Cryptocurrency investors brace for that you just will mediate turbulence available within the market as analysts predict a looming designate correction within the impending weeks. In step with insights from CryptoQuant, a main crypto analytics platform, on-chain information and technical chart analysis suggest that Bitcoin’s designate could perchance well dip to spherical the $forty eight,000 designate.

Bitcoin Faces Serious Juncture: Key Phases and Technical Indicators in Focus

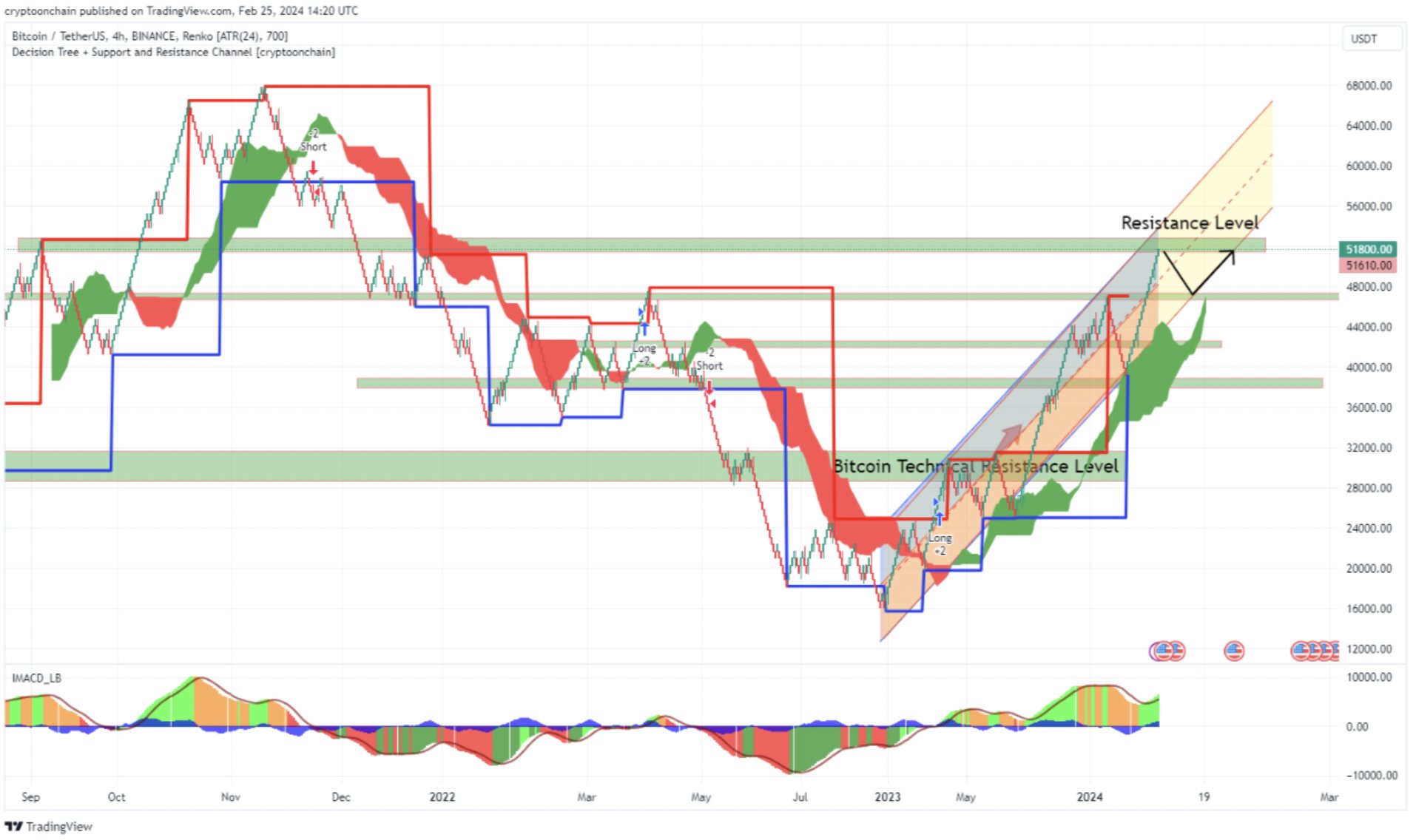

Bitcoin, which has been trading above the 50-day and 200-day Exponential Transferring Averages (EMAs), providing bullish signals, now faces a major juncture. Analysts highlight that a breakthrough above the $52,500 stage could perchance well perchance propel Bitcoin in the direction of the $fifty three,000 resistance stage and potentially surpass final week’s high of $fifty three,026. Nevertheless, a downward shift below the $50,500 toughen stage could perchance well perchance pave the system for bears to focal point on the $forty eight,178 toughen stage.

The analysis additional parts to the 14-Day to day Relative Strength Index (RSI) studying, within the within the meantime at 66.47, indicating that Bitcoin could perchance well test the $fifty three,000 resistance stage sooner than coming into overbought territory. This overview underscores the aptitude for quick-length of time designate fluctuations available within the market.

One amongst the principle metrics using this prediction is the 30-day inspiring average of quick-length of time Holder Spent Output Revenue Ratio (SORP), this skill that that Bitcoin is nearing the marketing zone for quick-length of time investors. This statement aligns with technical chart analysis, indicating that Bitcoin is within the within the meantime positioned below resistance levels.

Elements Influencing Bitcoin’s Shut to-Term Trajectory

Additionally, market information from this week reveals that Digital Asset Fund flows amounted to $598 million, a decline from the old week’s inflows of $2.forty five billion. This diminishing pattern in fund flows lends toughen to CryptoQuant’s forecast of a doubtless Bitcoin designate correction.

Whereas Bitcoin’s most contemporary bullish momentum has buoyed investor sentiment, analysts caution that the market could perchance well perchance expertise elevated volatility within the end to length of time. Merchants and investors are told to carefully video display key toughen and resistance levels, as effectively as on-chain information, for insights into doubtless market actions.

As Bitcoin navigates this serious allotment, market contributors, in conjunction with institutional investors, retail merchants, and cryptocurrency lovers, are carefully monitoring its actions and making ready for a ramification of doubtless eventualities. With rising mainstream adoption and regulatory developments shaping the industry, stakeholders are keenly conscious of the want to defend told and adaptable to changing market dynamics. This heightened vigilance underscores the significance of staying abreast of market developments and technical indicators to be conscious told choices.