A Bitcoin seller equipped a necessary amount of BTC, making mountainous earnings after conserving for two years.

The weekend noticed Bitcoin surge previous the $66,000 designate, persevering with its upward trajectory from previous beneficial properties. Then all over again, by Monday, the market experienced a necessary shift.

In a span of hours, Bitcoin’s designate dropped by $2,000, falling support to $64,200. This unexpected correction follows several days of sustained enhance, with the asset conserving above $65,000 earlier than the decline.

No topic this dip, Bitcoin’s long-time length designate performance remains spectacular. The crypto has particularly surged by 136.2% over the last 300 and sixty five days, offering mountainous beneficial properties for long-time length holders.

Trader Capitalizes on Bitcoin Good points

One seller, in particular, made necessary earnings from Bitcoin’s yearly rise. In step with knowledge from Lookonchain, the seller equipped 265.89 BTC, rate $17.5 million, realizing a income of $11.28 million.

This sale came about on the new time after Bitcoin’s interesting decline, indicating that the seller strategically capitalized on Bitcoin’s earlier beneficial properties. The seller originally bought 265.89 BTC at $23,443 every two years within the past, making an 181% income on the sale.

This case is no longer outlandish; diversified long-time length holders occupy furthermore begun to income. For instance, a September 20 file famous that miner wallets idle for over 15 years moved a complete of 250 BTC, rate roughly $15.9 million. These wallets acquired 50 BTC per block as mining rewards in 2009 when Bitcoin used to be priced at true $0.0009.

Profitability Metrics for Holders

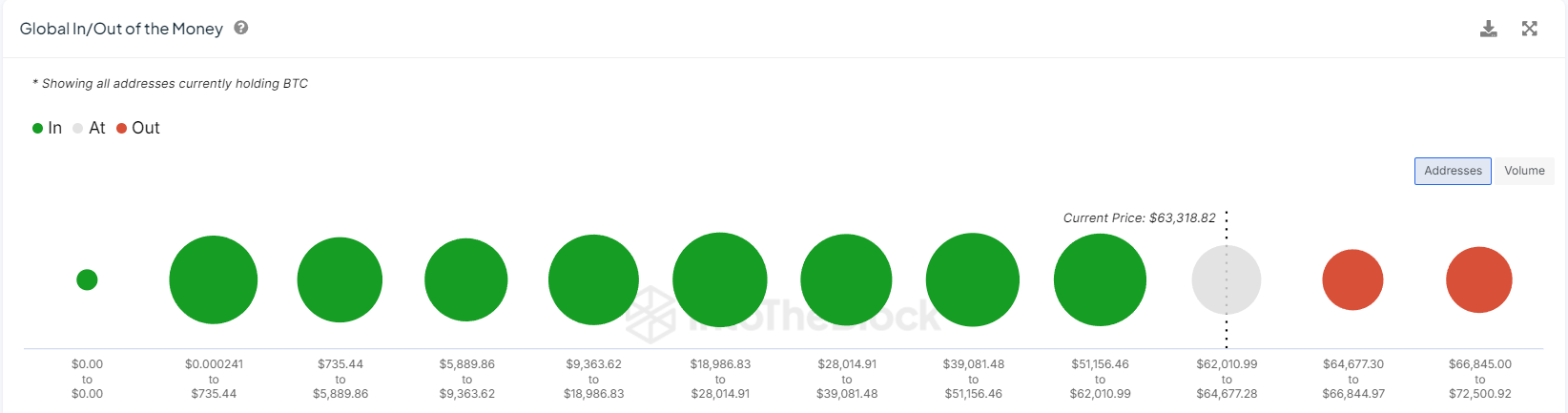

Diagnosis by IntoTheBlock highlights that a necessary cut of Bitcoin holders remains in income. In step with the “World In/Out of the Money” metrics, most Bitcoin addresses acquired the cryptocurrency at costs under its new stage of $63,318.82. A majority of holders equipped at ranges between $18,986 and $51,156, taking advantage of Bitcoin’s designate appreciation over time.

Conversely, fewer addresses are conserving Bitcoin at a loss, as indicated by pink zones within the evaluation. These addresses acquired Bitcoin at costs between $62,010.ninety nine and $72,500.92, placing them out of income given the new market charge.

Seriously, many of these traders entered for the duration of Bitcoin’s height, however as the new designate remains lower, they’re conserving at a loss.