Over the previous month or so, Bitcoin has fallen while the Nasdaq and S&P 500 own gained. Will the bulls be encourage after the spigots turn up the in a single day cash markets?

Bitcoin is down by 6% over the 30 days ending Friday, Sept. 13, while the Nasdaq Composite is up 3.7% for the month’s trades and the benchmark S&P 500 Index is up 4% over the same length.

So what offers with Bitcoin?

Is Wall Motorway inserting bearish selling strain on crypto costs with outflows from the Bitcoin ETFs and going searching out with the money for NVDA, TSMC, and ASML to simply wager on the chips and let Reddit customers resolve the remainder out?

Are Bitcoin miners selling to maintain with rising industrial electrical energy bills since April?

Goldman Sachs Economist: 25 – 50 Foundation Pt Minimize

“I wouldn’t rule out 50 basis aspects, but 25 basis aspects strikes me as more doubtless,” talked about Goldman Sachs chief economist Jan Hatzius on Monday.” “I believe there is a stable rationale for doing [a 50 basis point cut]. And the reason is that five and three-eighths, five and a quarter to five.5% is a terribly excessive fed funds fee. It’s one of the best coverage fee in the G10.”

Hatzius added the US has seen more growth on inflation than many of the G10.

Will Bitcoin’s Ticket Race Up When The Fed Cuts Rates?

Past results don’t mumble future performance, but history does are inclined to repeat and winners are inclined to earn over again. The US benchmark ardour fee is a macro tide that raises enormous boats love scorching Wall Motorway stocks and Bitcoin’s decentralized Net economy.

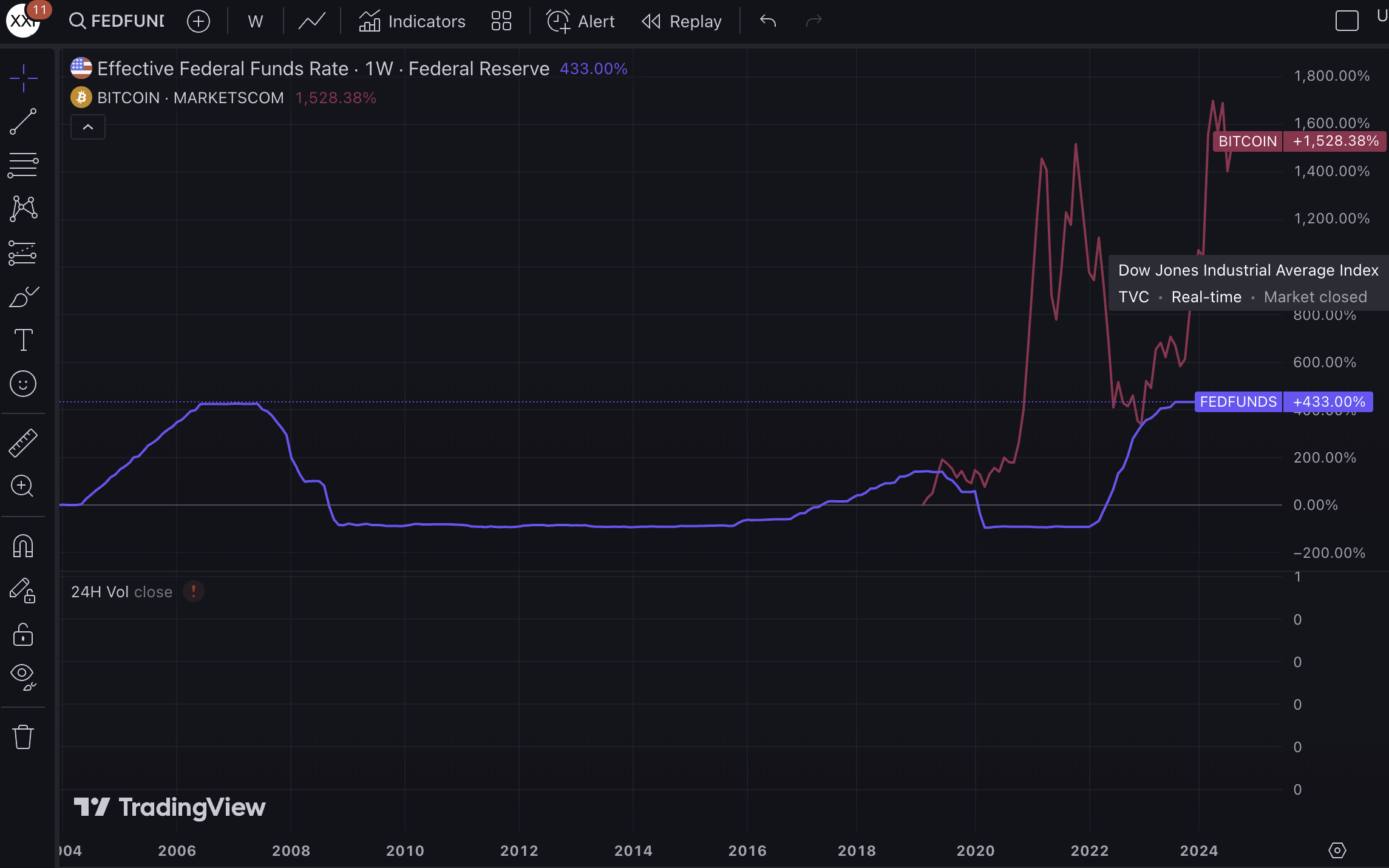

Past low-fee macro environments own correlated with big Bitcoin features. The length of most stellar ROIs for BTC holders became finally of the 2010s when charges were low sooner than the road for BTC begins on the graph below.

When charges dropped to zero in 2020, Bitcoin’s stamp surged nearly 8x to recount highs. As the Fed walked the fee up, Bitcoin settled encourage down to 2x its pre-pandemic stage. By slack 2023, the Fed simply stopped elevating charges and BTC went berserk.

Now there’s the crypto data cycle that became a enormous half of that, with years of anticipation for a Bitcoin ETF starting to gel spherical that point. Nonetheless the multi-month correlations to financial coverage is tight and basically based on financial offer and search data from idea.

Three previous Bitcoin four-One year offer cycles saw enormous rallies with height costs 12 – 18 mos. after the halving. Basically the most most widespread Bitcoin halving took draw on April 19.