At the present time, bag pleasure from the Lightspeed e-newsletter on Blockworks.co. Day after currently, bag the news delivered straight to your inbox. Subscribe to the Lightspeed e-newsletter.

Howdy!

As brat summer recedes from leer, I needed to open my reporter’s notebook and give you all a search for into some Solana-linked threads I’m attracted to following over the following few months.

Here, in no articulate notify, are six questions that I specialise in are worth preserving an glimpse on:

Six Solana questions defining the relaxation of 2024

Has pump.fun in truth sail out of aspect road?

Solana’s tag, DeFi volumes and validator earnings bask in all stumbled within the past couple weeks, and frail wisdom appears to be casting blame on declining hobby in memecoins. For higher or worse, memecoins — particularly ones traded thru the launchpad pump.fun — were within the back of grand of Solana’s tell in onchain volume over the past several months.

But, the thinking goes, the longshot odds of memecoins paying dividends, paired with a Justin Solar-backed competitor to pump.fun on the Tron blockchain, bask in left Solana’s memecoin ecosystem in a weak insist. It’s far gross that pump.fun’s earnings and selection of token launches bask in fallen noticeably below their Also can merely, June and July ranges.

I bask in my doubts about this tale, nonetheless. In its downtrodden insist, pump.fun is soundless booking $300,000-$400,000 in each day earnings, and so-called Solar Pump is seeing a fraction of its transaction volume. Pump.fun’s success as a enterprise ought to soundless no longer be undersold, although the center-broken saps are handiest no longer off route for $120 million in annual earnings (in would favor to $200 million). You would also mediate pump.fun’s relevance this style: When pump.fun used to be first popping out, it would infrequently be lumped into headlines alongside Yarn.top. When’s the closing time you heard one thing else about Yarn.top?

How strongly-held are the SEC’s beliefs?

The suddenness of SOL ETF functions can even handiest were matched by the price of their demise.

Things gave the impression fats-steam forward for doubtless self-discipline Solana ETF issuers VanEck and 21Shares until the Cboe replace without note eliminated 19b-4 forms from its internet converse. The elimination of the 19b-4, which ought to soundless be permitted by the SEC for ETFs to replace, got right here after the SEC privately reiterated its perception that SOL is a security, The Block reported. If SOL used to be outright declared a security, it’s in overall assumed that it would develop into refined for US-essentially essentially based investors to in truth purchase the asset.

Granted, this isn’t a replace of coronary heart from the SEC, which is soundless publicly alleging in its Coinbase lawsuit that SOL is a security. But because the US presidential election nears and the very-public FTX fiasco recedes from leer, I’m uncommon to leer whether or no longer political tides trigger any shifts within the SEC’s stance.

Who will discover the restaking hotfoot?

Ethereum restaking bloomed to develop into a several-billion dollar sector within the past yr. With Solana’s persevered development in mindshare relative to Ethereum, it handiest made sense that we’d leer groups strive to open identical infrastructure on Solana.

Jito and Solayer seem like the 2 extreme contenders in turning into the EigenLayer of Solana. Solayer bought its platform to mainnet first, while Jito has open-sourced its code (I’ve also been suggested semi-currently that the project expects Jito Restaking to open by the stop of the yr).

To this level, Solayer handiest boasts a chunk of larger than 30,000 restakers delegating roughly $30 million worth in restaked assets. It also handiest has an preliminary four AVSs stay to exhaust the restaking carrier, so it’s soundless early innings.

I bet we’ll leer extra Solana restaking bulletins soon, particularly as pertains to what I name the restaking arms hotfoot: These platforms need protocols to develop on top of them. Which one can plot a extra vaunted lineup?

Will Firedancer trip to mainnet?

It’s been years since Bounce Crypto started engaged on the Firedancer Solana client — which is written in C, somewhat than Rust — and ought to soundless supposedly be grand extra performant than the Agave and Jito-Solana customers which might perhaps well well be currently on supply.

Having a pair of customers will bask in Solana extra decentralized and bag rid of dangers that stem from having in actuality one validator client for the time being (Jito-Solana is terribly similar to the Agave client). Solana co-founder Anatoly Yakovenko has also mentioned he’ll stop pronouncing Solana is in mainnet-beta once Firedancer ships.

The patron is reportedly slated for a 2025 free up, but the lead-up would be a substantial deal too: In a handiest-case scenario, this can even watch similar to the pleasure the Ethereum community ginned up spherical its 2022 “Merge” to proof-of-stake.

How will Solana’s smooth DAOs work?

Native token airdrop season appears to bask in distress down for the moment, leaving several initiatives sitting on immense treasuries while determining how these tokens are to be feeble — which in many cases appears to be for governance.

Some initiatives, like Jito, are already forging forward with Ethereum-like DAOs the exhaust of “one token one vote” governance. Stream is toying with MetaDAO’s futarchy mannequin for market-essentially essentially based governance, but it undoubtedly also has a extra feeble DAO.

In customary, I’d be uncommon to leer whether or no longer the Solana ecosystem will innovate past the location quo for Ethereum DAOs, which, as someone who’s adopted or participated in them will show you, aren’t essentially the most functional of organizations. Or, since DAOs are widely unpopular and level to doubtless correct dangers, will Solana initiatives eschew them altogether?

What’s Solana’s next tale?

Blockchain ecosystems need convincing narratives to notify investors and developers what their functions are. A lack of obvious narratives can lead to grumpiness and internecine battle, which is arguably one thing we’re seeing play out within the Ethereum world straight away with its squabbles over DeFi and foundation spending.

For the past several months, memecoins drove a upward thrust in SOL’s tag and onchain metrics. Real investors grew extra bullish on the token, issuers filed for SOL ETFs and Solana clawed itself out of the outlet precipitated by FTX’s deep integration with the ecosystem.

