Latin The United States (LATAM) continues to teach its rising importance within the world crypto ecosystem. In Colombia, Nexo has joined the Fintech Affiliation, marking a significant step in its regional expansion. Meanwhile, Worldcoin is extending its World ID verification service to Guatemala, addressing digital identification points in a world increasingly extra dominated by bots.

This article explores these inclinations and additional, at the side of crypto adoption surges in Bolivia and Brazil’s advancement in developing its central bank digital currency (CBDC).

Bolivia’s Crypto Transactions Surge Following Ban Take

Bolivia has viewed a fleet rise in cryptocurrency project since its central bank lifted the prolonged-standing ban on digital assets in June 2024. The Central Financial institution of Bolivia (BCB) reported 100% enhance in crypto transactions over honest appropriate three months. Between July and August, the average crypto trading quantity in Bolivia soared to $15.6 million, doubling from the $7.6 million recorded within the principle half of of the year.

Stablecoins possess emerged because the most neatly-liked different for many Bolivians, providing an different for e-commerce and world transactions. BCB President Edwin Rojas highlighted the importance of this shift.

“The exercise of virtual assets is a honest appropriate step towards modernization and economic integration with the enviornment to present a grab to world industrial and monetary activities. For the reason that legislation came into force, the population has an different mechanism to direction of transfers to and from foreign and digital commerce funds, amongst other activities,” Rojas acknowledged.

No topic these features, Deputy Mariela Baldivieso, a proponent of cryptocurrency, stresses that extra work is an extraordinarily worthy. Bolivia mute faces challenges, particularly within the areas of monetary literacy and regulatory infrastructure. Baldivieso believes that with stronger training initiatives and clearer regulations, Bolivia can also was a hub for crypto innovation at some point.

Worldcoin Expands Digital ID Services and products in Guatemala

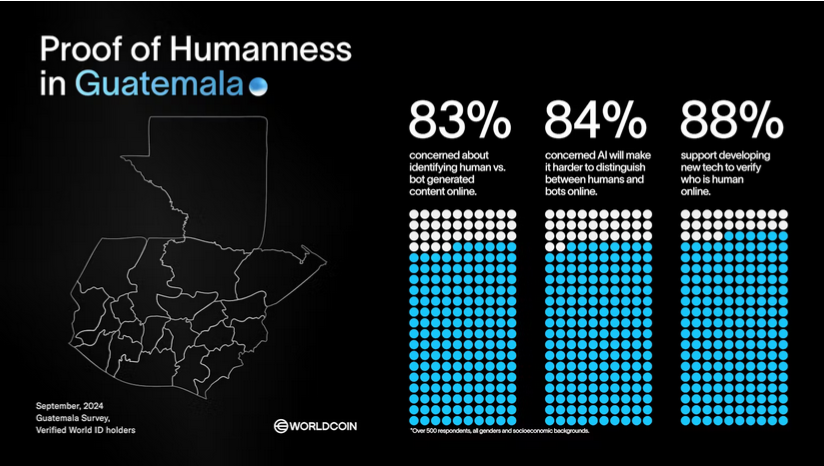

Worldcoin continues its expansion in Latin The United States by launching its World ID verification service in Guatemala. As of September 25, Guatemalan customers can exercise Worldcoin’s orb technology to study their identification as folks, countering the rising downside over online bots. With a immediate receive of the World App and an appointment at one amongst the orb places, customers can also very effectively be sure their online interactions are exact.

In a latest think, 83% of Guatemalans expressed issues about distinguishing between human-generated and bot-generated instruct online. The beginning of World ID is viewed as a technique to this instruct, providing elevated security and transparency in digital interactions.

Worldcoin’s expansion into Guatemala follows its earlier launches in Ecuador and Mexico, the put the technology has already gained traction. Then once more, as Worldcoin grows in Latin The United States, it has sparked privacy debates in worldwide locations admire Argentina, the put issues over biometric data security possess prompted regulatory discussions.

Nexo Eyes Mumble in Colombia with Fintech Affiliation Membership

On September 26, crypto lending platform Nexo officially joined the Colombia Fintech Affiliation. This partnership permits Nexo to integrate into Colombia’s monetary atmosphere and provide digital asset solutions. Becoming a member of the affiliation additionally permits Nexo to extra have interaction with the native fintech group and hit upon synergies all the method by method of the field.

In an announcement shared with BeInCrypto, Elitsa Taskova, Nexo’s Chief Product Officer, acknowledged that the partnership with the Colombia Fintech Affiliation reflects Nexo’s dedication to providing evolved digital asset solutions.

“Colombia gifts a clear different: with a valuable 92.1% of the population already having get entry to to crypto-connected products and services, the country is making a considerable jump towards digital finance. […] We’re no longer honest appropriate entering a market; we’re empowering millions of Colombians with accessible digital asset tools and shaping the strategy forward for finance in Latin The United States,” Taskova acknowledged.

These solutions meet the country’s rising inquire of for stablecoins and stable wrong-border transactions. Over the last year, Nexo has observed a 73% rise in native purchasers using its crypto-yield products. Colombia’s passion in cryptocurrencies, particularly stablecoins, has been driven by remittances and a rising need for digital monetary products and services.

Paraguay Develops World’s First Nationwide Blockchain to Push Sovereignty

Paraguay is making waves with the attain of Legaledger, the enviornment’s first third-generation blockchain community with nationwide sovereignty. The Paraguayan Blockchain Chamber drives this initiative, aiming to provide stable blockchain-basically basically based mostly solutions for the public and non-public sectors. These solutions encompass monetary, civil, and armed forces transactions.

Ricardo Prieto, the director of the Blockchain Chamber, defined that Legaledger is constructed on Hyperledger technology. It is miles designed to provide upright high-tail wager in blockchain transactions, addressing issues over security and fraud.

“Our blockchain community model is fractal. […] It will also very effectively be implemented in a firm, conglomerate, teach, and country, with the the same schematic assemble, and all would remain interoperable for the functions of what we name sequencing, publication of the scheme or transaction, at the side of world operations,” Prieto defined.

By its sovereign blockchain model, Legaledger goals to set apart Paraguay as a world chief in blockchain governance and innovation. The organization plans to magnify its solutions internationally by 2026.

Brazil’s CBDC Initiative DREX Enters 2nd Section of Construction

The Central Financial institution of Brazil is making development with its CBDC accomplishing—DREX. The establishment honest no longer too prolonged within the past entered the 2d segment of its DREX pilot program. This segment focuses on 13 strategic projects that will test the viability of spruce contract-basically basically based mostly monetary products and services.

“We can additionally test the utilization of assets no longer regulated by the Central Financial institution. To this pause, we’re working at the side of the Securities and Alternate Commission (CVM). Other regulators possess additionally confirmed passion in attempting out operations with assets beneath their jurisdiction so that you can magnify the usability of the platform,” Fabio Araújo, Coordinator of the Drex Initiative and Consultant of the Department of Banking Operations and Price Blueprint of Brazil’s Central Financial institution, elaborated.

The projects cloak assorted sectors, at the side of world alternate financing, accurate estate transactions, and credit collateralized in public securities. Predominant monetary gamers resembling Bradesco, Itaú, and Santander are piece of the consortium main the attain of DREX, which focuses on privacy and regulatory compliance.

Brazil’s push toward a CBDC is piece of its broader arrangement to modernize its monetary infrastructure. The country plans to roll out extra evolved digital solutions by mid-2025.