Bitcoin and equities have closed out the third quarter of 2024 with tough performances, defying forecasts and protecting off the conventional September downturns. The S&P 500 has climbed 5.1% for the quarter, its most attention-grabbing performance since 1997.

Bitcoin has surged over 7% this month, one of its strongest September performances ever. This indicators solid sentiment, at the same time as concerns linger in the broader market.

Goldman Sachs reports that hedge funds are actively placing three cases more bets on increasing IT shares than short positions.

Crypto Market Outlook: Can Bitcoin Retain Momentum?

Market analysts anticipate the equity rally to face challenges as Q3 earnings reports start in mid-October. Excessive values in every equities and Bitcoin could perchance well presumably be examined.

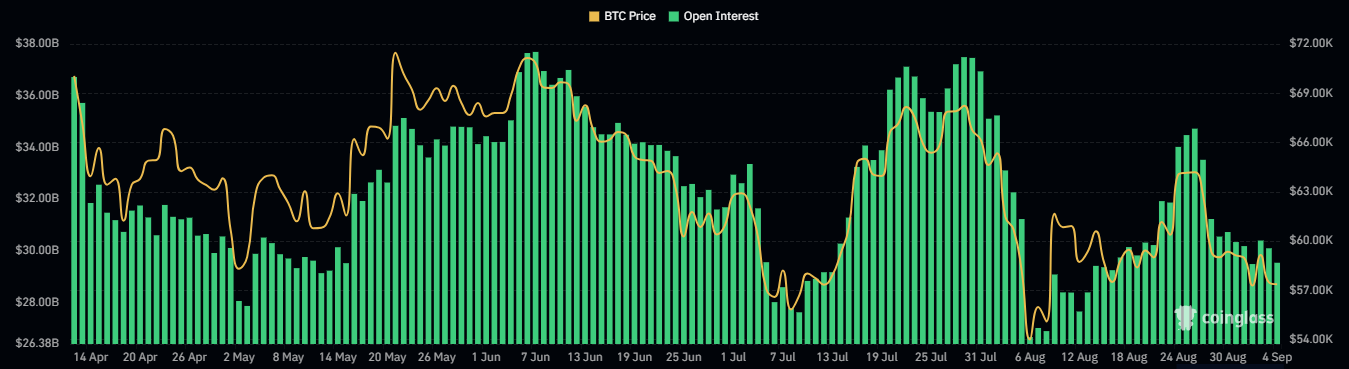

Nonetheless, Bitcoin could perchance well have the profit of any dip in equities attributable to its nature as a menace-on asset, severely in the general monetary easing. Additionally, in the medium time length, many market observers remain optimistic. A breakout above $70,000 could perchance well assemble extra bullish momentum, positioning Bitcoin for extra gains in the months ahead.

Fresh Market Stipulations and Technical Diagnosis

As of press time, Bitcoin used to be shopping and selling at $63,826.43, recording a decline of two.91% in the last 24 hours, furthermore, it reflected a slight pullback after a recent uptrend that peaked around $67,500.

From a technical prognosis, the MACD indicator reveals a bearish crossover, with the signal line falling below the orange line, suggesting a weakening in bullish momentum. The MACD histogram will seemingly be declining, indicating a bearish sentiment.

Moreover, the RSI stands at 62.26, showing a bullish condition but signaling a seemingly overbought drawback.

Disclaimer: The guidelines presented in this article is for informational and academic capabilities most attention-grabbing. The article does now not constitute monetary advice or advice of any form. Coin Version is now to not blame for any losses incurred attributable to the utilization of state material, products, or companies mentioned. Readers are told to exercise caution earlier than taking any stream related to the corporate.