Merchants are for the time being centered on the doable Federal Reserve ardour rate in the bargain of and the plot in which the financial coverage will most likely affect the price trajectory of most predominant assets reminiscent of Bitcoin (BTC).

Indeed, Bitcoin has neutral now not too prolonged in the past seen its designate fall below the $60,000 designate, pushed by considerations referring to the economy’s traditional correctly being. The rate cuts are seen as a possible path-altering transfer, particularly amid recessionary fears.

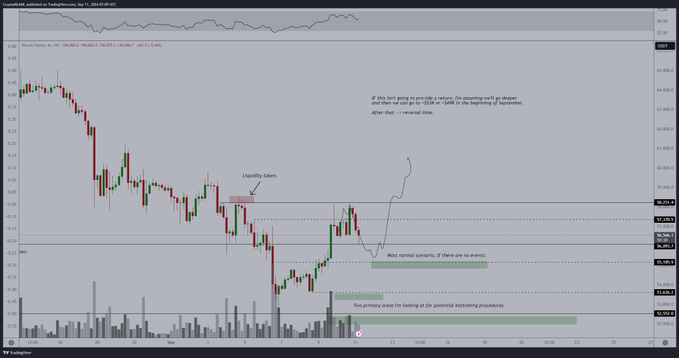

Relating to how Bitcoin will most likely react, cryptocurrency buying and selling skilled Trading Shot outlined that which that you just would possibly perhaps factor in scenarios for the maiden digital asset in a TradingView submit on 11th of September. The skilled centered on the correlation between the Global Liquidity Index (GLI) and Bitcoin’s designate trajectory.

A representation of the GLI highlighted the projection, monitoring most predominant central banks, alongside side the Federal Reserve, European Central Financial institution, Folks’s Financial institution of China, Financial institution of Japan, and Financial institution of England.

In step with the diagnosis, when central banks in the bargain of ardour rates, they inject more money into the economy, devaluing the brand new forex. This leads to increased entry to loans for companies and people, boosting their spending, buying, and investing capacities. Historically, riskier assets reminiscent of cryptocurrencies are inclined to rise in cost when liquidity increases.

Bitcoin’s past breakouts in terms of GLI

The skilled also drew attention to necessary breakouts in the GLI which absorb traditionally led to Bitcoin rallies. For instance, when liquidity previously dropped and flattened, it created a duration of resistance. As soon as this resistance became damaged, Bitcoin entered a bullish rally around 2016 and but again in 2020.

Furthermore, it marked the begin of Bitcoin’s safe cycles each time liquidity dropped and flattened. These drops in total created resistance zones that mandatory to be damaged for Bitcoin to rally but again. This sample became seen in 2018 and 2022, which correlated with Bitcoin’s downturns.

Chart patterns demonstrate that the GLI is forming a wedge sample with decrease highs as resistance. The GLI is now precisely on this trendline. A breakout above can also replicate old cycles’ resistance breakouts, doubtlessly initiating a parabolic rally for Bitcoin, an identical to old bull runs.

Bitcoin’s key designate ranges to ogle

Which ability truth, the principle plot became $68,000, which would possibly perhaps again as a psychological barrier and some extent of resistance the build some patrons can also neutral settle to grab profits.

One other plot is a new all-time excessive of $150,000. Furthermore, if the chart sample meets old expectations, a prolonged-time frame scenario of hitting $350,000 is that which that you just would possibly perhaps factor in. This plot would most likely require a sustained and necessary amplify in world liquidity, accompanied by continued favorable market prerequisites for cryptocurrencies.

Total, Bitcoin is quiet influenced by macroeconomic parts. With a focal level on the ardour rate in the bargain of, attention is on how the cryptocurrency will most likely react to the the User Tag Index. In this regard, crypto buying and selling skilled Michaël van de Poppe unprecedented on 11th of September that patrons can also neutral soundless sit down up for that which that you just would possibly perhaps factor in momentum after the records, supplied Bitcoin holds between $55,000 and $56,000.

It’s price noting that U.S. inflation slowed to 2.5% in August, showing signs of cooling but final stubbornly above the specified rate of 2%.

Bitcoin designate diagnosis

By press time, Bitcoin became buying and selling at $56,662, having corrected a miniature bit by 0.4% in the final 24 hours. On the weekly chart, BTC is up nearly 1%.

In summary, if Bitcoin were to mount a parabolic rally in the wake of the bustle cuts, it wants to push past the brand new resistance and reclaim the $60,000 stage, which is seen as a pass for new beneficial properties.

Disclaimer: The whisper material on this station can also neutral soundless now not be even handed funding advice. Investing is speculative. When investing, your capital is in distress.