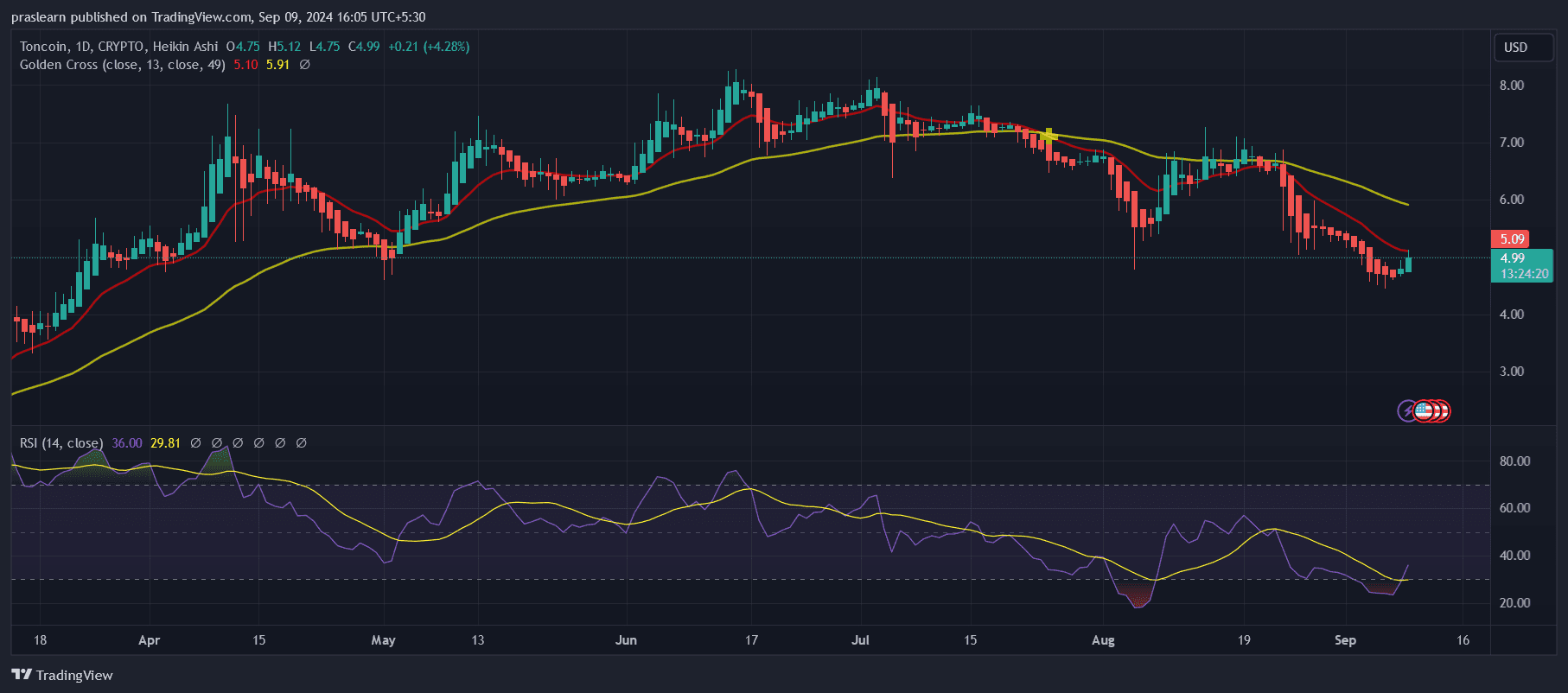

Toncoin (TON) has been struggling just no longer too long ago, with its tag falling and testing the $4.Forty five mark. The coin is at the moment beneath a important bearish pattern line and faces resistance spherical $6.00. But, the coin has displayed correct performance in the closing 24 hours. Let’s take a glimpse at this Toncoin tag prediction article in extra detail.

How has the Toncoin (TON) Designate Moved Now not too long ago?

Toncoin’s tag is at the moment $5.04, with a 24-hour purchasing and selling volume of $594.33 million and a market cap of $12.77 billion, giving it a market dominance of 0.65%. Correct during the last 24 hours, the value has increased by 6.41%.

Toncoin hit its all-time excessive of $8.27 on June 15, 2024, and its all-time low was as soon as $0.52 on September 21, 2021. Since reaching its all-time excessive, the bottom tag has been $4.47, and one of the best has been $5.12. Presently, the market sentiment for Toncoin is bearish, with the Distress & Greed Index exhibiting a level of 26 (Distress).

