Celestia (TIA) has skilled a basic 20% label elevate in the last three days. Portion of it used to be driven by excitement spherical its $100 million funding spherical. Can this momentum be sustained, or is a label correction on the horizon?

A important rise in perpetual futures volume, most recent RSI ranges that heart of attention on ongoing purchasing rigidity, and the newest golden corrupt formation on the EMAs ship basic insights.

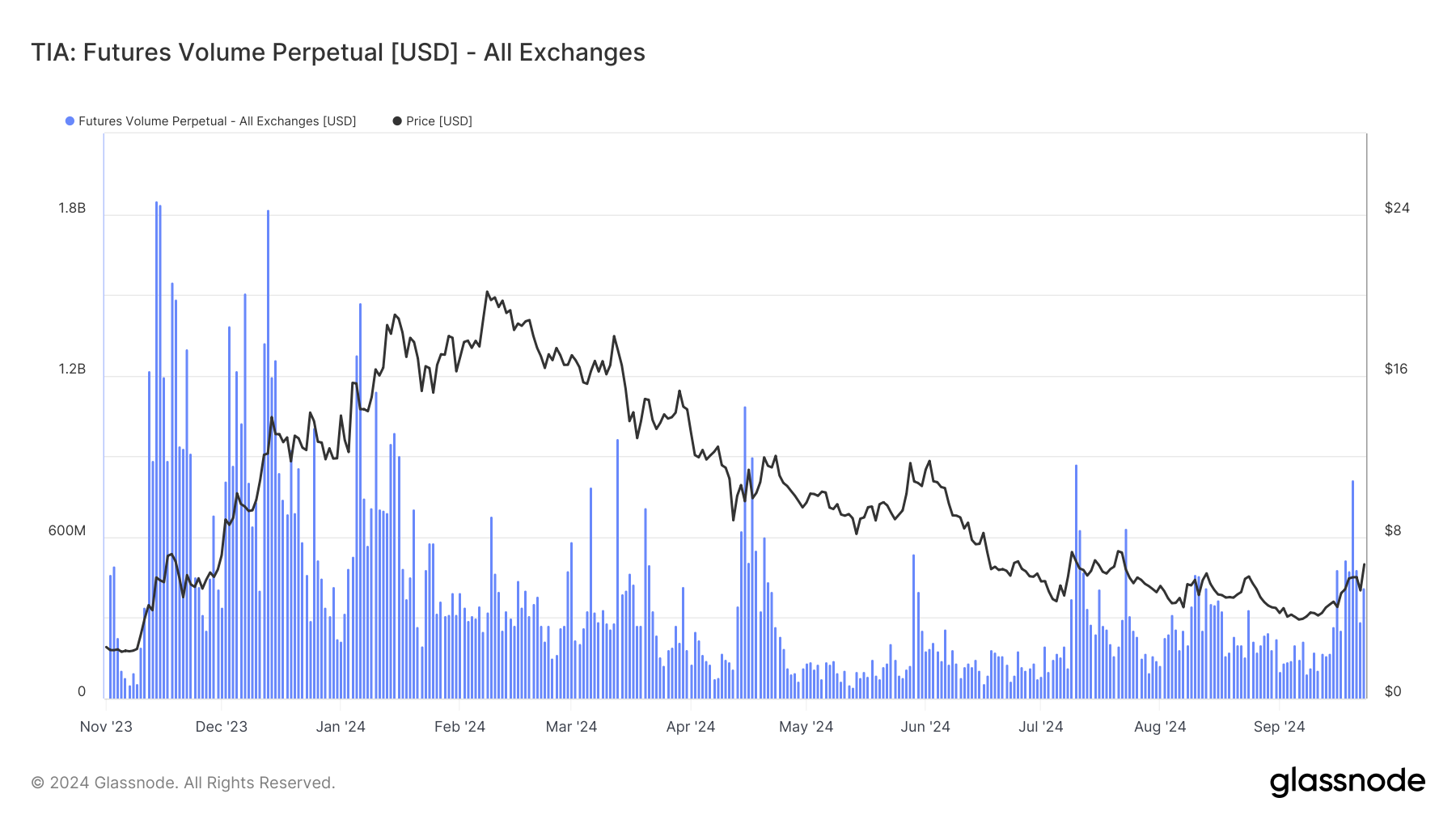

Celestia Futures Volume: Most up-to-date Surge Fails to Match Slack 2023 Peaks

In most recent days, there used to be a noticeable surge in perpetual futures volume for Celestia. That indicators renewed ardour and increased purchasing and selling direct. Nonetheless, this volume remains an excellent deal decrease compared to the peaks reached in November and December 2023, the score futures volume exceeded 1.8 billion USD.

Currently, it’s easy spherical 50% below these values, even with the newest uptick. This decline in volume means that, no topic the newest boost in purchasing and selling, the broader market sentiment and participation in TIA’s perpetual futures contracts haven’t yet returned to their earlier highs.

Read extra: 10 Handiest Altcoin Exchanges In 2024

Futures perpetuals are spinoff contracts that enable merchants to take a position on the long bustle label of an asset without an expiration date. When futures volume is rising, it on the final indicators increased speculative ardour. Conversely, falling futures volume suggests reduced speculative direct or ardour, indicating that merchants will likely be less willing to snatch on contemporary positions.

The truth that TIA’s futures volume remains decrease than its earlier highs could presumably presumably imply that whereas instant-term ardour has grown, the market has no longer yet fully recovered to the enthusiasm considered at the stay of 2023. Nonetheless, if the momentum continues, there is different room for TIA to grow in the following weeks.

TIA RSI at 59: Regular Momentum with Capacity for Further Gains

With an RSI of 59, Celestia (TIA) is in a quite bullish zone, indicating proper purchasing ardour without being overbought. On the final, an RSI between 50 and 60 suggests room for additional label boost, whereas an RSI above 70 would signal overbought prerequisites, potentially resulting in income-taking or a pullback.

The RSI, a momentum oscillator measuring the velocity and switch of label actions on a scale from 0 to 100, highlights market prerequisites. A reading above 70 signifies overbought, whereas below 30 suggests oversold.

Currently, Celestia’s RSI at 59 parts to strong purchasing momentum with room for additional beneficial properties, although merchants will knowing closely if it nears 70 for indicators of a possible retracement.

Celestia Imprint Sorts a Golden Defective: Might well also Momentum Push It to $7.5?

On September 16, the exponential attractive averages (EMAs) for Celestia label formed a golden corrupt, with the shorter-term EMA crossing above the longer-term EMAs. A golden corrupt is on the final considered as a bullish signal. It implies that upward momentum is building, and it can most likely presumably presumably on the final consequence in sustained label will increase.

The EMAs are calculated to subtle out label fluctuations and highlight trends. The 20-interval EMA (crimson) responds rapid to cost changes, whereas the 50-interval (orange), 100-interval (cyan), and 200-interval (blue) EMAs heart of attention on longer-term trends. Within the newest chart, all these EMAs are sloping upwards, reinforcing the certain momentum that began spherical mid-September.

Read More: 11 Cryptos To Add To Your Portfolio Sooner than Altcoin Season

If Celestia label can proceed this momentum, it can most likely presumably presumably damage the $7 resistance zone, which is a basic psychological barrier. A profitable breach could presumably presumably push the altcoin against $7.5, its absolute best stage since July 2024.

Nonetheless, if the momentum falters, the worth could presumably presumably retest the $5.06 toughen stage. Might well also simply easy this toughen fail, a additional decline could presumably presumably snatch it down to the $4.4 zone, a stage of ancient resistance.