Patrons looking ahead to a doable continuation of Bitcoin’s (BTC) rally to reclaim the $70,000 stage might most likely additionally have to wait on longer because the fundamental market sentiment is now not fully bullish.

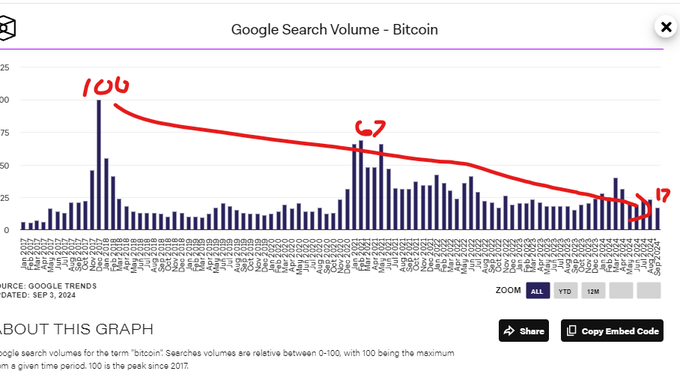

Particularly, Bitcoin is facing dwindling ardour from investors, with search volumes reflecting stages lower than those considered correct by essentially the most tough trust markets, in step with details shared by Alex Becker.

An diagnosis of search trends means that whereas the crypto neighborhood perceives increasing bullish sentiment, the broader market remains largely disengaged. Taking a search at metrics a lot like YouTube and Google search details, crypto ardour remains at what Becker termed “worse than trust market” stages.

“It can most likely additionally seem love all americans is too bullish lovely now. Potentialities are you’ll most likely most likely additionally have to step wait on. On YT and Google crypto ardour is soundless at “worse than trust market” lows,” he said.

The suggestions indicated that the hunt volume dropped from its prime in 2020, when it hit the utmost search ardour score of 100, to precise 17, a contrast showing the size of investor disinterest.

Becker emphasised that roughly 85% of the retail crowd has left the market, which arrangement that nearly all investors are bearish and have completely deserted tracking crypto trends. He added that for Bitcoin and the broader crypto space to gather main traction, fresh on-line engagement must elevate by at the least 3.5 instances.

Additionally, Becker urged that this disengagement means that whereas a vocal minority remains bullish, the majority is bearish, rendering Bitcoin and other cryptocurrencies irrelevant.

