-

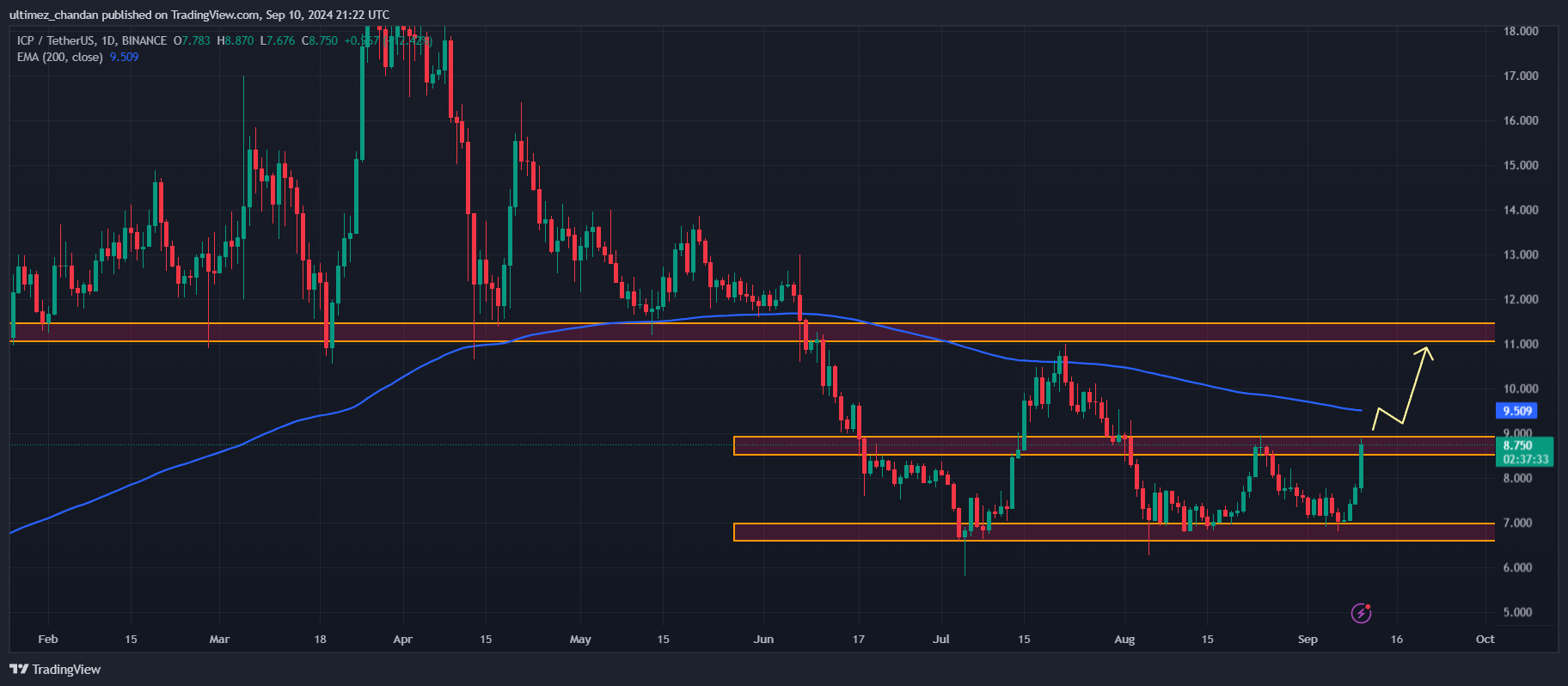

Web Computer (ICP) label can also fly by 25% to the $11 level if it closes a day-to-day candle above $9.

