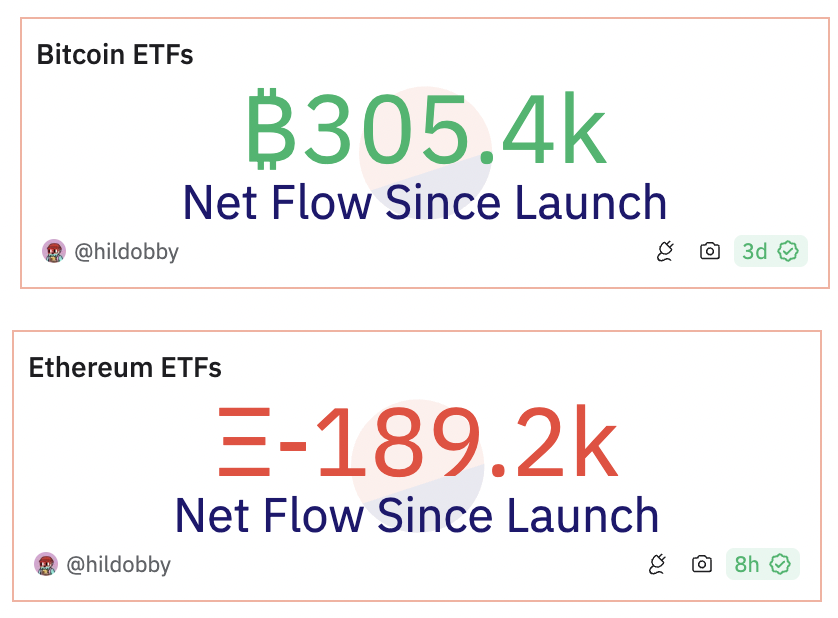

There is a definite performance distinction between Bitcoin and Ethereum ETFs according to most up-to-date knowledge. Since their begin, Ethereum ETFs possess experienced a get outflow of 189,200 ETH, whereas Bitcoin ETFs possess experienced a mountainous get influx of 305,000 BTC, marking an enormous distinction between the two property.

With Ethereum easy facing difficulties, Bitcoin has won roughly $16.7 billion over Ethereum, indicating rising institutional curiosity in the extinct. The divergence in ETF flows components to a being concerned sample for Ethereum. It looks that institutions are losing curiosity in ETH, as many possess sold their holdings covertly in most up-to-date months.

Ethereum’s market performance has been at once impacted by this ongoing dumping, as seen by a discernible decline in transaction quantity. Although Ethereum’s blockchain has historically seen a lot of exercise, its adoption and usability can also very successfully be below stress due to waning institutional self belief.

Ethereum’s swap to proof of stake (PoS) can also very successfully be one ingredient contributing to this decline in curiosity. Although PoS became expected to pork up scalability and efficiency, some institutional avid gamers attain now not seem like convinced of its lengthy-time length benefits. But one more ingredient contributing to investor reluctance can also very successfully be the ecosystem’s complexity, which comprises layer-2 choices and frequent updates.

Conversely, extra conservative and threat-averse institutional avid gamers can also very successfully be drawn to Bitcoin due to its established dispute. Ethereum’s 189,000 ETH outflow illustrates the indisputable truth that despite the technological advancements that ETH gives, institutions easy favor Bitcoin as their asset of various.

Ethereum needs to take care of these points if it needs to rebuild market power and institutional self belief, as indicated by the widening gap in get ETF flows. Ethereum can also salvage it difficult to protect onto its dispute on the increased cryptocurrency market if the dumping of ETH persists and institutions proceed to lean extra in direction of BTC.