But when memecoins and ETFs had been to develop into dead within the water, it’s currently unclear what the following tale pivot would be. In any occasion, there are a pair of checking out grounds where these narratives can even bask in: Colosseum’s Radar hackathon, Solana Labs’ 2nd incubator cohort and most importantly, the Solana Breakpoint conference.

I asked Helius CEO Mert Mumtaz this demand on a fresh episode of the Lightspeed podcast, and he gave the impression unperturbed.

He distilled his strategies later in an X post: “[S]olana’s tale is easy: easy, like a flash, low-price plot to develop chilly shit,” he wrote.

— Jack Kubinec

Zero In

The memecoin launchpad pump.fun currently handed $100 million in earnings, constant with a Dune dashboard.

Pump.fun makes its money on swap prices and Raydium seeding. Even with its earnings currently stalling a chunk, pump.fun done this milestone remarkably instant. As a reminder, the platform launched in January.

Alliance DAO’s Qiao Wang wrote on X that he asked AI chatbots if there has “ever been a startup in historical past that went from conception to $100m earnings in half of a yr.” No person can even give him an acknowledge, Wang mentioned, including: “take into consideration if extra web2 founders heard this unparalleled tale. they’d pivot from ai to crypto tmrw.”

— Jack Kubinec

The Pulse

Nicely-organized contracts…who needs ’em? Not you, constant with Helius’ Mert Mumtaz. On Sunday, he posted a behind-evening thread on X explaining “Solana has a program-essentially essentially based mannequin vs. an interface mannequin — that way it is doubtless you’ll well well leverage a ton of reward programs to jot down client code handiest.” In other phrases, it is doubtless you’ll well well take care of NFTs, tokens, transactions, token-gating, minting, bots and extra the exhaust of correct Javascript, without ever touching Rust or deploying a interesting contract.

Pushing back, @ajki76 challenged, “So, what are they constructing onchain, taking into consideration you mentioned ‘most cases don’t require constructing programs the least bit?’” Mert clarified, “The interesting contract already exists and is onchain — I’m pronouncing it is doubtless you’ll well well exhaust the reward ones without desiring to develop a brand smooth one.”

@kind3r.sol confirmed that this aligns with their experience: “I’ve been doing this for the past 2.5 years. Lawful deployed my first 3 lines of code Rust program a pair of weeks back out of necessity. But ninety nine.ninety nine% of the interactions it is doubtless you’ll well well carry out by the exhaust of reward (mostly open supply) programs and develop their instructions in a single transaction.”

It’s a search info from effectivity vs. creativity. Why burn time writing complex interesting contracts if you happen to can correct as simply stand on the shoulders of reward onchain programs? Though as @DanMulligann rightly asked, “but does that support any sort of innovation or extra of the identical shit?”

— Jeffrey Albus

One Valid DM

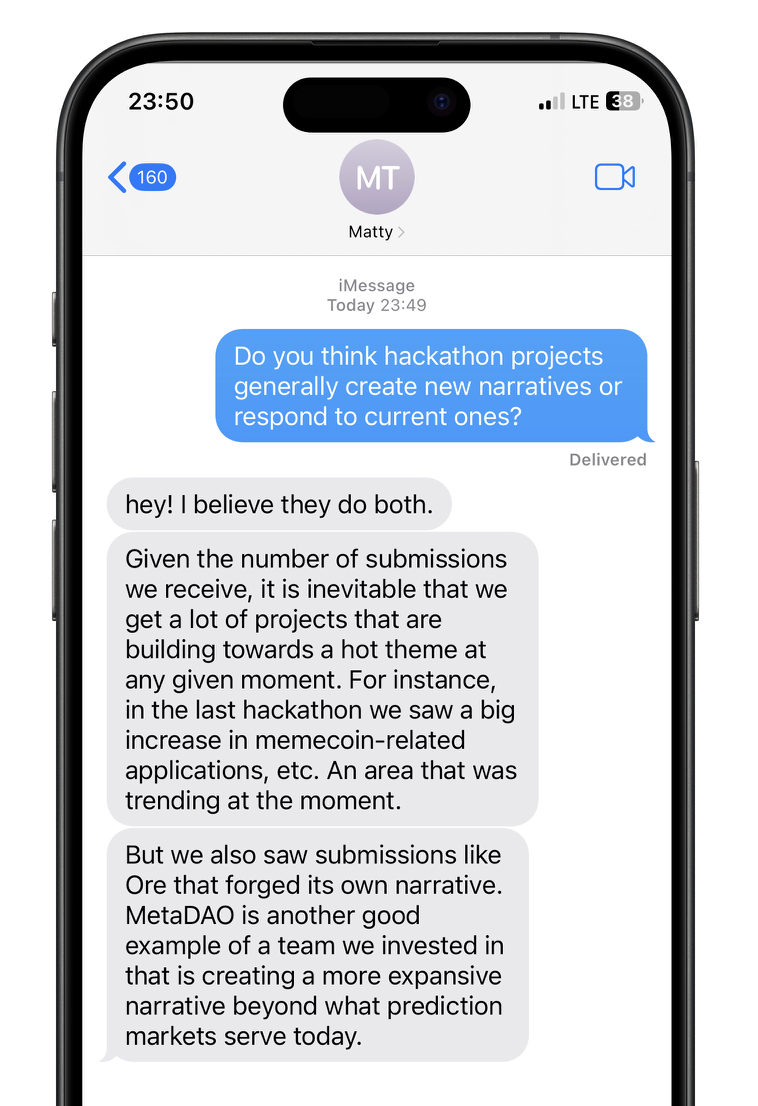

A message from Matty Taylor, co-founding father of Colosseum: