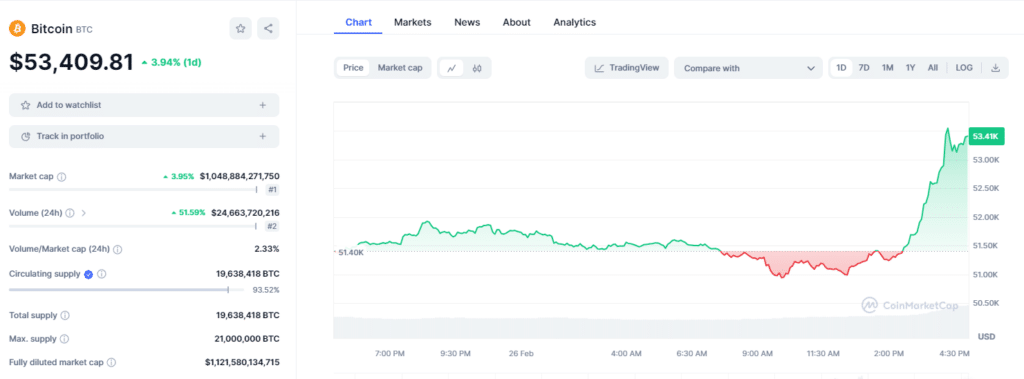

Bitcoin’s value soared to its highest point over two years, surpassing the $Fifty three,000 fee.

The leading digital forex skilled an upswing of up to 3.3%, reaching $Fifty three,456, an indication point no longer viewed since December 2021. In accordance with CoinMarketCap, BTC procuring and selling quantity has surged over 50% today time.

The uptick happened in the wake of experiences that MicroStrategy, beneath the management of Michael Saylor, expanded its Bitcoin portfolio by procuring an extra 3,000 devices at a entire sign of $155.4 million. MicroStrategy’s total Bitcoin funding is now valued at almost $10 billion. The acquisition sign averaged $51,813 per Bitcoin, with their holdings’ overall moderate bask in sign at $31,544.

Over the fresh weekend, analysts identified that Bitcoin would possibly maybe well well enter the third phase of a pattern that historically precedes vital sign rallies. It is smartly-known that Bitcoin’s sign assuredly advantages at some stage in intervals of elevated global liquidity – the mammoth sums of cash circulating inside the worldwide monetary ecosystem.

No matter a newest downturn in global liquidity, Bitcoin’s sign is on the upward push, leading analysts to take a position that its value would possibly maybe well well surge past expectations must global liquidity phases rebound.

With this newest rally, Bitcoin won almost 30% in February. Given the certain sentiment across the broader market, as April’s halving is getting nearer, Bitcoin’s bull flee would possibly maybe well well enter a brand original phase. BTC’s trouble and greed index has now entered 72 (greed), a huge 20 points for the rationale that birth of this 300 and sixty five days.

Learn extra: Dating app stumble on leads to $450,000 cryptocurrency romance rip-off