Any individual misplaced (yet every other) millions of bucks charge of funds to a phishing attack while the exhaust of decentralized finance (DeFi). That is a same earlier mistake amongst customers, affecting even consumers with developed data if the exhaust of cryptocurrencies that facilitate these assaults.

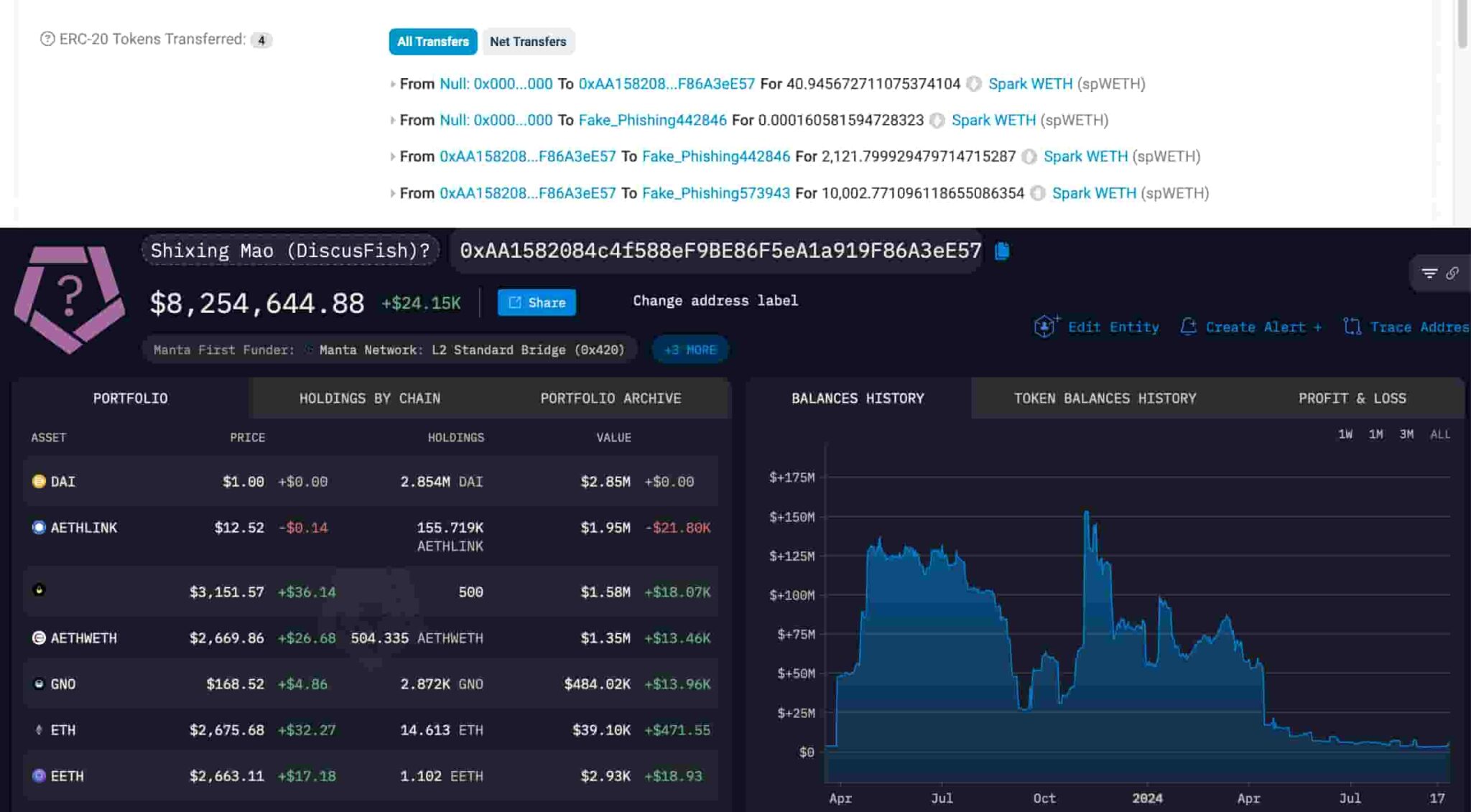

On this most modern match, the Ethereum address ‘0xAA1582084c4f588eF9BE86F5eA1a919F86A3eE57‘ misplaced 12,083.6 spEWTH, charge $32.33 million. Ethereum’s blockchain registered the transaction to 2 addresses labeled “Faux Phishing” on September 28 at 6:15 a.m. UTC.

