuations available within the market.

In accordance with CoinGecko, Ethereum holds about $84.6 billion in stablecoins, representing 49.1% of the total stablecoin provide as of September. The neat contract platform performs a really critical plan in DeFi, preserving simply about half of all stablecoins available within the market.

TRON also has a tough presence, preserving 83.9% of the $144.4 billion stablecoin market. TRON holds $59.8 billion, giving it a 34.8% portion. On the opposite hand, Ethereum’s market portion has moderately decreased.

This decline might maybe presumably maybe presumably even be due to increasing usage of layer 2 options and the most modern failure of Terra’s UST stablecoin. Essentially, Ethereum’s stablecoin provide grew by $17.2 billion this year, however its market portion aloof decreased.

ETH Place Faces Tension, But Prolonged-Time-frame Outlook Stays Decided

The cost of Ethereum’s native token, ETH, objective no longer too lengthy within the past fell under $2,500. It dropped by simply about 4% in 24 hours, reaching $2,480. This decline reflects broader market uncertainty, partly pushed by geopolitical tensions within the Center East.

Study also: Top 5 Layer-1 Blockchains: Beyond Ethereum in 2024

As ETH prices dropped, liquidations jumped, with $87 million in ETH positions liquidated inner a day. These style of positions had been lengthy, exhibiting overextended bullish sentiment.

Technical indicators counsel the market might maybe presumably maybe presumably also proceed to expertise bearish stress. ETH has fallen under mandatory keen averages – the 50 SMA, 100 SMA, and the 200 SMA. Analysts for the time being are looking forward to the next beef up level of $2,395.

Despite the non eternal volatility, many aloof trust in future ETH convey. Historically, Ethereum has viewed a tough return within the fourth quarter, averaging 20.8%.

Whale notify also signifies rising self belief. Addresses preserving between 100,000 and 1 million ETH dangle gathered more since August, now controlling 44.17% of the total provide. This accumulation means that stunning investors remain bullish.

In the meantime, Ethereum-basically basically based ETFs dangle lagged on the back of Bitcoin ETFs by diagram of efficiency. BlackRock executives explain their Ethereum ETF has underperformed expectations. They attribute this to a more complex investment narrative in contrast to Bitcoin’s “digital gold” positioning. Despite this, Ethereum continues to dominate the stablecoin market.

Disclaimer: The facts presented listed here is for informational and tutorial applications completely. The article does no longer constitute monetary advice or advice of any kind. Coin Edition will not be any longer liable for any losses incurred as a outcomes of the utilization of explain material, merchandise, or companies and products mentioned. Readers are urged to notify warning before taking any bound connected to the firm.