- Fractal patterns and Fibonacci prognosis suggest Ethereum might per chance reach $10K by year-dwell.

- Global liquidity and macro trends might per chance simply force Ethereum’s build surge alongside Bitcoin.

As talked about lately by a CNF substitute, Ethereum is normally referred to as the Crown Prince, and Ethereum’s build is anticipated to make fresh all-time highs earlier than 2025. Ethereum’s native token, Ether (ETH), is positioned to doubtlessly reach $10,000 within the discontinuance to future, supported by a quantity of bullish indicators and market patterns.

In this post, we will have the facility to focus on the three Bullish Components to Ogle within the Subsequent Cycle of Ethereum (ETH) on its song to $10K:

2023-2024 Fractal Suggests Upward Momentum

Irrespective of analysts prediction beforehand reported by CNF, Ethereum’s substitute build will peak by January 2025, one major clarification for this optimistic outlook comes from Ethereum’s build habits equivalent to a previous fractal sample seen between January 2023 and March 2024.

Furthermore, per Julien Bittel, head of macro learn at Global Macro Investor, Ethereum’s most traditional build budge mirrors this earlier consolidation allotment, the build ETH traded between $1,500 and $2,000 earlier than breaking out to $3,500. If ETH continues to note this sample with identical momentum, it would possibly per chance per chance make a bullish breakout, focusing on $10,000 by the dwell of the year.

Fibonacci Prognosis Substances to $10K Intention

Secondly, one more compelling ingredient for Ethereum’s development is technical prognosis in accordance with Fibonacci retracement phases, interesting averages (EMA), and the relative energy index (RSI). Historically, ETH has experienced sturdy rallies adopted by corrections in earlier bull cycles, such as in 2017-2018 and 2020-2021.

The CNF document additional predicts that Ethereum (ETH) might per chance reach $20K by January 2025. If Ethereum repeats the pattern from its 2022 low of $1,080, the Fibonacci extension areas capacity build targets at $6,978 and $10,623. Essentially the most traditional technical setup reveals Ethereum reclaiming key phases admire the 50-week EMA and a just RSI, indicating room for additional development.

Global M2 Money Provide as a Bullish Signal

Thirdly, world macroeconomic trends, particularly M2 money provide development, might per chance attend Ethereum’s build boost. Historically, Bitcoin’s build has risen alongside world M2 money provide expansions pushed by central monetary institution insurance policies. As central banks ease monetary restrictions in accordance with economic uncertainties, a renewed surge in liquidity might per chance take care of discontinuance both Bitcoin and Ethereum.

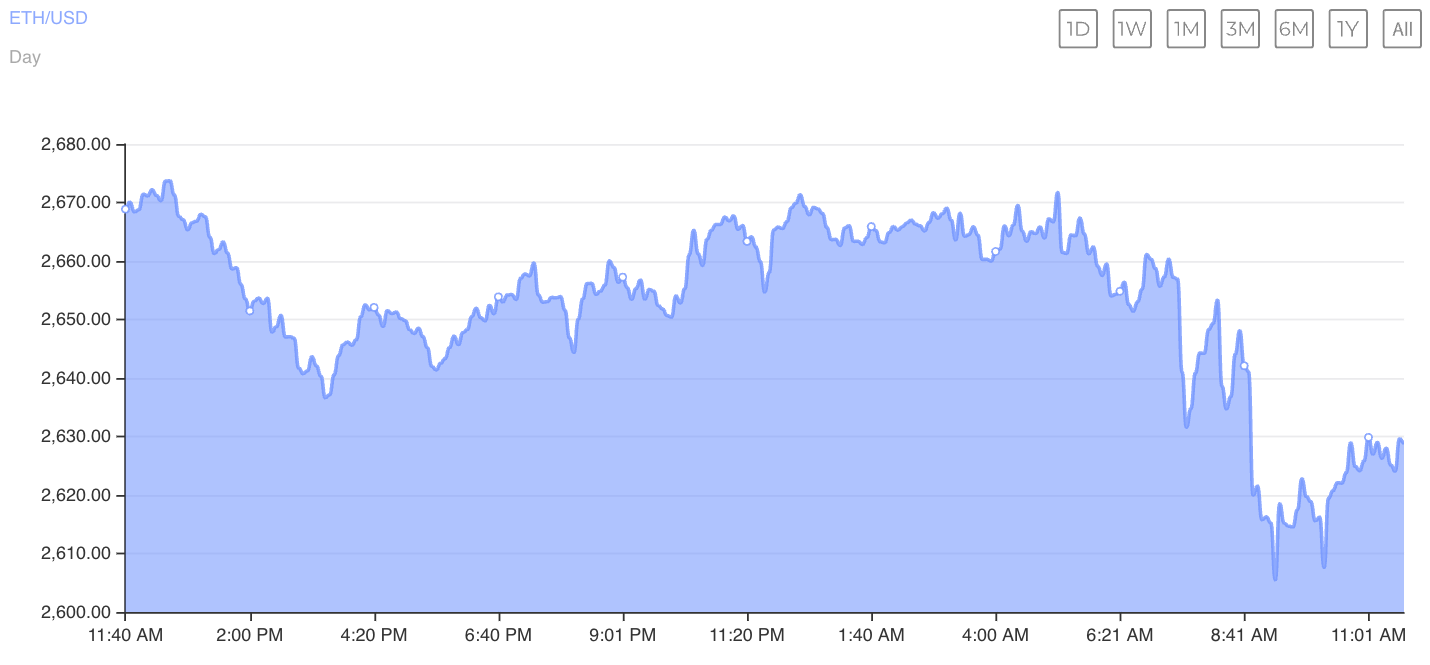

Given the correlation between the two assets, a Bitcoin rally might per chance push ETH toward the $10,000 label as world liquidity will increase. As of this day, Ethereum (ETH) is trading at $2,624.63, down 1.80% within the day gone by and 2.07% within the previous week. Stare the ETH build chart below.