Finbold consulted the Arkham Intelligence database, which implies the address belongs to Shixing Mao, also acknowledged as DiscusFish on X. Appropriate now, it silent holds $8.25 million charge of tokens, of which $2.85 million are in DAI stablecoin.

Particularly, Shixing Mao is an experienced crypto executive and co-founder of F2Pool and Cobo. If this address in actuality belongs to Mao, it’s a long way yet every other cautionary anecdote about how even experts can plunge victim to such assaults – urging the want to search out universal options to attach a long way from an analogous occasions.

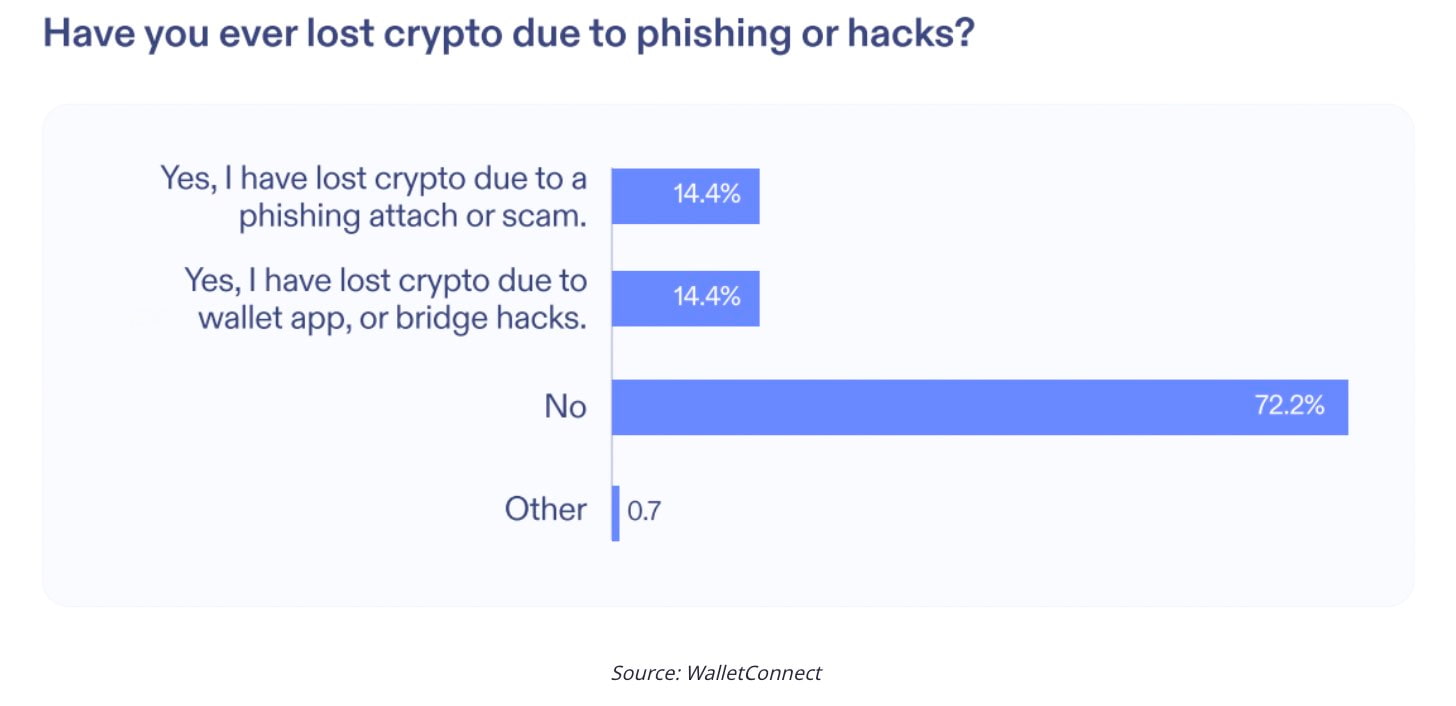

1 in 7 crypto consumers had been victims of Phishing

A glance from WalletConnect shows that with regards to one in every seven cryptocurrency customers has fallen victim to a Phishing attack. Per WalletConnect, 14.4% of respondents stated, “Certain, I even indulge in misplaced crypto as a result of a phishing attack or scam.”

Accounts on X indulge in reported a pair of of the gigantic numbers crypto consumers misplaced while interacting with malicious contracts or addresses. A contemporary instance entails Scam Sniffer‘s document on July 23 of a $4.69 million lack of Pendle (PENDLE) re-staking tokens.

Also, the $55 million DAI loss to a phishing attack Lookonchain reported on August 21, urging customers to double-check transactions.

A whale misplaced 55.47M $DAI in a phishing attack!

How did it occur?👇

The whale carelessly signed an unknown transaction 13 hours ago, setting the owner of his 55.47M $DAI in Maker to the phishing address”0x0000db5c…41e70000″.https://t.co/jpIz4pD043

When he later tried to… pic.twitter.com/qOkkcbYp4q

— Lookonchain (@lookonchain) August 21, 2024

On Finbold, we indulge in reported a lot of these cases. Namely connected to the TON ecosystem, Tether freezing suspicious assignment, and the attacker who returned stolen wBTC.

Yet, these are handiest share of a broader reveal that fees customers worldwide millions of bucks. Surprisingly, more moderen nonetheless much less favorite applied sciences and crypto protocols are already partly mitigating this reveal.

The contrivance to attach a long way from phishing assaults and pockets drains on DeFi?

Truly, all these assaults are as a result of human error, exploited in a lot of how. To illustrate, connecting a pockets to a malicious application or signing a malicious permission or transaction.

