Pseudonymous crypto analyst TechDev says that Bitcoin (BTC) and digital sources are in the center of a broad endure entice earlier than the following leg up.

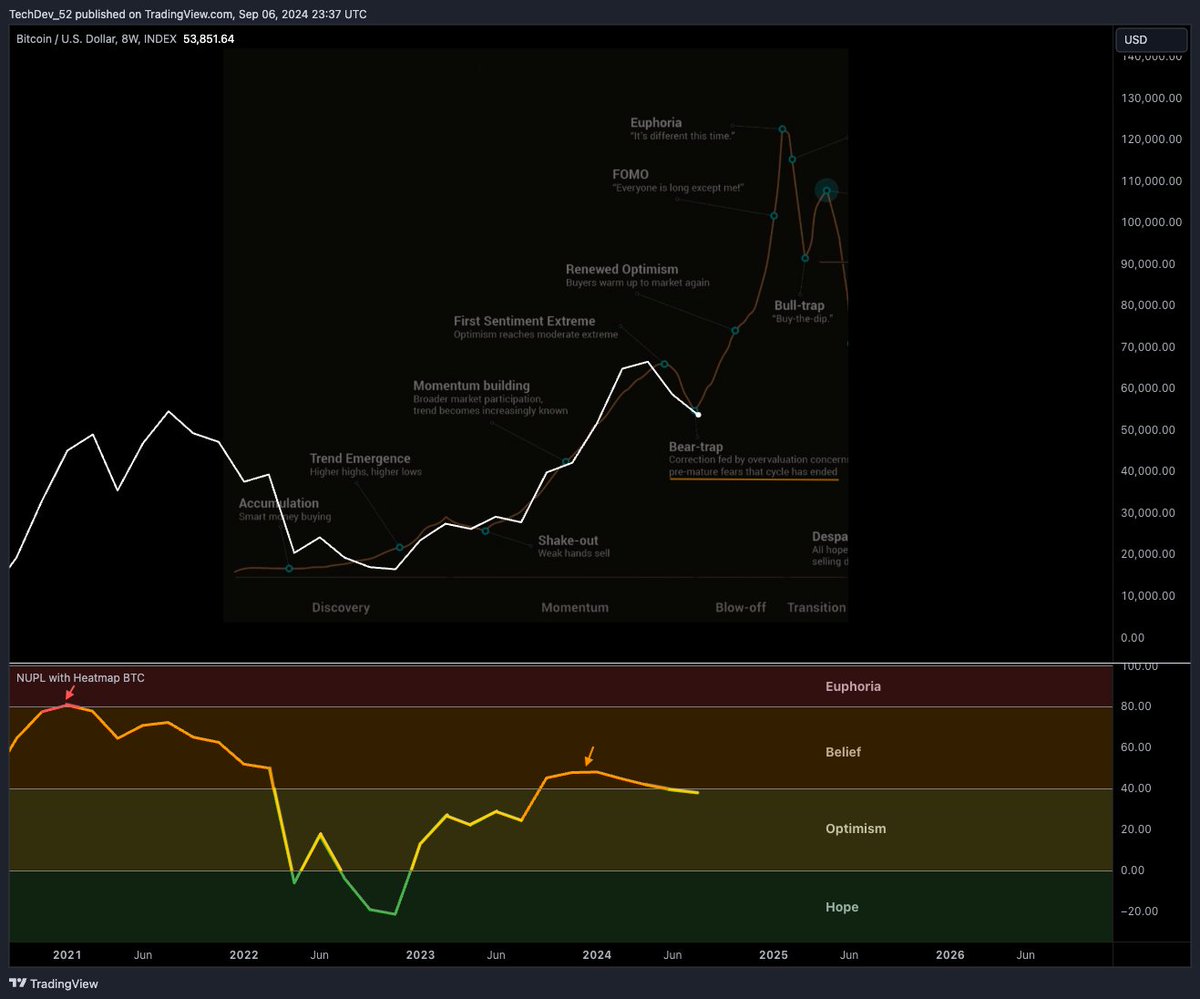

TechDev shares a chart with his 467,000 followers on the social media platform X that means Bitcoin’s market cycles occur in a series of stages beginning with “accumulation” and ending in a bull entice.

Fixed with TechDev, BTC is in the “endure entice” segment of the cycle, which precedes “renewed optimism,” “FOMO” (misfortune of lacking out) and “euphoria” stages earlier than topping out and entering the bull entice.

The analyst moreover believes that USDT dominance in the crypto markets looks to be bearish, implying that stablecoins will soon be traded en masse for other digital sources, boosting prices.

TechDev now not too long previously in comparison Bitcoin’s ancient trace circulate to the Nikkei 225, the ultimate Japanese stock market index.

Fixed with TechDev’s charts, the dealer suggested that Bitcoin would possibly perchance perchance well perchance lunge as high as $760,000 sometime between 2028 and 2029 earlier than witnessing a multi-365 days endure market, same to the Nikkei in the Nineties.

Final month, TechDev illustrious that he turned into optimistic about the fresh downturn in the crypto market.

“Clearly, there would possibly perchance be coarse misfortune available in the market. The remaining two weeks had been filled with ‘told you’ feedback from doomer bears – on a retest to $forty eight,000 ranges they beforehand acknowledged would by no map be reached the relaxation time they had been doom-posting at $25,000.

Exactly what I wish to ogle. The proven reality that it came at a time when global macro instances are pointing up makes it nothing more than two weeks of loud noise to me. More love the relaxation six months.

It’s usually the case in all speculative markets, however the relaxation two years fetch reflected this more than any other time in the crypto market – it doesn’t switch up till X is terrified completely shitless. That turned into the case at $15,000 after the FTX break, at $20,000 after regional banks had been failing, at $38,000 after the brutal put up-ETF wick, and now.

What you’ll moreover recall is how grand sentiment can whiplash in a couple of weeks. Awaiting it again. The total while, the worldwide cycle continues to point bigger.”

At time of writing, Bitcoin is price $54,435, up a shrimp on the day.

Generated Listing: Midjourney