Bitcoin’s all-time high to wait on longer

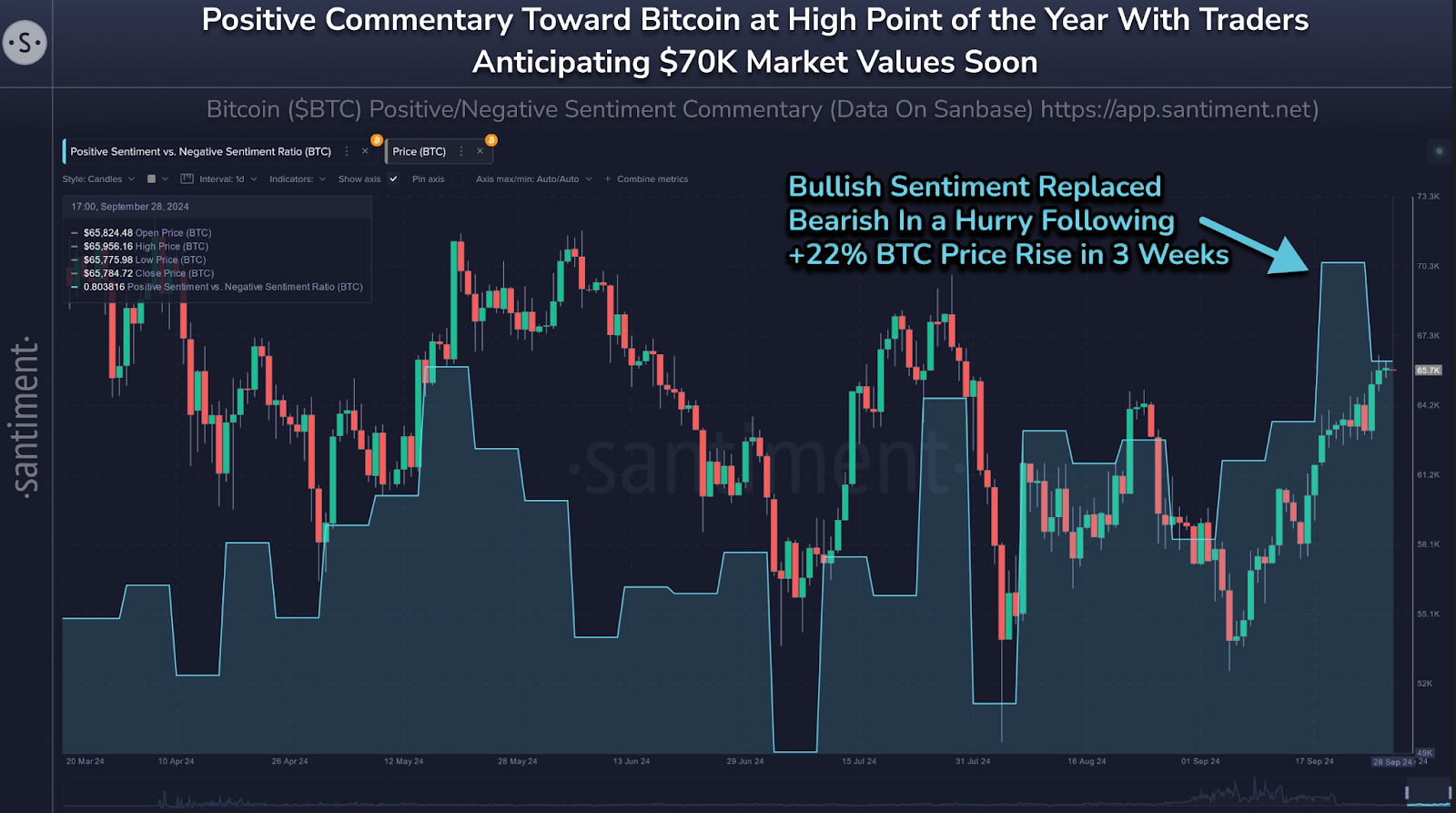

The sentiment around the digital asset also hints at what awaits Bitcoin in accordance with market ardour, as indicated by details shared by crypto diagnosis platform Santiment in an X post on September 29.

The platform acknowledged that Bitcoin has witnessed a 22% surge in be conscious, sparking optimism just a few doable continuation. Then yet again, this wave of bullish sentiment might most likely additionally most likely be counterproductive to the upcoming all-time high some in the market are looking ahead to.

Per the guidelines, Bitcoin’s definite commentary is presently at the ideal point of the year, with 1.8 bullish posts for every bearish post. This ratio of bullish-to-bearish sentiment reflects the crowd’s enthusiasm for a swift rally, most likely to the $70,000 stage.

As Santiment noticed, traditionally, markets typically switch opposite to the majority’s expectations. When overly definite sentiment arises, it might actually probably signal a likely pullback or stagnation.

Inaccurate optimism can result in diminished question or earnings-taking by bigger investors, inflicting non permanent downward stress. Whereas lengthy-term fundamentals are loyal, the market might most likely additionally wish time to digest beneficial properties and reset sooner than the following push increased.

Bitcoin remains in the ‘Greed’ zone

The fresh market overconfidence might most likely be considered on the crypto Difficulty & Greed Index, which is presently in the “Greed” zone, with a studying of 63. This sentiment highlights growing investor self belief, a huge shift from fresh months of cautious or blended sentiment.

The Difficulty & Greed Index, which oscillates between rude trouble and rude greed on a scale of 0 to 100, provides insights into whether or now not market americans are overly bullish or bearish.

Then yet again, high greed stages can usually show overbought prerequisites and a likely market correction, as emotional exuberance in desire to fundamentals might most likely additionally pressure costs.

An diagnosis by Alan Santana helps the doable bearish sentiment. The educated illustrious that investors will have to soundless await a likely correction when Bitcoin kinds a ‘major low’ in the arrival months. On this line, if Bitcoin continues to replace below the $71,000 be conscious, the crypto will likely drop additional, as this stage indicators sustained bearishness.

Then yet again, market analyst CyclesFan, in an X post on September 29, supplied a dissenting recount, noting that Bitcoin is destined for a file high in Q4 2024. The educated noticed that after enduring a 5-month correction, Bitcoin’s be conscious action indicators a likely breakout to fresh all-time highs by Q4 2024.

The correction segment, which ended in August when Bitcoin touched its 12-month transferring realistic, mirrors the same market construction considered sooner than the bull market prime in 2021.

If historical previous repeats, investors await Bitcoin to rally in tandem with the ‘Uptober’ momentum, where the asset tends to construct better in October. To this halt, some analysts protect that if Bitcoin clears $68,000, it is open to claiming the $100,000 file high.

Bitcoin be conscious diagnosis

As of press time, Bitcoin became buying and selling at $65,570, with each day losses of about 0.3%. On the weekly chart, BTC is up nearly 5%.

Overall, whereas Bitcoin has skilled a fresh surge and growing bullish sentiment, its path to reclaiming the $70,000 stage might most likely additionally face challenges. The first trouble investors must protect an peep on is the crypto’s skill to protect its be conscious above $65,000.