-

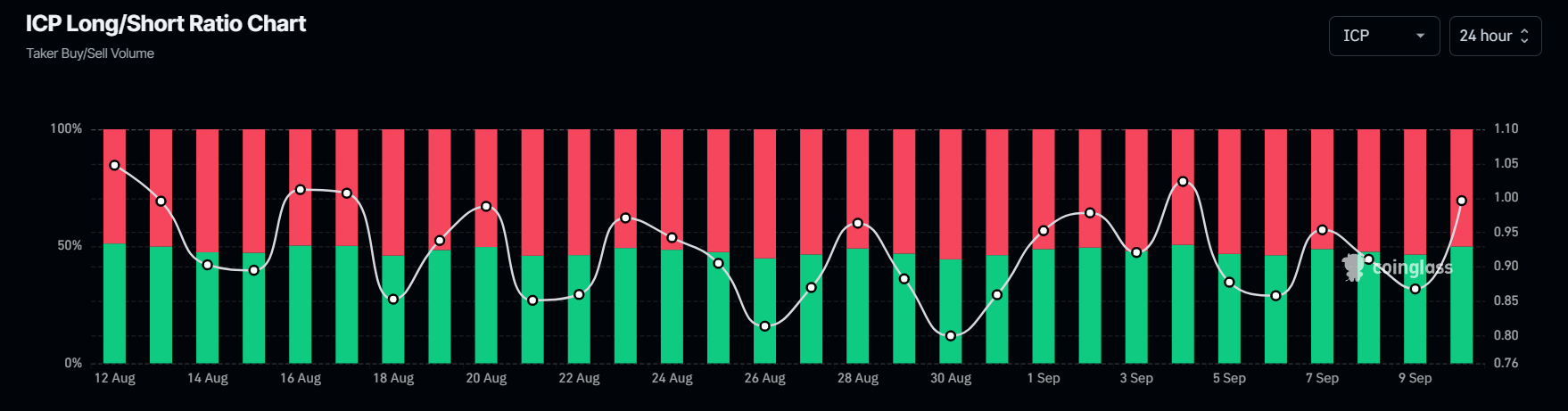

ICP’s starting up pastime has elevated by 21%, indicating extra futures-long positions had been built in the closing 24 hours.

-

ICP’s positive long/immediate ratio and rising future starting up pastime signal ability procuring alternatives.

On September 11, 2024, Web Computer (ICP) made waves in the cryptocurrency market with its spectacular label performance. Then one more time, in step with its chart and rate circulation, it appears that ICP is nice one step faraway from a doable 25% rally.

Web Computer (ICP) Ticket Efficiency

At press time, ICP is trading shut to $8.8 level and has skilled a label surge of over 15% in the closing 24 hours. Within the intervening time, its trading volume has elevated by 60% true by the same duration, indicating elevated traders and traders participation amid the continuing label recovery.

ICP Technical Prognosis and Upcoming Ranges

In line with educated technical prognosis, Web Computer (ICP) appears bullish despite trading below the 200 Exponential Transferring Average (EMA) on the day-to-day time body. For the time being, ICP is facing sturdy resistance shut to the $8.9 level.

Here’s the 2d time for the reason that starting of August 2024 that the ICP label has reached that resistance level. The closing time ICP reached that level, it underwent vital promoting rigidity, ensuing in a steep label decline of nearly 20%.

Then one more time, this time, dealer and investor participation is assorted, and the sentiment has shifted, rising the likelihood that ICP can also breach this resistance level. If ICP breaks out this resistance level and closes a day-to-day candle above $9, there might be a sturdy possibility it can also fly by 25%, reaching the $11 level in the arriving days.

This bullish thesis is handiest legitimate if the ICP label closes its day-to-day candle above $9, in some other case, it can also simply fail.

Bullish On-Chain Metrics

Furthermore, Web Computer’s (ICP) bullish outlook is additionally supported by on-chain metrics. Coinglass’s ICP Long/Short ratio currently stands at +1.019, reflecting bullish market sentiment. Additionally, ICP’s futures starting up pastime has elevated by 21%, indicating extra futures-long positions had been built in the closing 24 hours. Notably, this OI has been frequently rising.

In line with the knowledge, a favorable long/immediate ratio and rising future starting up pastime signals ability procuring alternatives. Merchants and traders assuredly steal this whereas building long/immediate positions.