Bitcoin’s tag has been consolidating below the $60K level over the closing few weeks.

Nevertheless, things would possibly maybe maybe well nicely be about to alternate quickly as the asset flew to an 8-day peak of almost $58,500 earlier as of late.

Technical Diagnosis

By Edris Derakhshi

The Day-to-day Chart

On the Day-to-day chart, the associated charge has neutral currently rebounded from the $52K enhance level and has broken help above the $57K be aware. For the time being, the market is more most likely to upward thrust toward the $60K resistance level in the arrival days.

Meanwhile, the RSI is furthermore climbing above the 50% threshold, which would maybe maybe maybe maybe point to a doable uptrend in the non permanent.

The 4-Hour Chart

The 4-hour chart furthermore demonstrates a classical bullish tag circulation pattern. The market has been declining in a descending channel. Nevertheless, it has neutral currently broken above it.

In accordance to classical tag circulation, this pattern will consequence in a bullish rally, which would maybe maybe maybe well consequence in an uptrend toward the $60K and even the $64K levels. Yet, the associated charge must retain above the $57K enhance level for this scenario to be legitimate.

On-Chain Diagnosis

By Edris Derakhshi

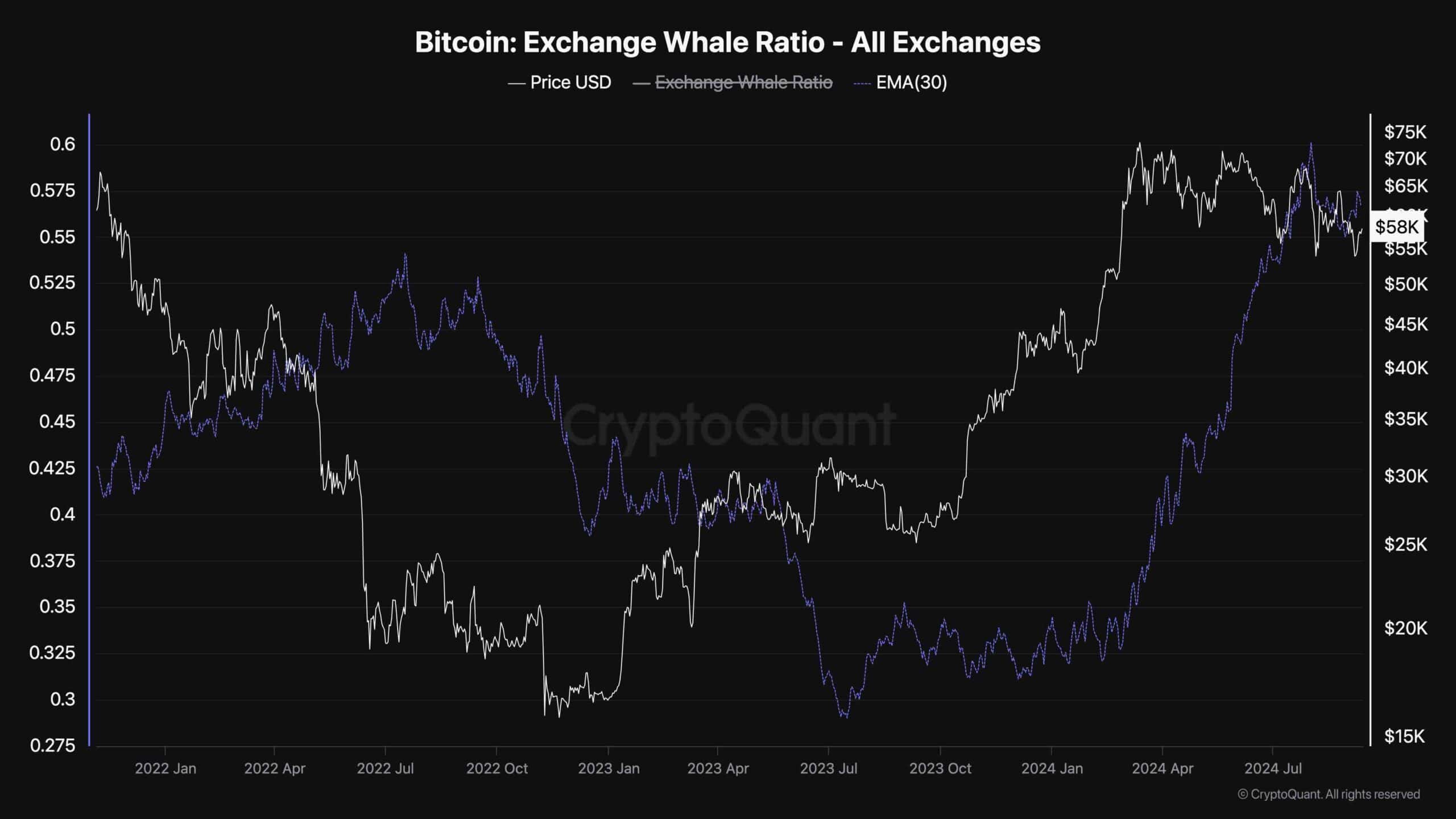

Bitcoin Alternate Whale Ratio

Whereas bitcoin’s tag has been going via a disturbing consolidation, the underlying market dynamics like changed greatly. Therefore, on-chain metrics can yield precious results.

This chart demonstrates the Bitcoin Alternate Whale Ratio, a metric for measuring the ratio of gigantic transactions in comparison to overall deposits to the exchanges.

Because the chart suggests, the Alternate Whale Ratio metric has been with out be aware surging in the end of the fresh consolidation. This indicates that many gigantic transactions are going on, as some market contributors are distributing their BTC whereas others are collecting. Whereas the outcomes of this shift on the associated charge live to be viewed, a vital tag pass is probable.