The circulating provide of Toncoin stands at 2.Fifty three billion out of a most provide of 5 billion. The annual provide inflation rate is -26.20%, indicating that 899.15 million TON were minted in the previous One year.

Why is Toncoin Designate UP?

The most modern rise in Toncoin (TON) tag could perchance perchance very successfully be attributed to the TON Basis’s newly launched 5 million Toncoin DeFi incentive program. This initiative targets to raise the adoption of USDt-TON by rewarding liquidity suppliers in key pools akin to TON/USDt, stTON/USDt, and tsTON/USDt on platforms like STON.fi and DeDust.

By incentivizing liquidity provision, this system enhances the token’s utility and attractiveness one day of the DeFi ecosystem, which doubtless contributes to the decided tag circulation.

As liquidity in these pools will improve, it goes to power higher quiz and purchasing and selling process for Toncoin, doubtless main to further tag good points. Additionally, the increased visibility and engagement from such incentive programs can attract contemporary investors and users, further supporting the upward pattern in Toncoin’s tag.

The most modern open of the 5 million Toncoin DeFi incentive program by the TON Basis is a important construction with grand implications for Toncoin’s tag and market presence.

This initiative targets to raise the adoption of Toncoin (TON) by rewarding liquidity suppliers in diverse USDt-TON purchasing and selling pools, akin to TON/USDt, stTON/USDt, and tsTON/USDt, on platforms like STON.fi and DeDust. By incentivizing these liquidity suppliers, this system is doubtless to pork up the token’s integration into the DeFi ecosystem, selling increased use and acceptance amongst users.

One in all the principle impacts of this program is the broaden in liquidity within these purchasing and selling pools. Greater liquidity usually finally ends up in smoother purchasing and selling experiences and diminished tag volatility, making Toncoin a extra pleasing asset for merchants and investors.

As extra people are drawn to those pools, the general purchasing and selling volume of Toncoin is expected to rise, which is ready to consequence in upward tension on its tag. The increased quiz from liquidity suppliers who deserve to earn Toncoin to take part in the incentivized pools further supports this tag broaden.

Additionally, the inducement program tremendously boosts Toncoin’s market visibility. As this system draws consideration from DeFi followers and probably investors, Toncoin’s profile available in the market is elevated.

This increased visibility can attract contemporary users and investors who’re drawn to the alternatives equipped by the inducement program, contributing to further quiz and probably tag appreciation.

While, the DeFi incentive program is poised to lend a hand Toncoin’s situation available in the market by enhancing liquidity, using quiz, and extending visibility. These components blended are doubtless to positively affect Toncoin’s tag, reflecting the rising passion and engagement in its DeFi capabilities.

How excessive can Toncoin Designate trot?

Given primarily the most modern developments and performance metrics for Toncoin (TON), the functionality for further tag will improve looks to be promising. Correct during the last One year, Toncoin has surged by 187%, tremendously outperforming 82% of the tip 100 crypto sources, including primary gamers like Bitcoin and Ethereum. This solid performance highlights Toncoin’s rising market energy and resilience.

Presently, Toncoin is purchasing and selling above its 200-day straightforward shifting practical, a decided technical indicator suggesting persevered bullish momentum. Additionally, with Toncoin purchasing and selling terminate to its cycle excessive, the possibility of reaching contemporary highs stays grand. The presence of excessive liquidity, supported by a sturdy market cap, further bolsters the possibility of upward tag circulation, because it permits for smoother purchasing and selling and now not more tag volatility.

Moreover, the negative yearly inflation rate of -26.20% implies that the provision of Toncoin is lowering, which could well contribute to upward tag tension as quiz continues to develop. Despite the indisputable fact that there had been handiest 14 inexperienced days out of the closing 30 (47%), signaling some most modern volatility, the general pattern and the incentives from the contemporary DeFi program indicate a decided outlook.

So, if Toncoin maintains its recent performance trends and market stipulations remain favorable, there could be well-known probably for further tag appreciation. Given its previous performance, solid liquidity, and primarily the most modern DeFi incentive program, Toncoin could perchance perchance doubtless reach contemporary highs, surpassing outdated cycle peaks and reinforcing its situation as a main cryptocurrency.