The most natural contrivance to attach a long way from falling victim to a phishing attack or pockets drain is to double-check websites and perceive what you are signing up for, actually. For that, customers can prioritize wallets and protocols with easily readable transaction signing, disclosing the action intimately.

Nonetheless, more developed applied sciences indulge in already developed built-in options for crypto protocols that support terminate human errors, specializing in security.

Native property terminate phishing and pockets drains

In vogue blockchains like Ethereum (ETH), BNB Chain (BNB), Solana (SOL), Tron (TRX), Avalanche (AVAX), Algorand (ALGO), and Attain (NEAR) all exhaust a mannequin the attach tokens work differently from their native property, functioning through trim contract calls that require a earlier special permission to transfer the funds.

Dave, also acknowledged as DBCrypto, commented about this mannequin with Finbold.

“The trim contract-basically based token mannequin found on Ethereum, L2’s, and EVM chains is no longer handiest inefficient nonetheless also anxious, delaying Web3 adoption.”

– Dave (DBCrypto)

4/ These “tokens” are upright objects of data in a trim contract which indulge in a hash announcing you indulge in verbalize to them

But they aren’t in your possession or in your pockets

Let’s watch at an instance…

Own you ever puzzled why your total #ETH NFTs don’t present in your pockets normally?

— DBCrypto⚡️ (@DBCrypt0) December 7, 2023

On the utterly different hand, chains like Cardano (ADA), Sui (SUI), MultiversX (EGLD), and Radix (XRD) exhaust a local-asset token mannequin. On this mannequin, all tokens behave as native property for the period of the protocol, no longer requiring database permissions that might perhaps additionally be exploited. Users want to label every transaction to transfer tokens of their ownership, increasing every other layer of security.

Curiously, customers can now earnings as developers take a more cautious watch toward security concerns, phishing assaults, and token units. At one level, consumers will inevitably want to make a decision whether or no longer they glean the frail requirements or migrate to the more moderen ones in the competitive and modern free market that’s crypto.